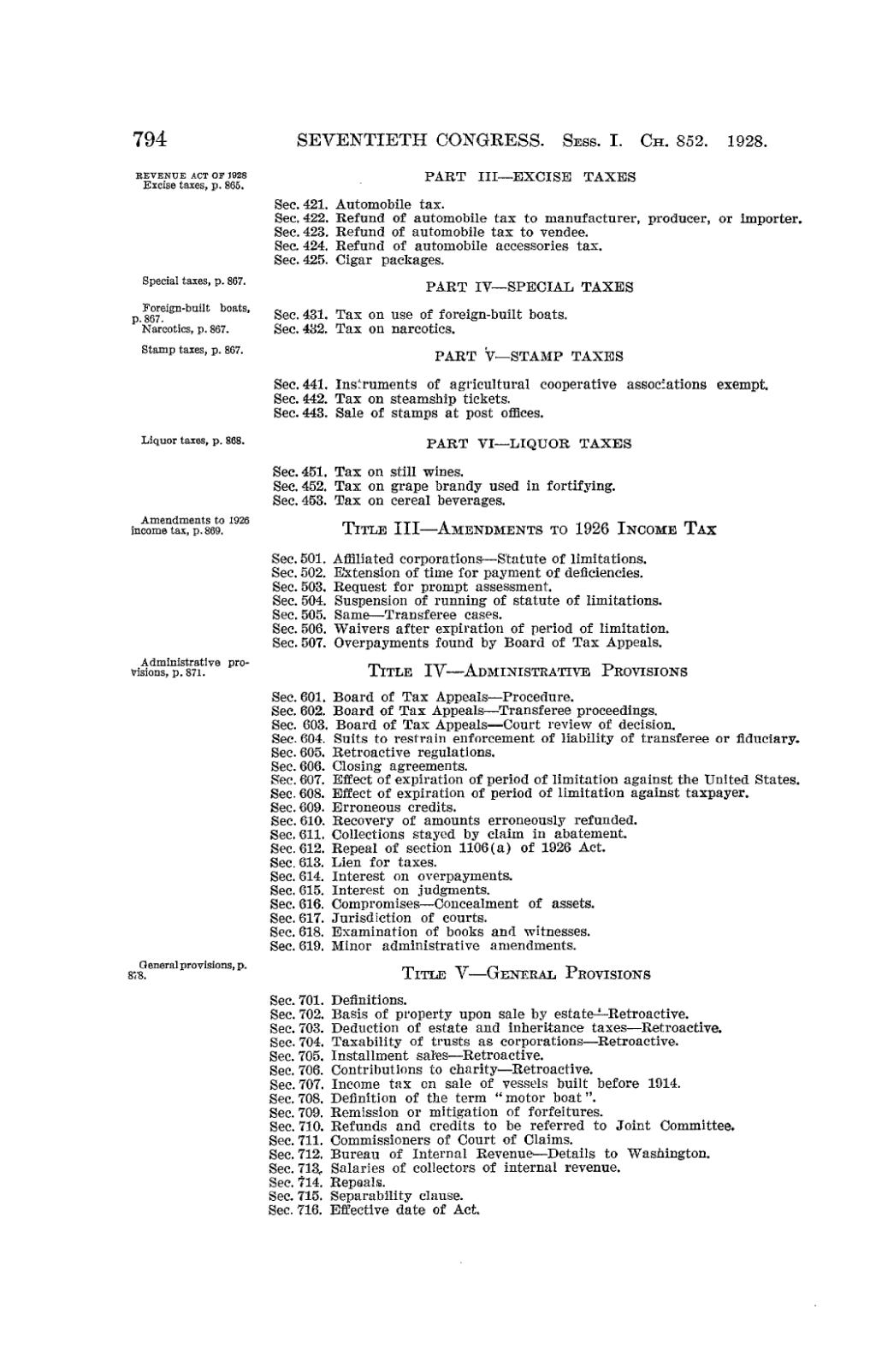

794 REVENUE ACT OF 1928 Excise taxes, p . 865 . Special taxes, p . 867. Foreign-built boats, p.867. Narcotics, p . 8 67 . Stamp taxes, p. 867 . Liquor taxes, p . 868. Amendments to 1926 income tax, p.869. Administrative pro- Visions, p . 871 . General provisions, p . 5. 8. SEVENTIETH CONGRESS . SEss . I. CH. 852 . 1928 . PART III-EXCISE TAXES Sec.421 . Automobile tax. See. 422 . Refund of automobile tax to manufacturer, See. 423 . Refund of automobile tax to vendee . See. 424 . Refund of automobile accessories tax . See. 425 . Cigar packages. See. 431. Tax See . 432. Tax PA RT IV-SPECIAL TAXES on use of foreign-b uilt boats . on narcotics. P ART V- STAMP TAXE S Se c . 44 1 . Instruments of agricultural See . 442. Tax on steamship tickets . Sec .443. Sale of stamps at post offices. PA RT VI-LIQUOR TAXES Sec.451 . Tax on still wines . See. 452 . Tax on grape brandy used in fortifying . See. 45 3 . Tax on cereal b everages . TITLE III-AMENDMENTS TO 1926 INcoME TAX Sec . 501. Affiliated corporations-Statute of limitations . Sec . 502. Extension of time for payment of deficiencies . See . 503. Request for prompt assessment . Sec . 504 . Suspension of running of statute of limitations . See . 505. Same-Transferee cases . See . 506 . Waivers after expiration of period of limitation . See . 507. Overpayments found by Board of Tax Appeals . TITL E IV- ADMIN ISTRA TIVE PRO VI SIO NS Sec . 601 . Board of Tax Appeals-Procedure . Sec. 602. Board of Tax Appeals-Transferee proceedings . Sec. 603 . Board of Tax Appeals-Court review of decision . See . 604. Suits to restrain enforcement of liability of transferee or fiduciary . See. 605. Retroactive regulations. See. 606 . Closing agreements . Sec. 607 . Effect of expiration of period of limitation against the United States . Se e . 608 . Effect of e xpiration of period of l imitation aga inst taxpaye r . See . 609 . Erroneous credits . See. 610. Recovery of amounts erroneously refunded . See . 611 . Collections stayed by claim in abatement. Se e . 612 . Repeal of section 1106(a) of 1926 Act . See . 613. Lien for taxes . See . 614. Interest on overpayments. Sec .015. Interest on judgments . See . 616 . Compromises-Concealment of assets . Sec . 617 . Jurisdiction of courts. Sec . 618. Examination of books and witnesses . Sec . 619 . Minor administrative amendments . TITLE V-GENERAL PROVISIONS See. 701 . Definitions. Se c . 702 . Ba sis of property upon sale by estate-Retr oactive . See. 703. Deduction of estate and inheritance taxes-Retroactive . Se c . 704 . Ta xability of trusts a s corporations-Retro active . Se e . 705 . In stallment sales-Retr oactive . Se e . 706 . Co ntributions to chari ty-Retroactive . See . 707. Income tax on sale of vessels built before 1914 . Sec. 708 . Definition of the term "motor boat" . See. 709 . Remission or mitigation of forfeitures . Sec. 710. Refunds and credits to be referred to Joint Committee . See. 711 . Commissioners of Court of Claims. Sec. 712 . Bureau of Internal Revenue-Details to Washington . See. 713, Salaries of collectors of internal revenue . Sec. 714 . Repeals . Sec . 715 . Separability clause . Sec . 716. Effective date of Act . producer, or importer. cooperative assoc`-ations exempt .

�