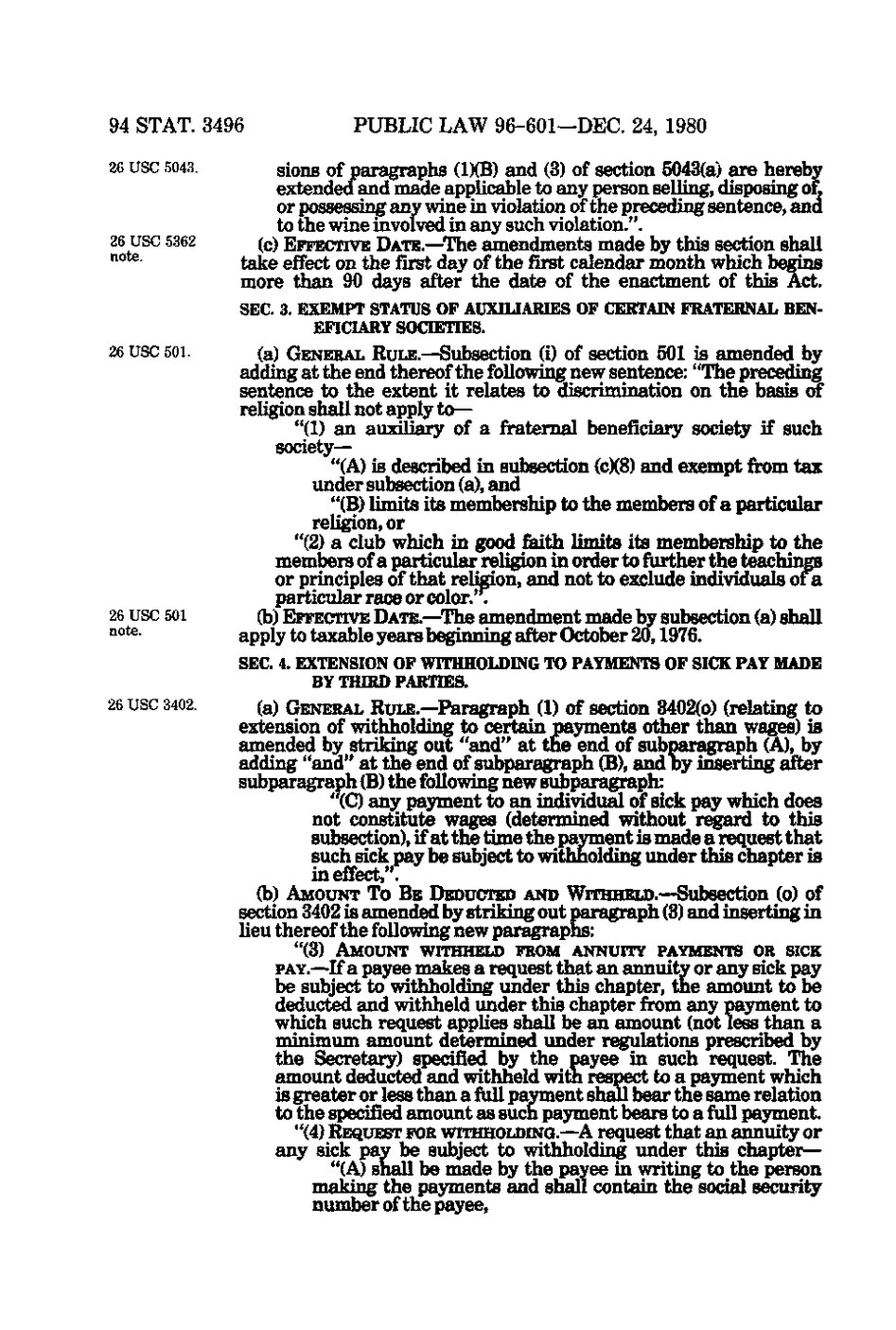

94 STAT. 3496 26 USC 5043.

26 USC 5362 ^°^^-

26 USC 501.

26 USC 501 "°*^

26 USC 3402.

PUBLIC LAW 96-601—DEC. 24, 1980

sions of paragraphs (1)(B) and (3) of section 5043(a) are hereby extended and made applicable to any person selling, disposing of, or possessing any wine in violation of the preceding sentence, and to the wine involved in any such violation.". (g) EFFECTIVE DATE.—The amendments made by this section shall take effect on the first day of the first calendar month which begins more than 90 days after the date of the enactment of this Act. SEC. 3. EXEMPT STATUS OF AUXILIARIES OF CERTAIN FRATERNAL BENEFICIARY SOCIETIES. (a) GENERAL RULE.—Subsection (i) of section 501 is amended by adding at the end thereof the following new sentence: "The preceding sentence to the extent it relates to discrimination on the basis of religion shall not apply to— "(1) an auxiliary of a fraternal beneficiary society if such society— "(A) is described in subsection (c)(8) and exempt from tax under subsection (a), and "(B) limits its membership to the members of a particular religion, or "(2) a club which in good faith limits its membership to the members of a particular religion in order to further the teachings or principles of that religion, and not to exclude individueds of a particular race or color.. (b) EFFEcmvE DATE.—The amendment made by subsection (a) shall apply to taxable years beginning after October 20, 1976. SEC. 4. EXTENSION OF WITHHOLDING TO PAYMENTS OF SICK PAY MADE BY THIRD PARTIES. (a) GENERAL RULE.—Paragraph (1) of section 3402(o) (relating to extension of withholding to certain payments other than wages) is amended by striking out "and" at the end of subparagraph (A), by adding "and" at the end of subparagraph (B), and by inserting after subparagraph (B) the following new subparagraph: "(C) any payment to an individual of sick pay which does not constitute wages (determined without regard to this subsection), if at the time the payment is made a request that such sick pay be subject to withholding under this chapter is in effect,". (b) AMOUNT TO BE DEDUCTED AND WITHHELD.—Subsection (o) of

section 3402 is amended by striking out paragraph (3) and inserting in lieu thereof the following new paragraphs: "(3) AMOUNT WITHHELD FROM ANNUITY PAYMENTS OR SICK

PAY.—If a payee makes a request that an annuity or any sick pay be subject to withholding under this chapter, the amount to be deducted and withheld under this chapter from gmy payment to which such request applies shall be an amount (not less than a minimum amount determined under regulations prescribed by the Secretary) specified by the payee in such request. The amount deducted and withheld with respect to a payment which is greater or less than a full payment shall bear the same relation to the specified amount as such payment bears to a full payment. "(4) REQUEST FOR WITHHOLDING.-A request that an annuity or any sick pay be subject to withholding under this chapter— "(A) shall be made by the payee in writing to the person making the payments and shall contain the social security number of the payee,

�