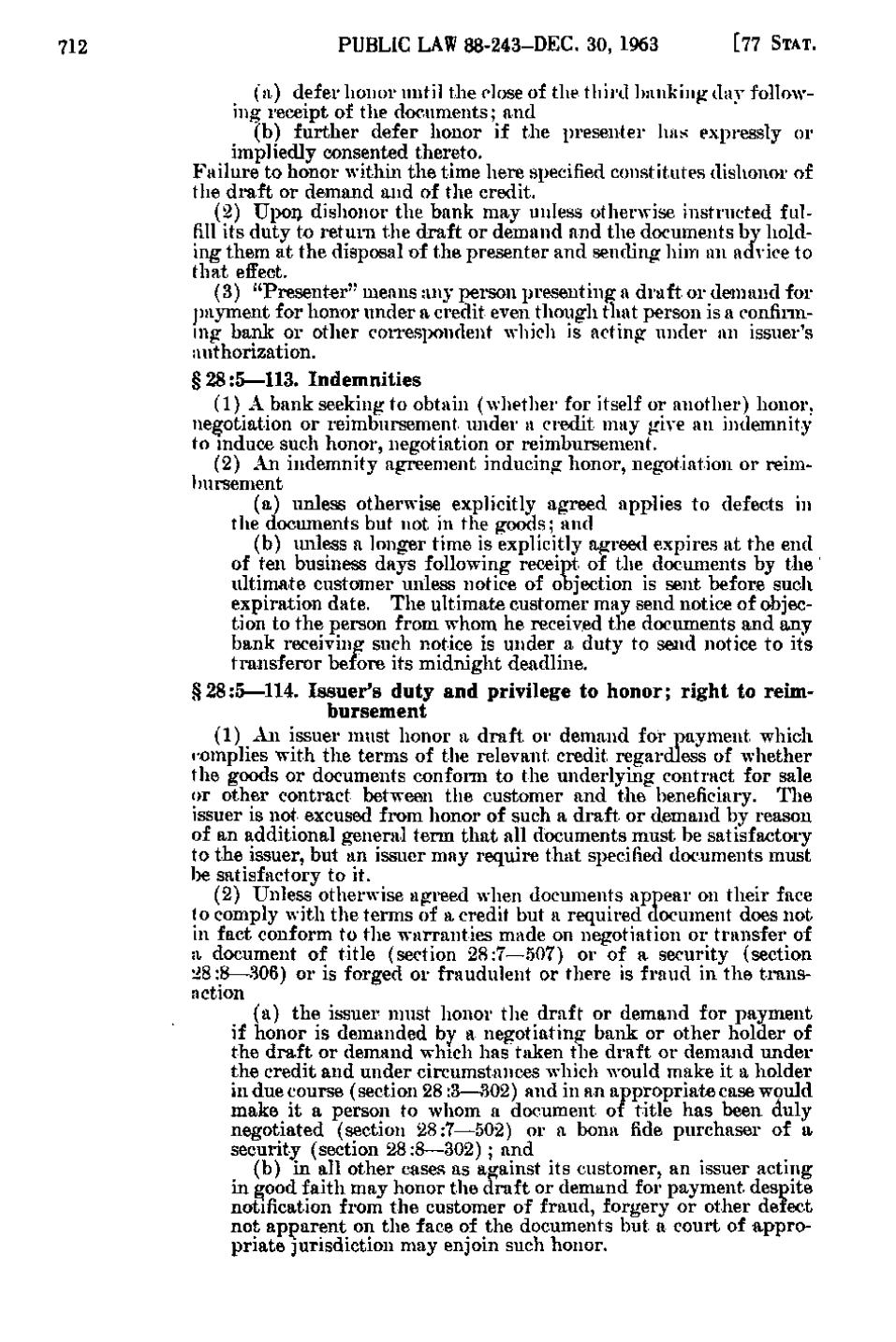

712

PUBLIC LAW 88-243-DEC. 30, 1963

[77 STAT.

(a) defer honor until the close of the third banking- day following- receipt of the documents; and (b) further defer honor if the presenter lias expressly or impliedly consented thereto. Failure to honor within the time here specified constitutes dishonor of the draft or demand and of the credit. (2) Upoi; dishonor the bank may unless otherwise instructed fulfill its duty to return the draft or demand and the documents by holding them at the disposal of the presenter and sending him an advice to that effect. (3) "Presenter" means any person presenting a draft oi' demand for payment for honor under a credit even though that person is a confinning bank or other coiTespondent which is acting under an issuer's authorization. § 28:5—113. Indemnities (1) A bank seeking to obtain (whether for itself or another) honor, negotiation or reimbursement under a credit may give an indemnity to induce such honor, negotiation or reimbursement. (2) An indemnity agreement inducing honor, negotiation or reim))ursement (a) unless otherwise explicitly agreed applies to defects in. the documents but not in the goods; and (b) unless a longer time is explicitly agreed expires at the end of ten business days following receipt of the documents by the ultimate customer unless notice of objection is sent before such expiration date. The ultimate customer may send notice of objection to the person from whom he received the documents and any bank receiving such notice is under a duty to send notice to its transferor before its midnight deadline. §28:5—114. Issuer's duty and privilege to honor; right to reimbursement (1) An issuer must honor a draft or demand for payment which complies with the terms of the relevant credit regardless of whether the goods or documents conform to the underlying contract for sale or other contract between the customer and the beneficiary. The issuer is not excused from honor of such a draft or demand by reason of an additional general term that all documents must be satisfactory to the issuer, but an issuer may require that specified documents must be satisfactory to it. (2) Unless otherwise agreed when documents appear on their face to comply with the terms of a credit but a required document does not in fact conform to the warranties made on negotiation or transfer of a document of title (section 28:7—507) or of a security (section 28:8—306) or is forged or fraudulent or there is fraud in the transaction (a) the issuer must honor the draft or demand for payment if honor is demanded by a negotiating bank or other holder of the draft or demand which has taken the draft or demand under the credit and under circumstances which would make it a holder in due course (section 28:3—302) and in an appropriate case would make it a person to whom a document of title has been duly negotiated (section 28:7—502) or a bona fide purchaser of a security (section 28:8—302); and (b) in all other cases as against its customer, an issuer acting in good faith may honor the draft or demand for payment despite notification from the customer of fraud, forgery or other detect not apparent on the face of the documents but a court of appropriate jurisdiction may enjoin such honor.

�