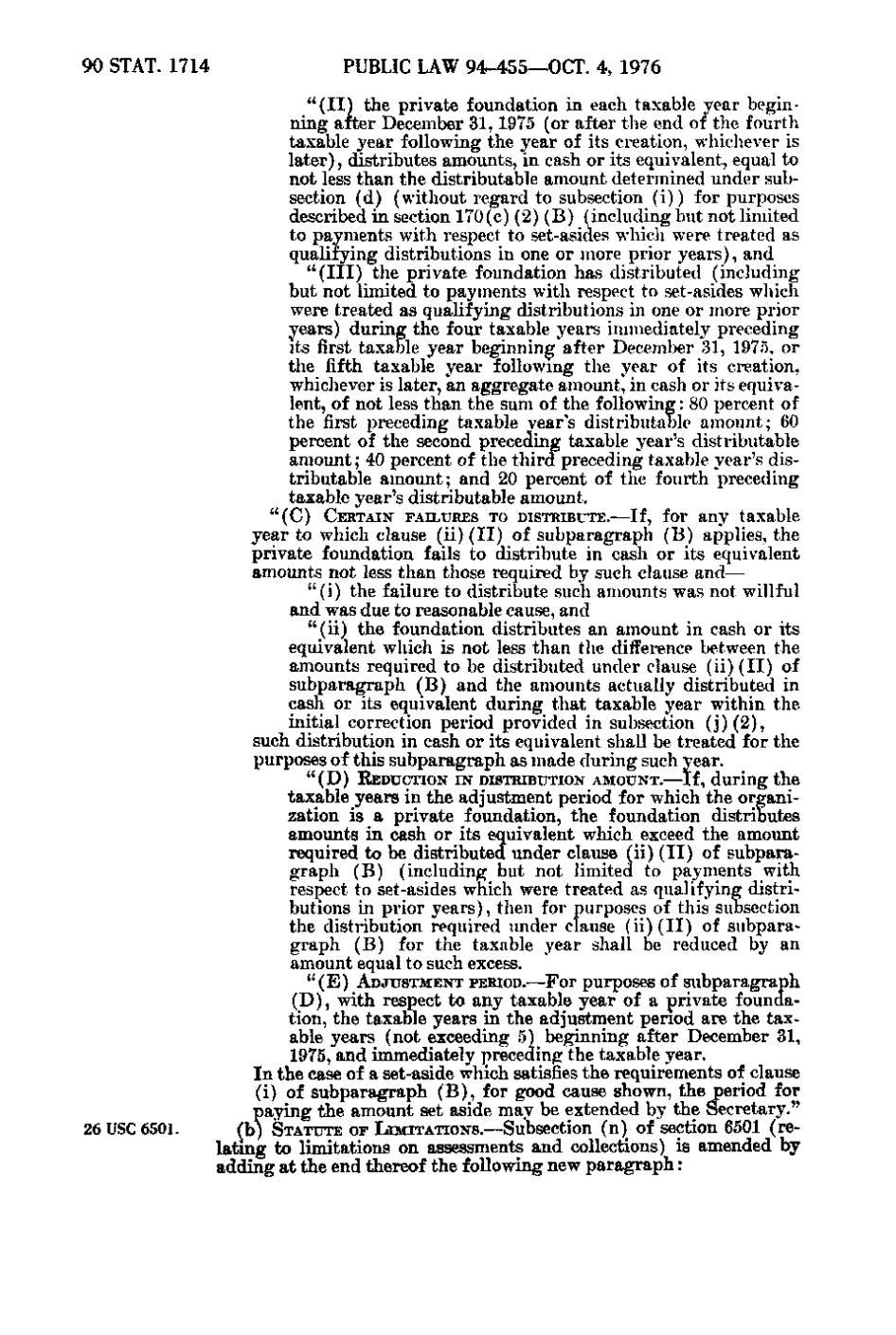

90 STAT. 1714

PUBLIC LAW 94-455—OCT. 4, 1976 " ( II) the private foundation in each taxable year beginning after December 31, 1975 ( o r after the end of the fourth taxable year following the year of its creation, whichever is l a t e r), distributes amounts, in cash or its equivalent, equal to not less than the distributable amount determined under subsection (d) (without regard to subsection (i)) for purposes described in section 170(c)(2)(B) ( i n c l u d i n g b u t not limited to payments with respect to set-asides which were treated as qualifying distributions in one or more prior year s), and " ( III) the private foundation has distributed (including but not limited to payments with respect to set-asides which were treated as qualifying distributions in one or more prior years) during the four taxable years immediately preceding its first taxable year beginning after December 31, 1975, o r the fifth taxable year following the year of its creation, whichever is later, a n aggregate amount, in cash or its equivalent, of not less than the sum of the following: 80 percent of the first preceding taxable year's distributable a m o u n t; 60 percent of the second preceding taxable year's distributable a m o u n t; 40 percent of the t h i r d preceding taxable year's distributable a m o u n t; and 20 percent of the fourth preceding taxable year's distributable amount. "(C)

CERTAIN FAILURES TO DISTRIBUTE.—If, for any

taxable

year to which clause (ii) ( II) of subparagraph (B) applies, the private foundation fails to distribute in cash or its equivalent amounts not less than those required by such clause and— " (i) the failure to distribute such amounts was not willful and was due to reasonable cause, and " ( i i) the foundation distributes an amount in cash or its equivalent which is not less than the difference between the amounts required to be distributed under clause (ii) ( II) of subparagraph (B) and the amounts actually distributed in cash or its equivalent during that taxable year within the initial correction period provided i n subsection (j)(2), such distribution in cash or its equivalent shall be treated for the purposes of this subparagraph as made during such year. " (D) REDUCTION IN DISTRIBUTION AMOUNT.—If, during the

taxable years in the adjustment period for which the organization is a private foundation, the foundation distributes amounts i n cash or its equivalent which exceed the amount required to be distributed under clause (ii) ( II) of subparagraph (B) (including b u t not limited to payments with respect to set-asides which were treated as qualifying distributions in prior year s), then for purposes of this subsection the distribution required under clause (ii) ( II) of subparagraph (B) for the taxable year shall be reduced by an amount equal to such excess. " (E) ADJUSTMENT PERIOD.—For purposes of subparagraph

(D), with respect to any taxable year of a private foundation, the taxable years i n the adjustment period are the taxable years ( not exceeding 5) beginning after December 31, 1975, and immediately preceding the taxable year. I n the case of a set-aside which satisfies the requirements of clause (i) of subparagraph (B), for good cause shown, the period for p a y i n g the amount set aside may be extended by the Secretary." 26 USC 6501.

(b) STATUTE o r LIMITATIONS.—Subsection (n) of "section 6501 (re-

l a t i n g to limitations on assessments and collections) is amended by adding a t the end thereof the following new paragraph:

�