702

PUBLIC LAW 91-172-DEC. 30, 1969

[83 STAT.

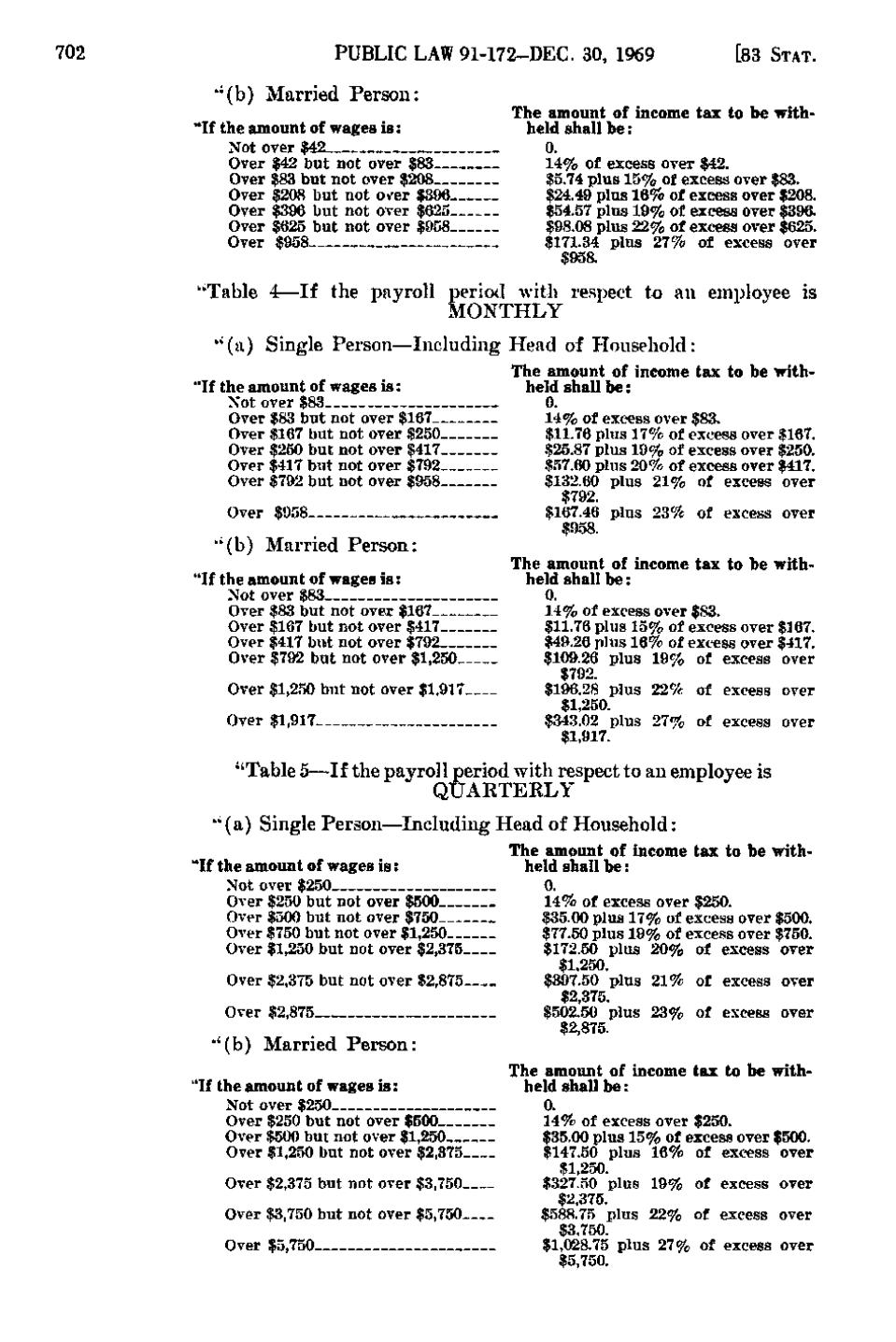

"(b) Married Person: 'If the amount of wages i s: Not over $42 Over $42 but not over $83 Over $83 but not over $208 Over $208 but not Ov^er $396 Over $396 but not over $625 Over $625 but not over $958 Over $958

'Table

The a m o u n t of income tax to b e withheld shall b e: 0. 14% of excess over $42. $5.74 plus 1 5 % of excess over $83. $24.49 plus 16% of excess over $208. $54.57 plus 19% of excess over $396. $98.08 plus 2 2 % of excess over $625. $171.34 plus 2 7 % of excess over $958.

If the payroll period with respect to an employee is MONTHLY

" (a) Single Person—Including Head of Household: 'If the amount of wages i s: Not over $83 Over $83 but not over $167 Over $167 but not over $250 Over $250 but not over $417 Over $417 but not over $792 Over $792 but not over $958 Over $958 '•(b) Married

The amount of income tax to be withheld shall b e: 0. 14% of excess over $83. $11.76 plus 17% of excess over $167. .$25.87 plus 19% of excess over $250. $57.60 plus 20% of excess over $417. $132.60 plus 2 1 % of excess over $792 $167.46 plus 2 3 % of excess over $9.58.

Person:

'If the amount of wages i s: Not over $83 Over $83 but not over $167 Over $167 but not over $417 Over $417 but not over $792 Over $792 but not over $1,250 Over $1,250 but not over $1.917 Over $1,917

The amount of income tax to b e withheld shall b e: 0. 14% of excess over $83. $11.76 plus 15% of excess over $167. $49.26 plus 16% of excess over $417, $109.26 plus 19% of excess over $792. $196.28 plus 22% of excess over $1 250. $343!o2 "plus 2 7 % of excess over $1,917.

• ' T a b l e 5 — I f the p a y r o l l period w i t h r e s p e c t to a n e m p l o y e e is QUARTERLY " (a) S i n g l e P e r s o n — I n c l u d i n g H e a d of H o u s e h o l d: "If the amount of wages i s: Not over $250 Over $250 but not over $500 Over $500 but not over $750 Over $750 but not over $1,250— Over $1,250 but not over $2,375. Over $2,375 but not over $2,875. Over $2,875 •'(b)

Married

Person:

'If the amount of wages i s: Not over $250 Over $250 but not over $500 Over $500 but not over $1,250___ Over $1,250 but not over $2,375. Over $2,375 but not over $3,750. Over $3,750 but not over $5,750. Over $5,750

The amount of income tax to be withheld shall b e: 0. 14% of excess over $250. $35.00 plus 17% of excess over $500. $77.50 plus 19% of excess over $750. $172.50 plus 20% of excess over $1,250. $397.50 plus 2 1 % of excess over $2,375. $502.50 plus 2 3 % of excess over $2,875. The amount of income tax to be withheld shall b e: 0. 1 4 % of excess over $250. $35.00 plus 1 5 % of excess over $500. $147.50 plus 1 6 % of excess over $1,250. $327.50 plus 1 9 % of excess over $2,375. $588.75 plus 2 2 % of excess over $3 750. $1,028.75 plus 2 7 % of excess over $5,750.

�