1288

PUBLIC LAW 85-859-SEPT. 2, 1958

[72 S T A T.

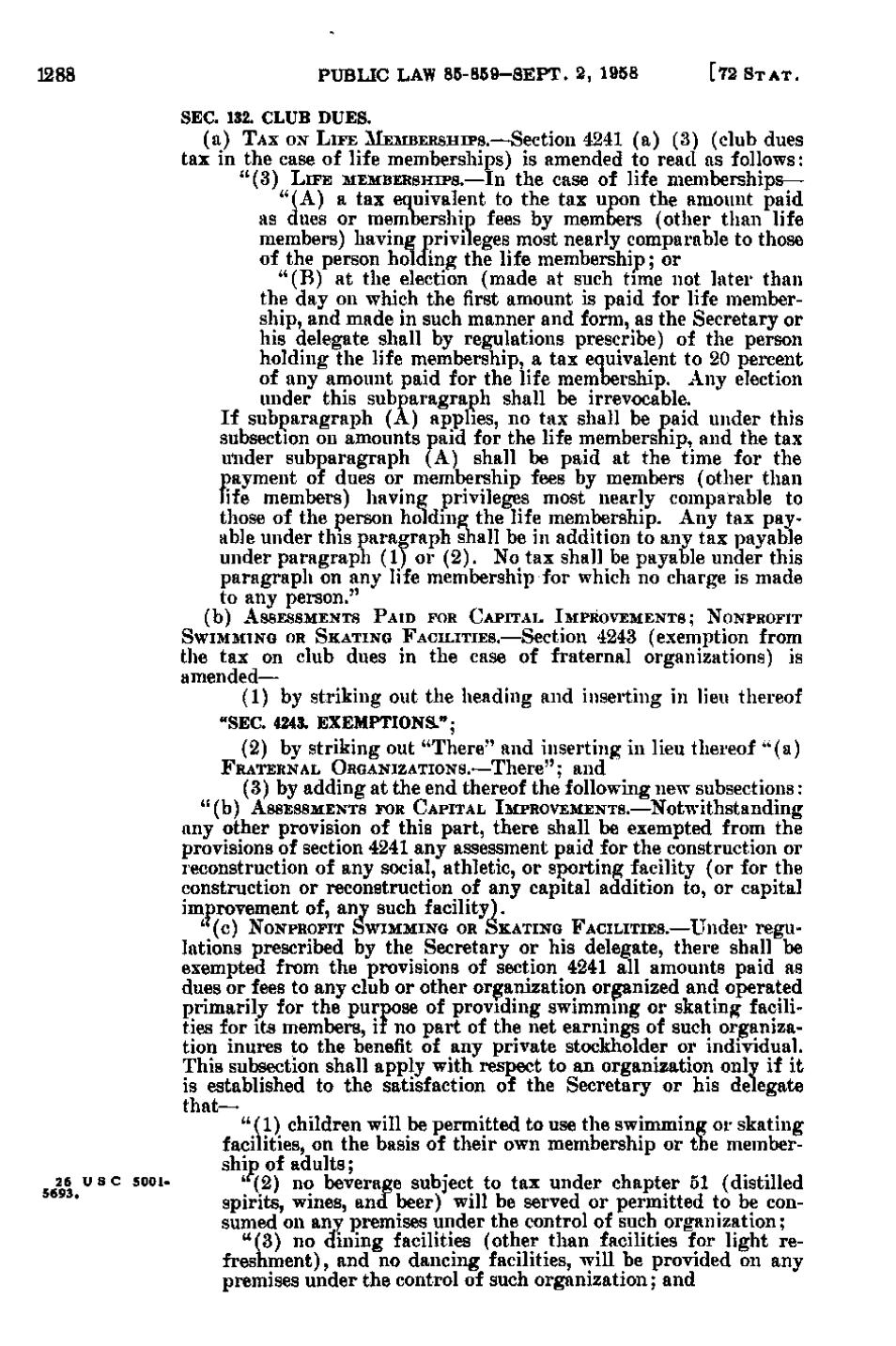

SEC. 132. CLUB DUES. (a) TAX ON L I F E MEMBERSHIPS.—Section 4241(a)(3) (club dues tax in the case of life memberships) is amended to read as follows: "(3) L I F E MEMBERSHIPS.—In the case of life memberships— " (A) a tax equivalent to the tax upon the amount paid as dues or membership fees by members (other than life members) having privileges most nearly comparable to those of the person holding the life membership; or " (B) at the election (made at such time not later than the day on which the first amount is paid for life membership, and made in such manner and form, as the Secretary or his delegate shall by regulations prescribe) of the person holding the life membership, a tax equivalent to 20 percent of any amount paid for the life membership. Any election under this subparagraph shall be irrevocable. If subparagraph (A) applies, no tax shall be paid under this subsection on amounts paid for the life membership, and the tax under subparagraph (A) shall be paid at the time for the payment of dues or membership fees by members (other than life members) having privileges most nearly comparable to those of the person holding the life membership. Any tax payable under this paragraph shall be in addition to any tax payable under paragraph (1) or (2). No tax shall be payable under this paragraph on any life membership for which no charge is made to any person." (b) ASSESSMENTS PAID FOR CAPITAL, IMPROVEMENTS; NONPROFIT SWIMMING OR SKATING FACILITIES.—Section 4243 (exemption from

the tax on club dues in the case of fraternal organizations) is amended— (1) by striking out the heading and inserting in lieu thereof "SEC. 4243. EXEMPTIONS."; (2) by striking out "There" and inserting in lieu thereof "(a) FRATERNAL ORGANIZATIONS.—There";

and

(3) by adding at the end thereof the following new subsections: "(b)

ASSESSMENTS FOR CAPITAL IMPROVEMENTS.—Notwithstanding

any other provision of this part, there shall be exempted from the provisions of section 4241 any assessment paid for the construction or reconstruction of any social, athletic, or sporting facility (or for the construction or reconstruction of any capital addition to, or capital improvement of, any such facility). "(c) NONPROFIT SWIMMING OR SKATING FACILITIES.—Under regulations prescribed by the Secretary or his delegate, there shall be exempted from the provisions of section 4241 all amounts paid as dues or fees to any club or other organization organized and operated primarily for the purpose of providing swimming or skating facilities for its members, if no part of the net earnings of such organization inures to the benefit of any private stockholder or individual. This subsection shall apply with respect to an organization only if it is established to the satisfaction of the Secretary or his delegate that— "(1) children will be permitted to use the swimming or skating facilities, on the basis of their own membership or the membership of adults; 26 USC 5001"(2) no beverage subject to tax under chapter 51 (distilled spirits, wines, and beer) will be served or permitted to be consumed on any premises under the control of such organization; "(3) no dining facilities (other than facilities for light refreshment), and no dancing facilities, will be provided on any premises under the control of such organization; and

�