•870

70 Stat. 754. S u s e 2260.

5 USC 2259.

5 USC 2257, Infra.

S u s e 2260.

5 USC 2259.

PUBLIC LAW 87-793-OCT. 11, 1962

[76

STAT.

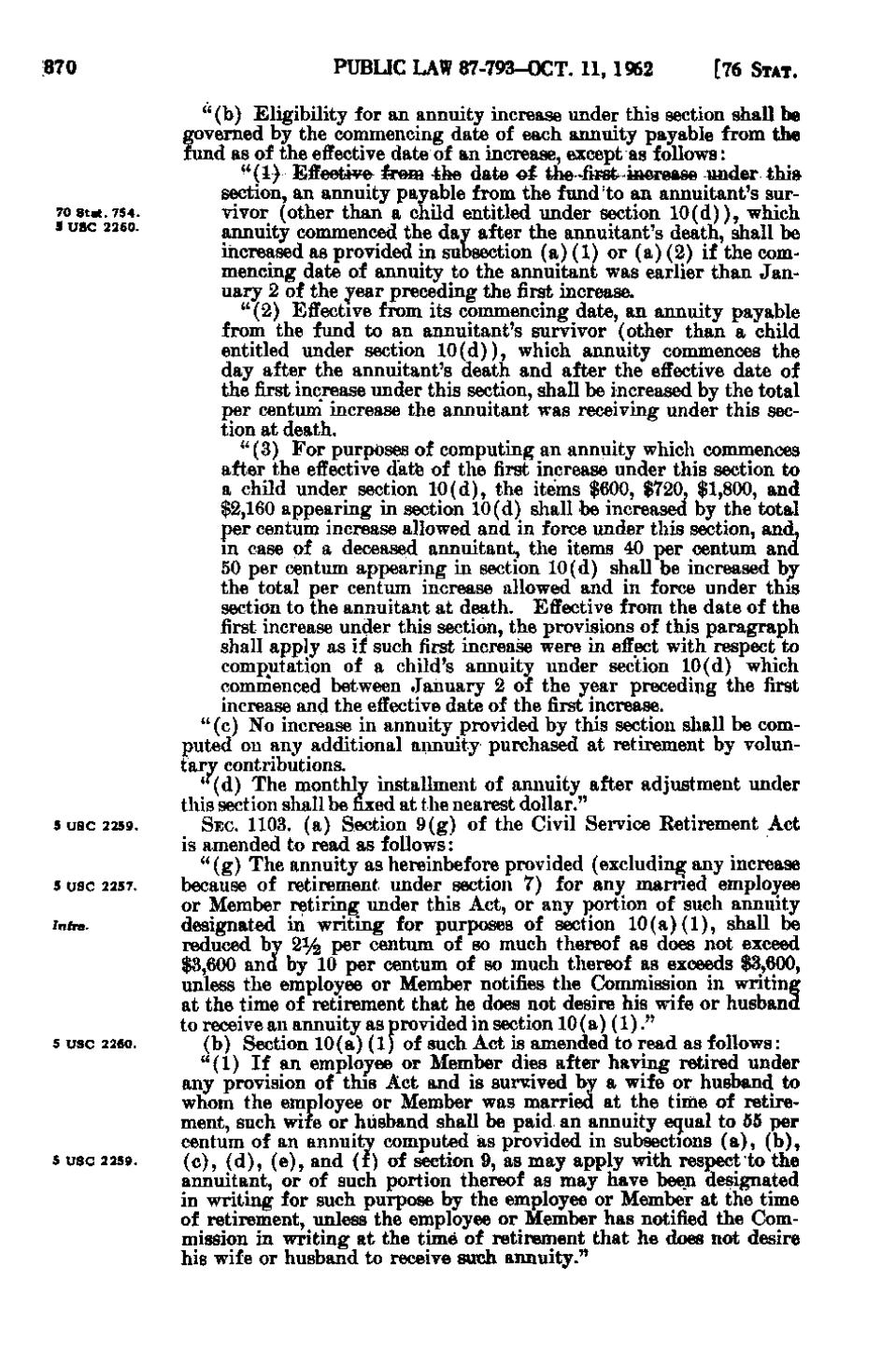

" (b) Eligibility for an annuity increase under this section shall be governed by the commencing date of each annuity payable from the fund as of the effective date of an increase, except as follows: ^'(1) Effective- f r ^ n ^he date o i the-first in^-ease under thi& section, an annuity payable from the fund'to an annuitant's survivor (other than a child entitled under section 1 0 (d)), which annuity commenced the day after the annuitant's death, shall be increased as provided in subsection (a)(1) or (a)(2) if the commencing date of annuity to the annuitant was earlier than January 2 of the year preceding the first increase. "(2) Effective from its commencing date, an annuity payable from the fund to an annuitant's survivor (other than a child entitled under section 1 0 (d)), which annuity commences the day after the annuitant's death and after the effective date of the first increase under this section, shall be increased by the total per centum increase the annuitant was receiving under this section at death. "(3) For purposes of computing an annuity which commences after the effective date of the first increase under this section to a child under section 10(d), the items $600, $720, $1,800, and $2,160 appearing in section 10(d) shall be increased by the total per centum increase allowed and in force under this section, and, m case of a deceased annuitant, the items 40 per centum and 50 per centum appearing in section 10(d) shall be increased by the total per centum increase allowed and in force under this section to the annuitant at death. Effective from the date of the first increase under this section, the provisions of this paragraph shall apply as if such first increase were in effect with respect to computation of a child's annuity under section 10(d) which commenced between January 2 of the year preceding the first increase and the effective date of the first increase. "(c) No increase in annuity provided by this section shall be computed on any additional annuity purchased at retirement by voluntary contributions. " (d) The monthly installment of annuity after adjustment under this section shall be fixed at the nearest dollar." SEC. 1103. (a) Section 9(g) of the Civil Service Retirement Act is amended to read as follows: " (g) The annuity as hereinbefore provided (excluding any increase because of retirement under section 7) for any married employee or Member retiring under this Act, or any portion of such annuity designated in writing for purposes of section 1 0 (a)(1), shall be reduced by 2% per centum of so much thereof as does not exceed $3,600 and by 10 per centum of so much thereof as exceeds $3,600, unless the employee or Member notifies the Commission in writing at the time of retirement that he does not desire his wife or husband to receive an annuity as provided in section 10(a)(1)." (b) Section 10(a)(1) of such Act is amended to read as follows: "(1) If an employee or Member dies after having retired under any provision of this Act and is survived by a wife or husband to whom the employee or Member was married at the time of retirement, such wife or husband shall be paid an annuity eq[ual to 55 per centum of an annuity computed as provided in subsections (a), (b), (c), (d), (e), and (t) of section 9, as may apply with respect to the annuitant, or of such portion thereof as may have been designated in writing for such purpose by the employee or Member at the time of retirement, unless the employee or Member has notified the Commission in writing at the time of retirement that he does not desire his wife or husband to receive such annuity."

�