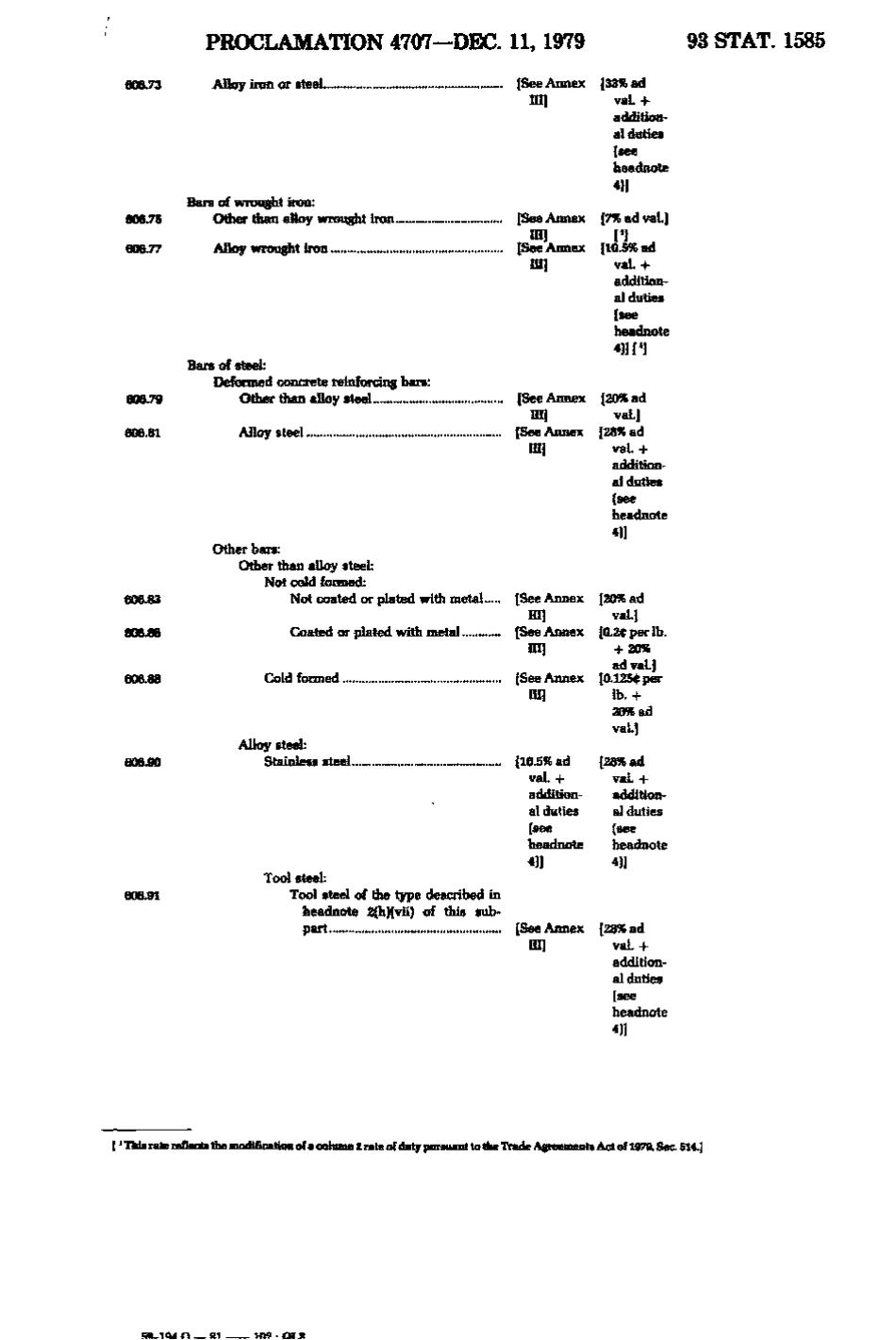

93 STAT. 1585

PROCLAMATION 4707—DEC. 11, 1979 [See Annex HI]

Alloy iron or steel.,

606.75

- n

Bars of wrought iron: Other than alloy wrought iron.

[See Annex HI] [See Annex

Alloy wrought iron.

606.77

[33% ad val. + additional duties {see headnote

m

[7% ad val.] [10.5% ad vaL + additional duties [see headnote

4311M 606.79

Bars of steel: Deformed concrete reinforcing bars: Other than alloy steel Alloy steel.

606.81

606.83

[See Annex [20% ad III] val.] [See Annex [28% ad val. + III] additional duties (see headnote

Other bars: Other than alloy steel: Not cold formed: Not coated or plated with metal Coated or plated with metal

606.66

[See Annex III] [See Annex

m Cold formed

[See Annex III]

606.88

Alloy steel: Stainless steel

,

606.90

[10.5% ad val. -Iadditional duties (see headnote

[20% ad val.] [0.2$ per lb. -- 20% f ad val.] [0.125* per lb.-I20% ad val.] val. -Iadditional duties (see headnote

413 Tool steel: Tool steel of the type described in headnote 2(h)(vii) of this subpart..

606.91

[See Annex III]

[28% ad val. + additional duties (see headnote 4}]

I ' This rate reflects the modiflcation of a column 2 rate of duty pursuant to the Trade Agreements Act of 1979, Sec. 514.]

AQ-lQAn

81

�