87 STAT. ]

PUBLIC LAW 93-17-APR. 10, 1973

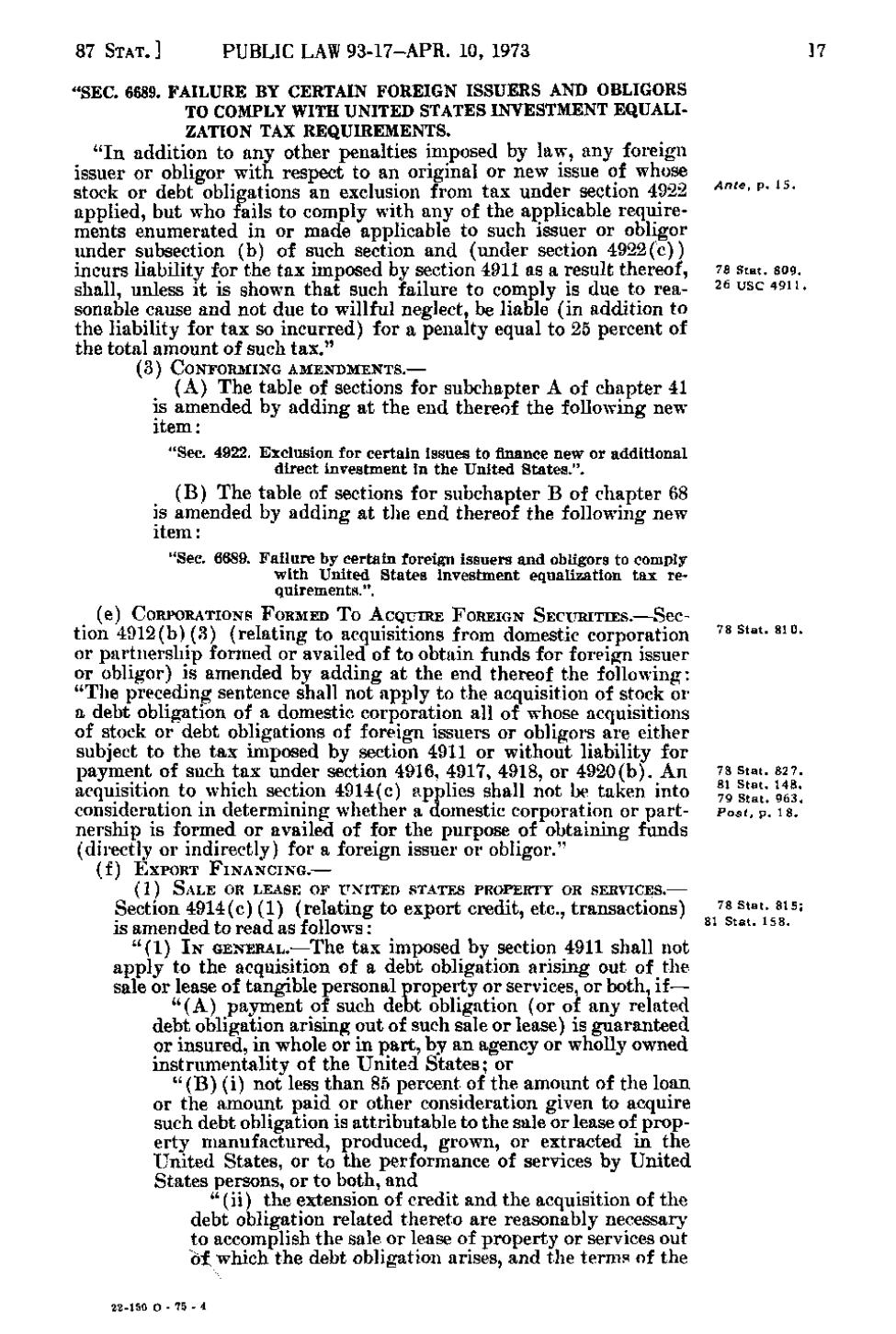

"SEC. 6689. FAILURE BY CERTAIN FOREIGN ISSUERS AND OBLIGORS TO COMPLY WITH UNITED STATES INVESTMENT EQUALIZATION TAX REQUIREMENTS. " I n addition to any other penalties imposed by law, any foreign issuer or obligor with respect to an original or new issue of whose stock or debt obligations an exclusion from tax under section 4922 applied, but who fails to comply with any of the applicable requirements enumerated in or made applicable to such issuer or obligor under subsection (b) of such section and (under section 4922(c)) incurs liability for the tax imposed by section 4911 as a result thereof, shall, unless it is shown that such failure to comply is due to reasonable cause and not due to willful neglect, be liable (in addition to the liability for tax so incurred) for a penalty equal to 25 percent of the total amount of such tax."

17

Ante,

p. 15.

78 Stat. 809. ^^ use 4911.

(3) CONFORMING AMENDMENTS.—

(A) The table of sections for subchapter A of chapter 41 is amended by adding at the end thereof the following new item: "Sec. 4922. Exclusion for certain issues to finance new or additional direct investment in the United States.". (B) The table of sections for subchapter B of chapter 68 is amended by adding at the end thereof the following new item: "Sec. 6689. Failure by certain foreign issuers and obligors to comply with United States investment equalization tax requirements.". (e)

CORPORATIONS FORMED To ACQUIRE FOREIGN SECURITIES.—Sec-

tion 4912(b)(3) (relating to acquisitions from domestic corporation or partnership formed or availed of to obtain funds for foreign issuer or obligor) is amended by adding at the end thereof the following: "The preceding sentence shall not apply to the acquisition of stock or a debt obligation of a domestic corporation all of whose acquisitions of stock or debt obligations of foreign issuers or obligors are either subject to the tax imposed by section 4911 or without liability for payment of such tax under section 4916, 4917, 4918, or 4920(b). An acquisition to which section 4914(c) applies shall not be taken into consideration in determining whether a domestic corporation or partnership is formed or availed of for the purpose of obtaining funds (directly or indirectly) for a foreign issuer or obligor." (f)

78 Stat. 810.

78 Stat. 827 79 Itat'. 963 Post, p. 18.

EXPORT FINANCING.— (1) SALE OR LEASE OF UNITED STATES PROPERTY OR SERVICES.—

Section 4914(c)(1) (relating to export credit, etc., transactions) ^^ ^*^'- ^^^ is amended to read as follows: ^^ ^*^*- ^^^• "(1) IN GENERAL.—The tax imposed by section 4911 shall not apply to the acquisition of a debt obligation arising out of the sale or lease of tangible personal property or services, or both, if— " (A) payment of such debt obligation (or of any related debt obligation arising out of such sale or lease) is guaranteed or insured, in whole or in part, by an agency or wholly owned instrumentality of the United States; or " (B)(i) not less than 85 percent of the amount of the loan or the amount paid or other consideration given to acquire such debt obligation is attributable to the sale or lease of property manufactured, produced, grown, or extracted in the United States, or to the performance of services by United States persons, or to both, and " (ii) the extension of credit and the acquisition of the debt obligation related thereto are reasonably necessary to accomplish the sale or lease of property or services out ^ i which the debt obligation arises, and the terms of the 22-150 O - 75 - 4

�