1728

Penalties.

12 USC 2608.

Liability.

PUBLIC LAW 93-533-DEC. 22, 1974

[88 STAT.

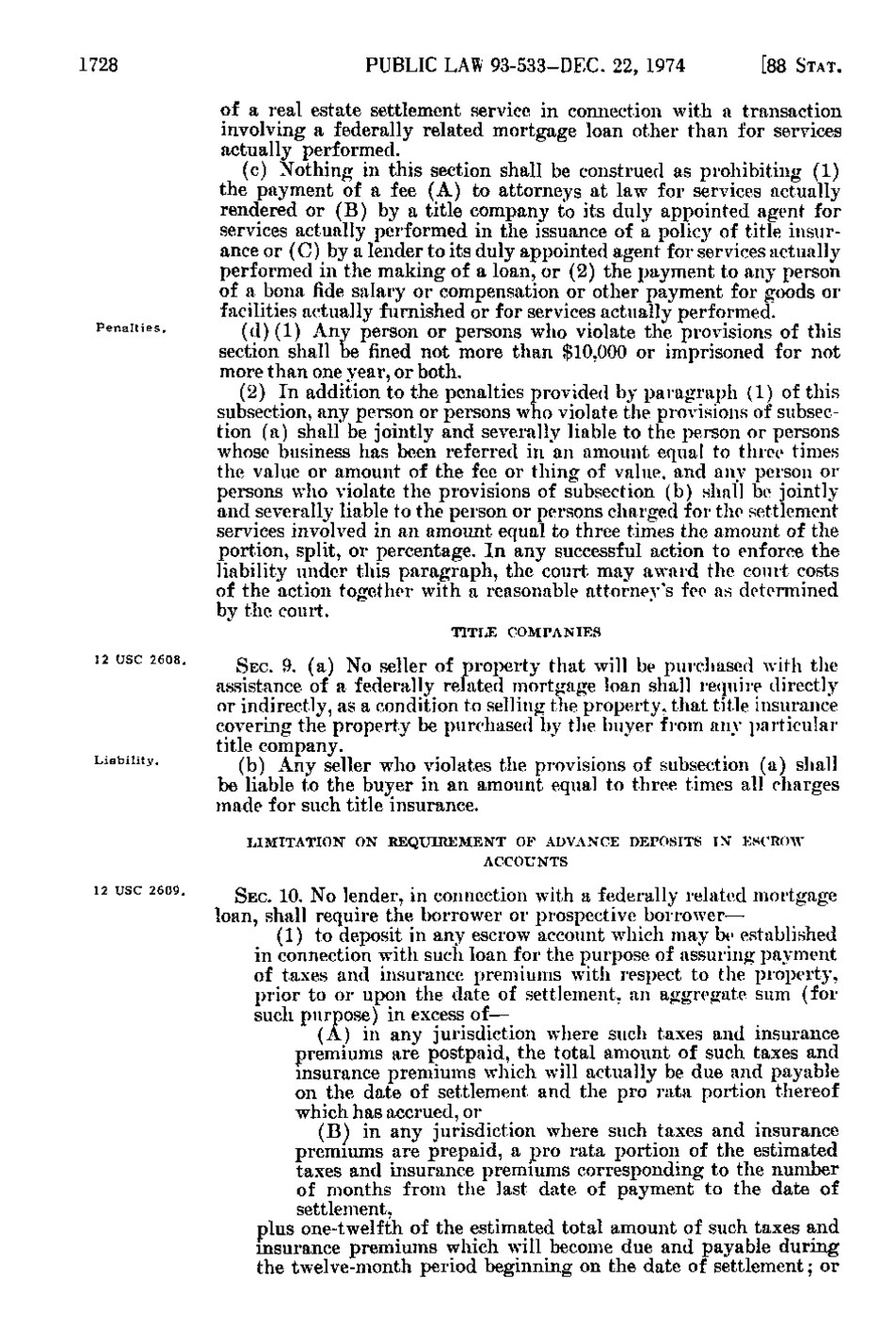

of a real estate settlement service in connection with a transaction involving a federally related mortgage loan other than for services actually performed. (c) Nothing in this section shall be construed as prohibiting (1) the payment of a fee (A) to attorneys at law for services actually rendered or (B) by a title company to its duly appointed agent for services actually performed in the issuance of a policy of title insurance or (C) by a lender to its duly appointed agent for services actually performed in the making of a loan, or (2) the payment to any person of a bona fide salary or compensation or other payment for goods or facilities actually furnished or for services actually performed. (d)(1) Any pcrsou Or persons who violate the provisions of this section shall be fined not more than $10,000 or imprisoned for not more than one year, or both. (2) In addition to the penalties provided by paragraph (1) of this subsection, any person or persons who violate the provisions of subsection (a) shall be jointly and severally liable to the person or persons whose business has been referred in an amount equal to three times the value or amount of the fee or thing of value, and any peison or persons who violate the provisions of subsection (b) shall be jointly and severally liable to the person or persons charged for the settlement services involved in an amount equal to three times the amount of the portion, split, or percentage. In any successful action to enforce the liability under this paragraph, the court may award the court costs of the action together with a reasonable attorney's fee as determined by the court. TITLE COMPANIES g^^ g_ ^^^ j ^ ^ Seller of property that will be purchased with the assistance of a federally related mortgage loan shall require directly or indirectly, as a condition to selling the property, that title insurance covering the property be purchased by the buyer from any particular title company. ^1^^ ^j^y seiigj. ^j^Q violates the provisions of subsection (a) shall be liable to the buyer in an amount equal to three times all charges made for such title insurance. LIMITATION ON REQUIREMENT OP ADVANCE DEPOSITS IN ESCROW ACCOUNTS

12 USC 2609.

S E C 10. No lender, in connection with a federally related mortgage loan, shall require the borrower or prospective borrower— (1) to deposit in any escrow account which may be established in connection with such loan for the purpose of assuring payment of taxes and insurance premiums with respect to the property, prior to or upon the date of settlement, an aggregate sum (for such purpose) in excess of— (A) in any jurisdiction where such taxes and insurance premiums are postpaid, the total amount of such taxes and insurance premiums which will actually be due and payable on the date of settlement and the pro rata portion thereof which has accrued, or (B) in any jurisdiction where such taxes and insurance premiums are prepaid, a pro rata portion of the estimated taxes and insurance premiums corresponding to the number of months from the last date of payment to the date of settlement, plus one-twelfth of the estimated total amount of such taxes and insurance premiums which will become due and payable during the twelve-month period beginning on the date of settlement; or

�