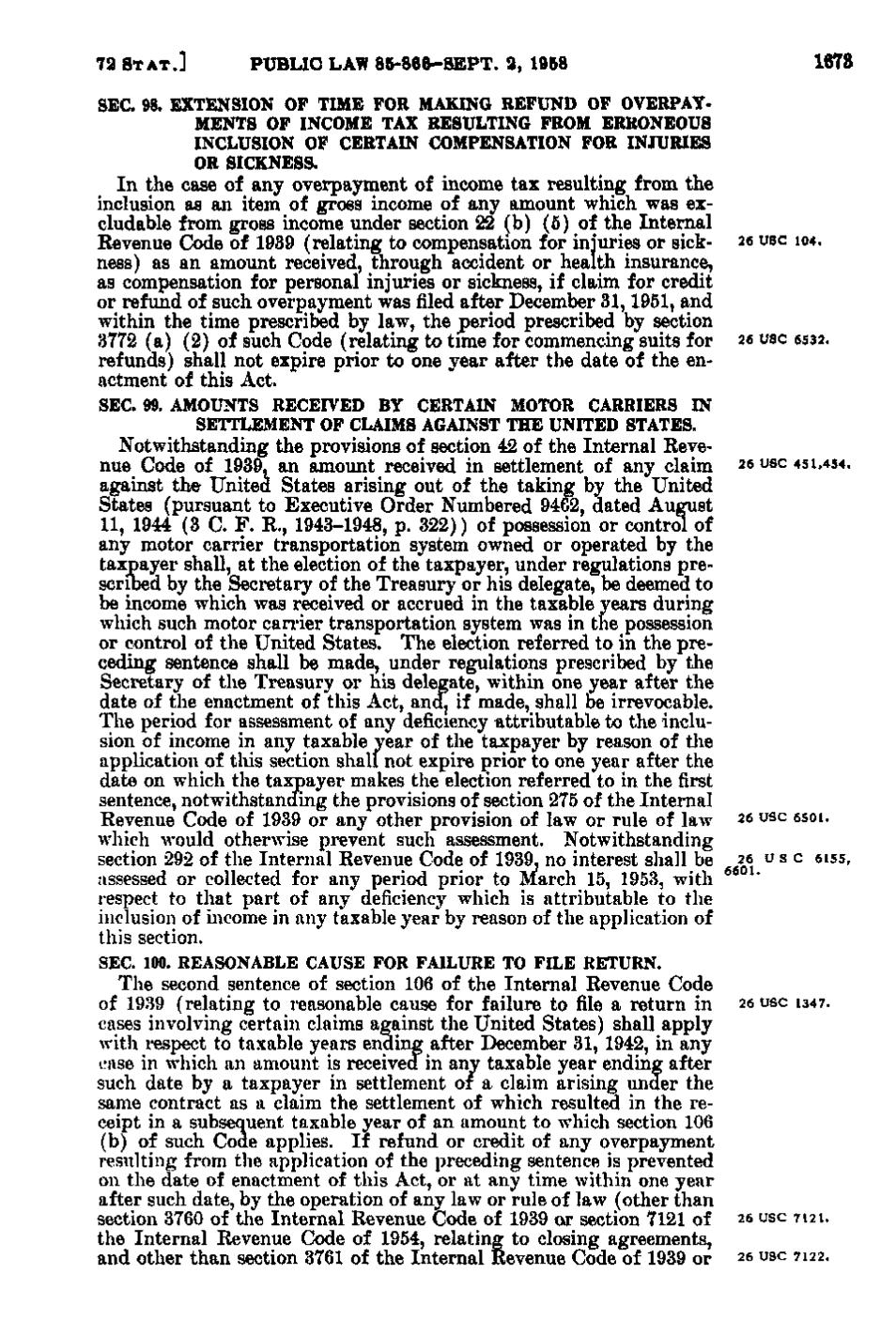

72 S T A T. ]

PUBLIC LAW 86-866-8EPT. 2, 1968

1678

SEC. 98. EXTENSION OP TIME FOR MAKING REFUND OF OVERPAYMENTS OF INCOME TAX RESULTING FROM ERRONEOUS INCLUSION OF CERTAIN COMPENSATION FOR INJURIES OR SICKNESS. I n the case of any overpayment of income tax resulting from the inclusion as an item of gross income of any amount which was excludable from gross income under section 22(b)(5) of the Internal Revenue Code of 1939 (relating to compensation for injuries or sick- 26 USC io4. ness) as an amount received, through accident or health insurance, as compensation for personal injuries or sickness, if claim for credit or refund of such overpayment was filed after December 31, 1951, and within the time prescribled by law, the period prescribed by section 3772 (a)(2) of such Code (relating to time for commencing suits for 26 USC 6S32. refunds) shall not expire prior to one year after the date of the enactment of this Act. SEC. 99. AMOUNTS RECEIVED BY CERTAIN MOTOR CARRIERS IN SETTLEMENT OF CLAIMS AGAINST THE UNITED STATES. Notwithstanding the provisions of section 42 of the Internal Revenue Code of 1939, an amount received in settlement of any claim 26 USC 4S 1,454. against the United States arising out of the taking by the United States (pursuant to Executive Order Numbered 94G2, dated August 11, 1944 (3 C. F. R., 1943-1948, p. 322)) of possession or control of any motor carrier transportation system owned or operated by the taxpayer shall, at the election of the taxpayer, under regulations prescribed by the Secretary of the Treasury or his delegate, be deemed to be income which was received or accrued in the taxable years during which such motor carrier transportation system was in the possession or control of the United States. The election referred to in the preceding sentence shall be made, under regulations prescribed by the Secretary of the Treasury or his delegate, within one year after the date of the enactment of this Act, andj if made, shall be irrevocable. The period for assessment of any deficiency attributable to the inclusion of income in any taxable year of the taxpayer by reason of the application of this section shall not expire prior to one year after the date on which the taxpayer makes the election referred to in the first sentence, notwithstanding the provisions of section 275 of the Internal Revenue Code of 1939 or any other provision of law or rule of law 26 USC esoi. which would otherwise prevent such assessment. Notwithstanding section 292 of the Internal Revenue Code of 1939, no interest shall be 26 USC 6155, iissessed or collected for any period prior to March 15, 1953, with ^^ respect to that part of any deficiency which is attributable to the inclusion of income in any taxable year by reason of the application of this section. SEC. 100. REASONABLE CAUSE FOR FAILURE TO FILE RETURN. The second sentence of section 106 of the Internal Revenue Code of 1939 (relating to reasonable cause for failure to file a return in cases involving certain claims against the United States) shall apply with respect to taxable years ending after December 31, 1942, in any case in which an amount is received in any taxable year ending after such date by a taxpayer in settlement of a claim arising under the same contract as a claim the settlement of which resulted in the receipt in a subsequent taxable year of an amount to which section 106 (b) of such Code applies. If refund or credit of any overpayment resulting from the application of the preceding sentence is prevented on the date of enactment of this Act, or at any time within one year after such date, by the operation of any law or rule of law (other than section 3760 of the Internal Revenue Code of 1939 or section 7121 of the Internal Revenue Code of 1954, relating to closing agreements, and other than section 3761 of the Internal Revenue Code of 1939 or

26 USC 1347.

26 USC 7121. 26 USC 7122.

�