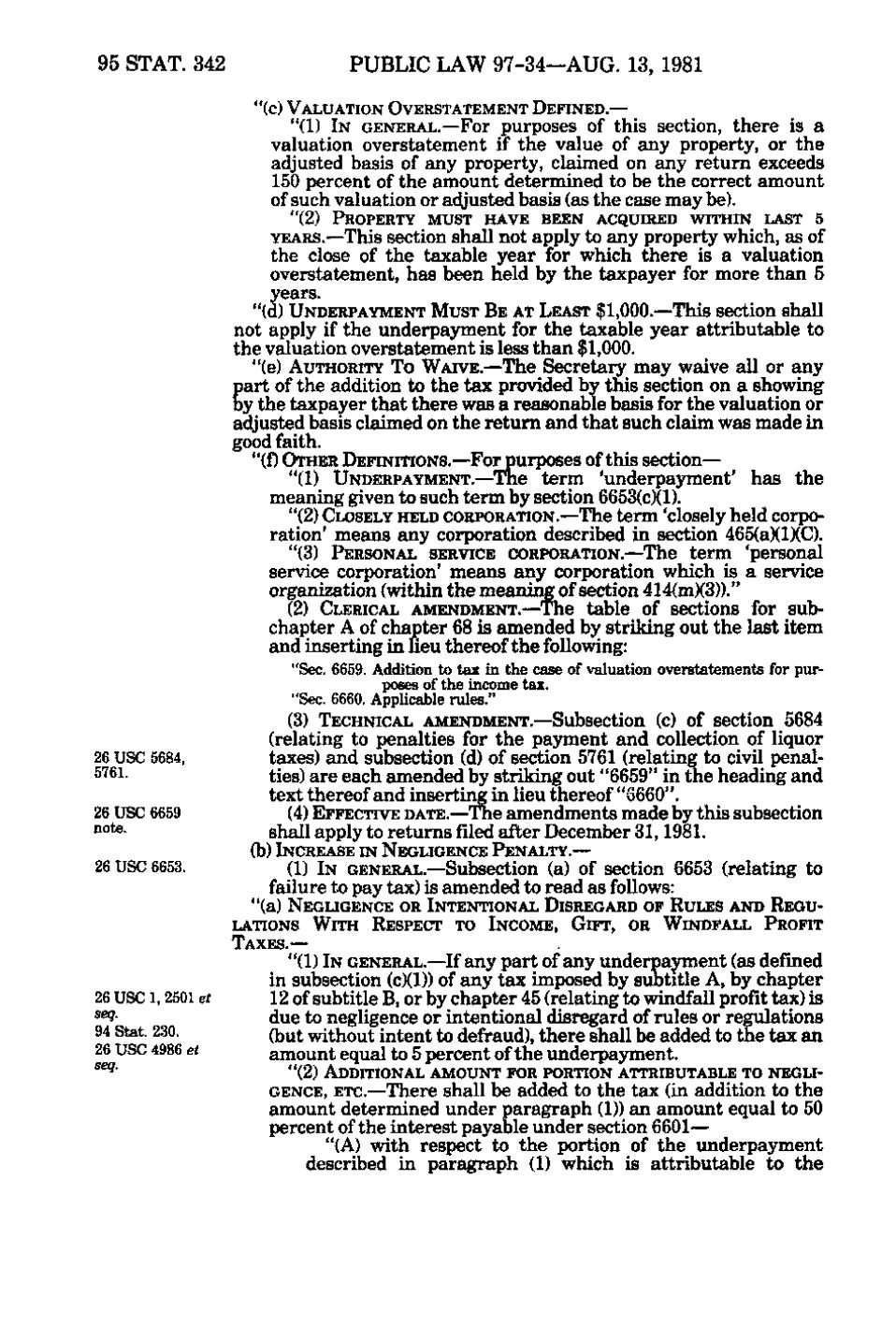

95 STAT. 342

PUBLIC LAW 97-34—AUG. 13, 1981 "(c) VALUATION OVERSTATEMENT DEFINED.—

"(1) IN GENERAL.—For purposes of this section, there is a valuation overstatement if the value of any property, or the adjusted basis of any property, claimed on any return exceeds 150 percent of the amount determined to be the correct amount of such valuation or adjusted basis (as the case may be). "(2) PROPERTY MUST HAVE BEEN ACQUIRED WITHIN LAST 5

YEARS.—This section shall not apply to any property which, as of the close of the taxable year for which there is a valuation overstatement, has been held by the taxpayer for more than 5 years. "(d) UNDERPAYMENT MUST B E AT LEAST $1,000.—This section shall not apply if the underpayment for the taxable year attributable to the valuation overstatement is less than $1,000. "(e) AUTHORITY TO WAIVE.—The Secretary may waive all or any part of the addition to the tax provided by this section on a showing by the taxpayer that there was a reasonable basis for the valuation or adjusted basis claimed on the return and that such claim was made in good faith. "(f) OTHER DEFINITIONS.—For purposes of this section— "(1) UNDERPAYMENT.—The term 'underpayment' has the meaning given to such term by section 6653(c)(1). "(2) CLOSELY HELD CORPORATION.—The term 'closely held corporation' means any corporation described in section 465(a)(1)(C). "(3) PERSONAL SERVICE CORPORATION.—The term 'personal service corporation' means any corporation which is a service organization (within the meaning of section 414(m)(3))." (2) CLERICAL AMENDMENT.—'The table of sections for subchapter A of chapter 68 is amended by striking out the last item and inserting in lieu thereof the following: "Sec. 6659. Addition to tax in the case of valuation overstatements for purposes of the income tax. "Sec. 6660. Applicable rules." (3) TECHNICAL AMENDMENT.—Subsection (c) of section 5684

26 USC 5684, 5'76i. 26 USC 6659 "o^-

(relating to penalties for the payment and collection of liquor taxes) and subsection (d) of section 5761 (relating to civil penalties) are each amended by striking out "6659" in the heading and text thereof and inserting in lieu thereof "6660". (4) EFFECTIVE DATE.—The amendments made by this subsection shall apply to returns filed after December 31, 1981. (b) INCREASE IN NEGLIGENCE PENALTY.—

26 USC 6653.

(1) IN GENERAL.—Subsection (a) of section 6653 (relating to failure to pay tax) is amended to read as follows: "(a) NEGLIGENCE OR INTENTIONAL DISREGARD OF RULES AND REGULATIONS WITH RESPECT TO INCOME, GIFT, OR WINDFALL PROFIT TAXES.—

26 USC 1, 2501 et ®^994 Stat. 230. 26 USC 4986 et

- ^^'

"(1) IN GENERAL.—If any part of any underpayment (as defined in subsection (c)(1)) of any tax imposed by subtitle A, by chapter 12 of subtitle B, or by chapter 45 (relating to windfall profit tax) is due to negligence or intentional disregard of rules or regulations (but without intent to defraud), there shall be added to the tax an amount equal to 5 percent of the underpayment. "(2) ADDITIONAL AMOUNT FOR PORTION ATTRIBUTABLE TO NEGLIGENCE, ETC.—There shall be added to the tax (in addition to the

amount determined under paragraph (1)) an amount equal to 50 percent of the interest payable under section 6601— "(A) with respect to the portion of the underpayment described in paragraph (1) which is attributable to the

�