482

Short title.

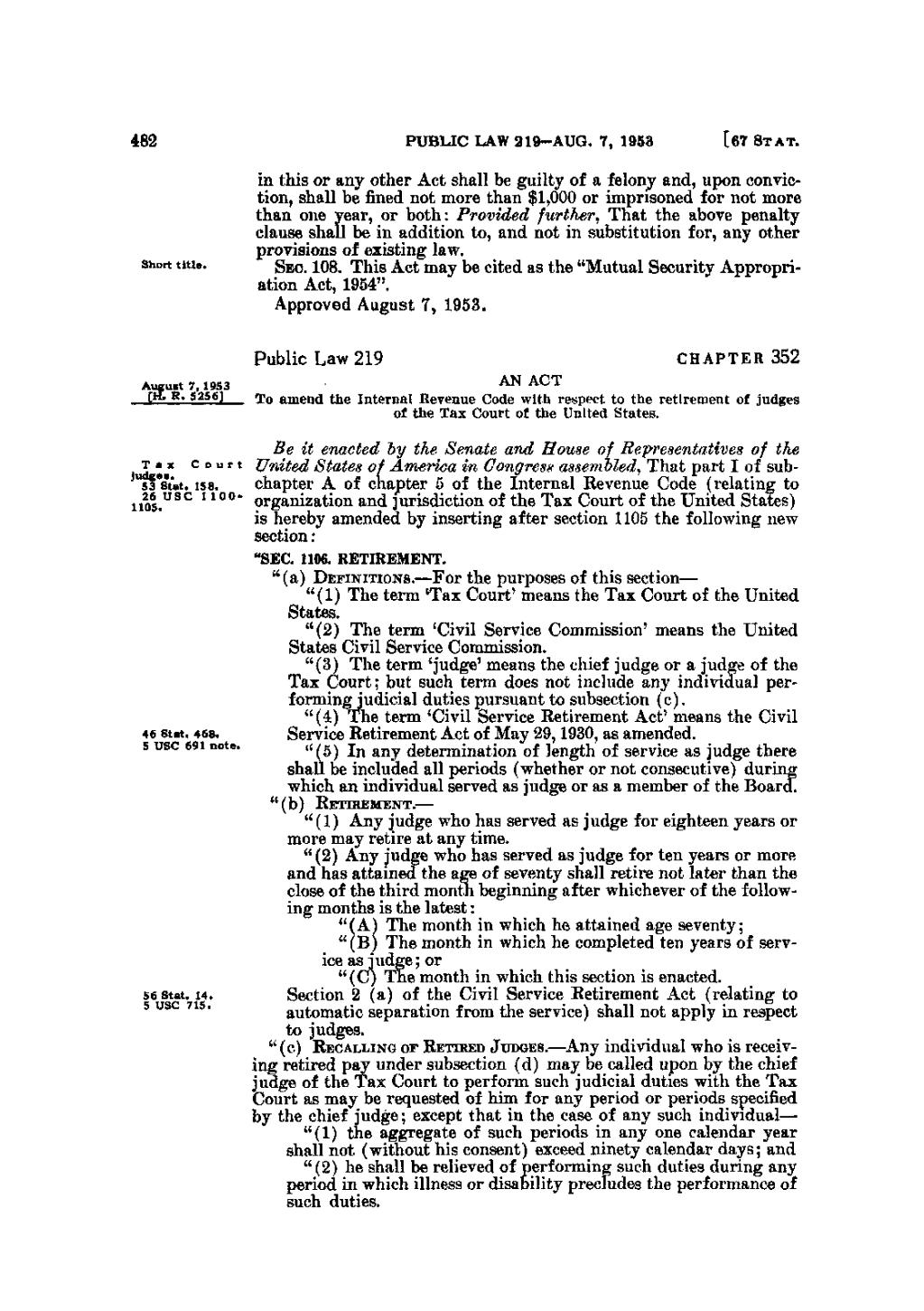

PUBLIC LAW 219-AUG. 7, 1953

in this or any other Act shall be guilty of a felony and, upon conviction, shall be fined not more than $1,000 or imprisoned for not more than one year, or both: Provided further, That the above penalty clause shall be in addition to, and not in substitution for, any other provisions of existing law. QEO. 108. This Act may be cited as the "Mutual Security Appropriation Act, 1954". Approved August 7, 1953. Public Law 219

August 7, 1953 [H. R. 5256]

[67 S T A T.

CHAPTER 352

^^ ACT To amend the Internal Revenue Code with respect to the retirement of judges of the Tax Court of the United States.

Be it enacted by the Senate and House of Representatives of the Tax C o u r t United States of America in Congress assembled, That part I of sub"sFstat. 158. chapter A of chapter 5 of the Internal Revenue Code (relating to 1105.^^^ ^ ^ °°* organization and jurisdiction of the Tax Court of the United States) is hereby amended by inserting after section 1105 the following new section: "SEC. 1106. RETIREMENT. "(a) DEFINITIONS.—For the purposes of this section— "(1) The term T a x Court'means the Tax Court of the United States. "(2) The term 'Civil Service Commission' means the United States Civil Service Commission. "(3) The term 'judge' means the chief judge or a judge of the Tax Court; but such term does not include any individual performing judicial duties pursuant to subsection (c). "(4) The term 'Civil Service Retirement Act' means the Civil 46 Stat. 468. ^ Service Retirement Act of May 29, 1930, as amended. 5 USC 691 note. ' """ ' " ' "" " (5) I n any determination of length of service as judge there shall be included all periods (whether or not consecutive) during which an individual served as judge or as a member of the Board. "(b)

56 Stat.^i4. 5 USC 715. " ""'" ^ "

RETIREMENT.—

"(1) Any judge who has served as judge for eighteen years or more may retire at any time. "(2) Any judge who has served as judge for ten years or more and has attained the age of seventy shall retire not later than the close of the third month beginning after whichever of the following months is the latest: " (A) The month in which he attained age seventy; " (B) The month in which he completed ten years of service as judge; or " (C) The month in which this section is enacted. Section 2(a) of the Civil Service Retirement Act (relating to automatic separation from the service) shall not apply in respect to judges. " (c) RECALLING OF RETIRED JUDGES.—Any individual who is receiving retired pay under subsection (d) may be called upon by the chief judge of the Tax Court to perform such judicial duties with the Tax Court as may be requested of him for any period or periods specified by the chief judge; except that in the case of any such individual— "(1) the aggregate of such periods in any one calendar year shall not (without his consent) exceed ninety calendar days; and "(2) he shall be relieved of performing such duties during any period in which illness or disability precludes the performance of such duties.

�