1400

PUBLIC LAW 85-859-8EPT. 2, 1958

[72 S T A T.

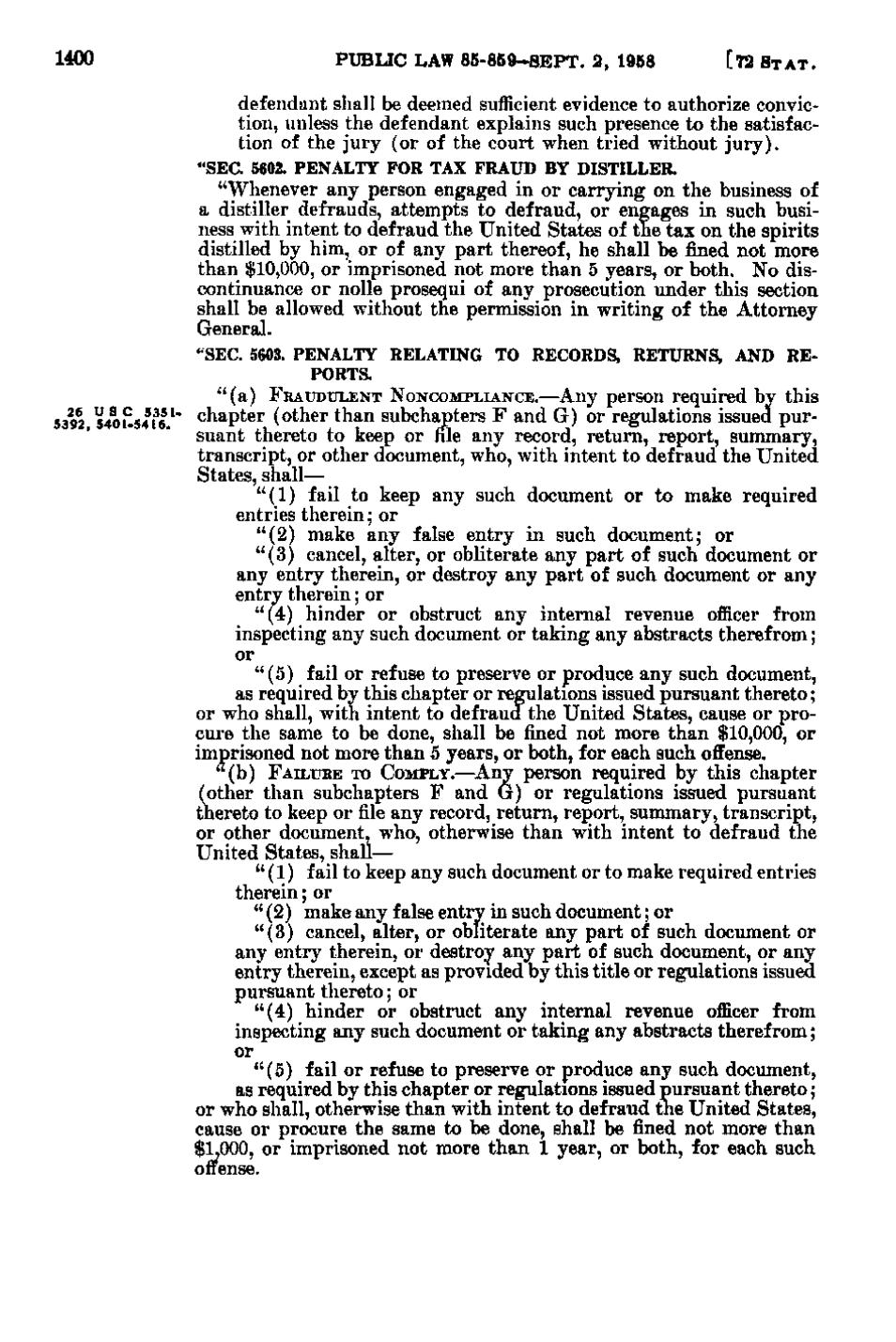

defendant shall be deemed sufficient evidence to authorize conviction, unless the defendant explains such presence to the satisfaction of the jury (or of the court when tried without j u r y). "SEC. 5602. PENALTY FOR TAX FRAUD BY DISTILLER. "Whenever any person engaged in or carrying on the business of a distiller defrauds, attempts to defraud, or engages in such business with intent to defraud the United States of the tax on the spirits distilled by him, or of any part thereof, he shall be fined not more than $10,000, or imprisoned not more than 5 years, or both. No discontinuance or nolle prosequi of any prosecution under this section shall be allowed without the permission in writing of the Attorney General.

"SEC. 5 0. PENALTY RELATING TO RECORDS, RETURNS, AND RE63 PORTS. 53^2 ^40?.s4iiy

" (a) FRAUDULENT NONCOMPLIANCE.—Any person required by this chapter (other than subchapters F and G) or regulations issued pursuant thereto to keep or file any record, return, report, summary, transcript, or other document, who, with intent to defraud the United States, shall— "(1) fail to keep any such document or to make required entries therein; or "(2) make any false entry in such document; or "(3) cancel, alter, or obliterate any part of such document or any entry therein, or destroy any part of such document or any entry therein; or "(4) hinder or obstruct any internal revenue officer from inspecting any such document or taking any abstracts therefrom; or "(5) fail or refuse to preserve or produce any such document, as required by this chapter or regulations issued pursuant thereto; or who shall, with intent to defraud the United States, cause or procure the same to be done, shall be fined not more than $10,000, or imprisoned not more than 5 years, or both, for each such offense. "(b) FAILURE TO COMPLY.—Any person required by this chapter (other than subchapters F and G) or regulations issued pursuant thereto to keep or file any record, return, report, summary, transcript, or other document, who, otherwise than with intent to defraud the United States, shall— " (1) fail to keep any such document or to make required entries therein; or "(2) make any false entry in such document; or "(3) cancel, alter, or obliterate any part of such document or any entry therein, or destroy any part of such document, or any entry therein, except as provided by this title or regulations issued pursuant thereto; or "(4) hinder or obstruct any internal revenue officer from inspecting any such document or taking any abstracts therefrom; or "(5) fail or refuse to preserve or produce any such document, as required by this chapter or regulations issued pursuant thereto; or who shall, otherwise than with intent to defraud the United States, cause or procure the same to be done, shall be fined not more than $1,000, or imprisoned not more than 1 year, or both, for each such offense.

�