1004

26 USC 542.

26 USC 1033.

PUBLIC LAW 86-779-SEPT. 14, 1960

[74 S T A T.

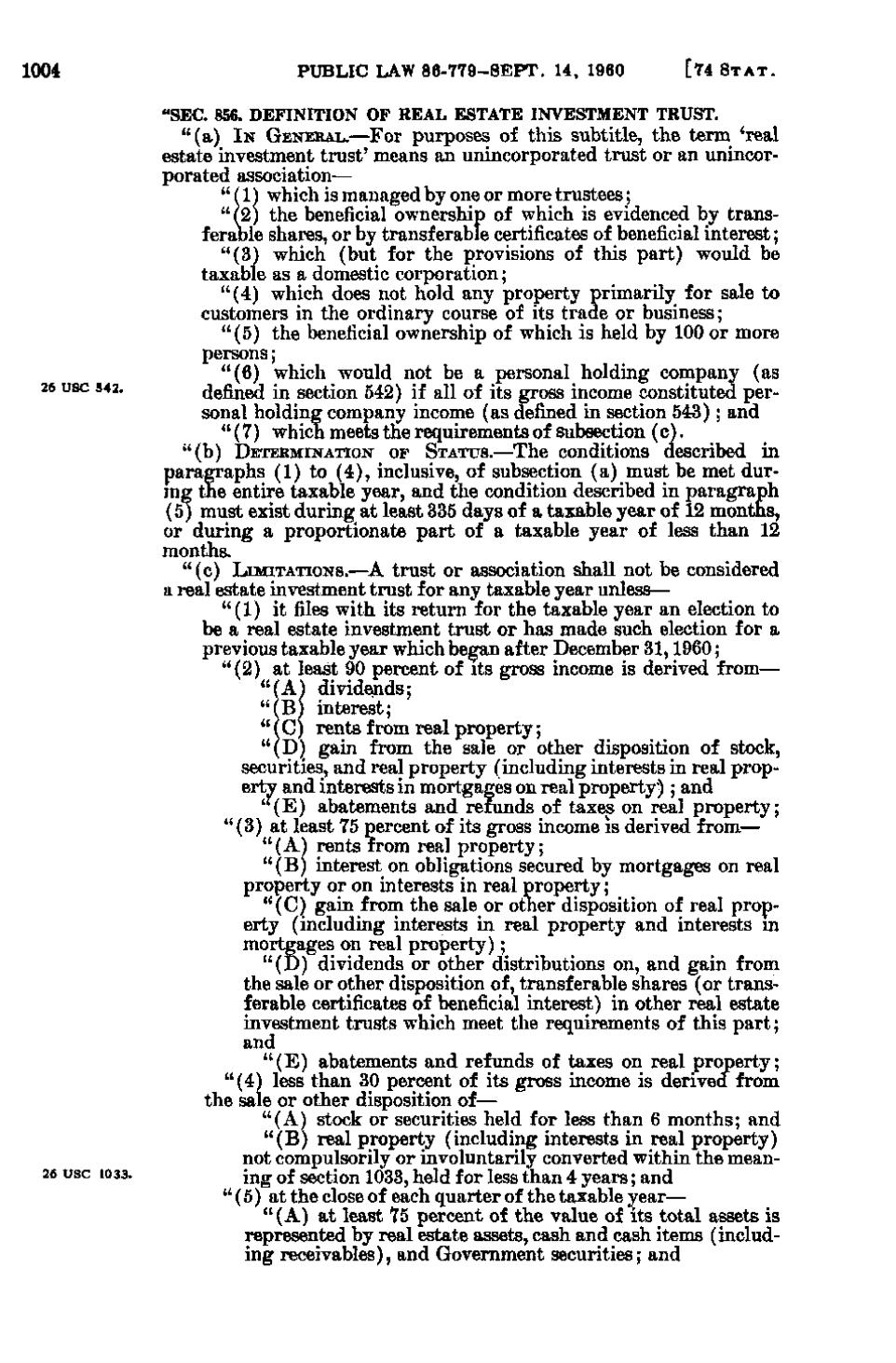

"SEC. 856. DEFINITION OF REAL ESTATE INVESTMENT TRUST. " (a) IN GENERAL.—For purposes of this subtitle, the term 'real estate investment trust' means an unincorporated trust or an unincorporated association— " (1) which is managed by one or more trustees; "(2) the beneficial ownership of which is evidenced by transferable shares, or by transferable certificates of beneficial interest; "(3) which (but for the provisions of this part) would be taxable as a domestic corporation; "(4) which does not hold any property primarily for sale to customers in the ordinary course of its trade or business; "(5) the beneficial ownership of which is held by 100 or more persons; "(6) which would not be a personal holding company (as defined in section 542) if all of its gross income constituted personal holding company income (as defined in section 543); and " (7) which meets the requirements of subsection (c). " (b) DETERMINATION OF STATUS.—The conditions described in paragraphs (1) to (4), inclusive, of subsection (a) must be met durnig the entire taxable year, and the condition described in paragraph (5) must exist during at least 335 days of a taxable year of 12 months, or during a proportionate part of a taxable year of less than 12 months. "(c) LIMITATIONS.—A trust or association shall not be considered a real estate investment trust for any taxable year unless— "(1) it files with its return for the taxable year an election to be a real estate investment trust or has made such election for a previous taxable year which be^an after December 31, 1960; "(2) at least 90 percent of its gross income is derived from— " (A) dividends; " (B) interest; " (C) rents from real property; " (D) gain from the sale or other disposition of stock, securities, and real property (including interests in real property and interests in mortgages on real property); and " (E) abatements and refunds of taxes on real property; "(3) at least 75 percent of its gross income is derived from— " (A) rents from real property; " (B) interest on obligations secured by mortgages on real property or on interests in real property; " (C) gain from the sale or other disposition of real property (including interests in real property and interests m mortgages on real property); " (D) dividends or other distributions on, and gain from the sale or other disposition of, transferable shares (or transferable certificates of beneficial interest) in other real estate investment trusts which meet the requirements of this part; and " (E) abatements and refunds of taxes on real property; "(4) less than 30 percent of its gross income is derived from the sale or other disposition of— " (A) stock or securities held for less than 6 months; and " (B) real property (including interests in real property) not compulsorily or involuntarily converted within the meaning of section 1033, held for less than 4 years; and " (5) at the close of each quarter of the taxable year— " (A) a t least 75 percent of the value of its total assets is represented by real estate assets, cash and cash items (including receivables), and Government securities; and

�