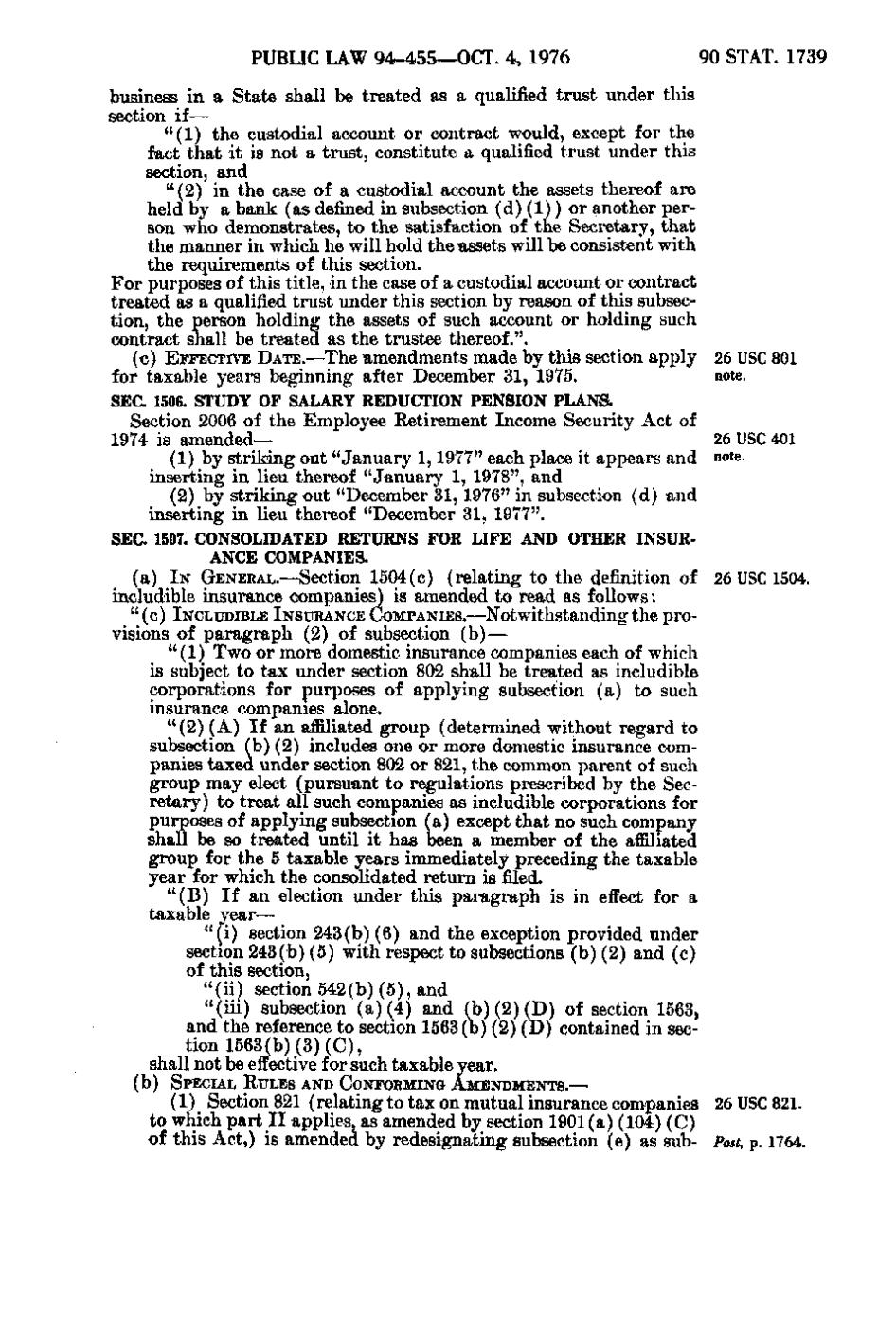

PUBLIC LAW 94-455—OCT. 4, 1976

90 STAT. 1739

business in a State shall be treated as a qualified t r u s t under this section if— " (1) the custodial account or contract would, except for the fact that i t is not a trust, constitute a qualified trust under this section, and " (2) in the case of a custodial account the assets thereof are held by a bank (as defined in subsection (d)(1)) or another person who demonstrates, to the satisfaction of the Secretary, that the manner in which he will hold the assets will be consistent with the requirements of this section. , . * '. <: For purposes of this title, in the case of a custodial account or contract treated as a qualified trust under this section by reason of this subsection, the person holding the assets of such account or holding such contract shall be treated as the trustee thereof.". (c) EFFECTIVE D A T E. — The amendments made by this section apply 26 USC 801 for taxable years beginning after December 31, 1975. note. SEC. 1506. STUDY OF SALARY REDUCTION PENSION PLANS. Section 2006 of the Employee Retirement Income Security Act of 1974 is amended— 26 USC 401 (1) by striking out " January 1, 1977" each place it appears and note, inserting in lieu thereof " January 1, 1978", and (2) by striking out "December 31, 1976" in subsection (d) and inserting in lieu thereof "December 31, 1977". SEC. 1507. CONSOLIDATED RETURNS FOR LIFE AND OTHER INSURANCE COMPANIES. (a) IN GENERAL.—Section 1504(c) (relating to the definition of 26 USC 1504. includible insurance companies) is amended to read as follows: " (c) INCLUDIBLE INSURANCE COMPANIES.—Notwithstanding the pro-

visions of paragraph (2) of subsection (b) — " (1) T w o or more domestic insurance companies each of which is subject to tax under section 802 shall be treated as includible corporations for purposes of applying subsection (a) to such insurance companies alone. " (2)(A) I f an affiliated g r o u p (determined without regard to subsection (b)(2) includes one o r more domestic insurance companies taxed under section 802 or 821, the common parent of such g r o u p may elect (pursuant to regulations prescribed by the Secretary) to treat all such companies as includible corporations for purposes of a p p l y i n g subsection (a) except that no such company shall be so treated until it has been a member of the affiliated g r o u p for the 5 taxable years immediately preceding the taxable year for which the consolidated return is filed. " (B) I f an election under this paragraph is in effect for a taxable year— " (i) section 243(b)(6) and the exception provided under section 243(b)(5) with respect to subsections (b)(2) and (c) of this section, " ( i i) section 542(b)(5), and " ( i i i) subsection (a)(4) and (b)(2)(D) of section 1563, and the reference to section 1563(b)(2)(D) contained in section 1563(b)(3)(C), shall not be effective for such taxable year. (b)

SPECIAL RULES AND CONFORMING AMENDMENTS, —

(1) Section 821 (relating to tax on mutual insurance companies 26 USC 821. to which part II applies, as amended by section 1901(a) (104)(C) of this Act,) is amended by redesignating subsection (e) as sub- Post, p. 1764.

�