95 STAT. 636

Ante, p. 629.

45 USC 231c.

45 USC 23id.

42 USC 402.

42 USC 401. 45 USC 231b.

45 USC 23ld.

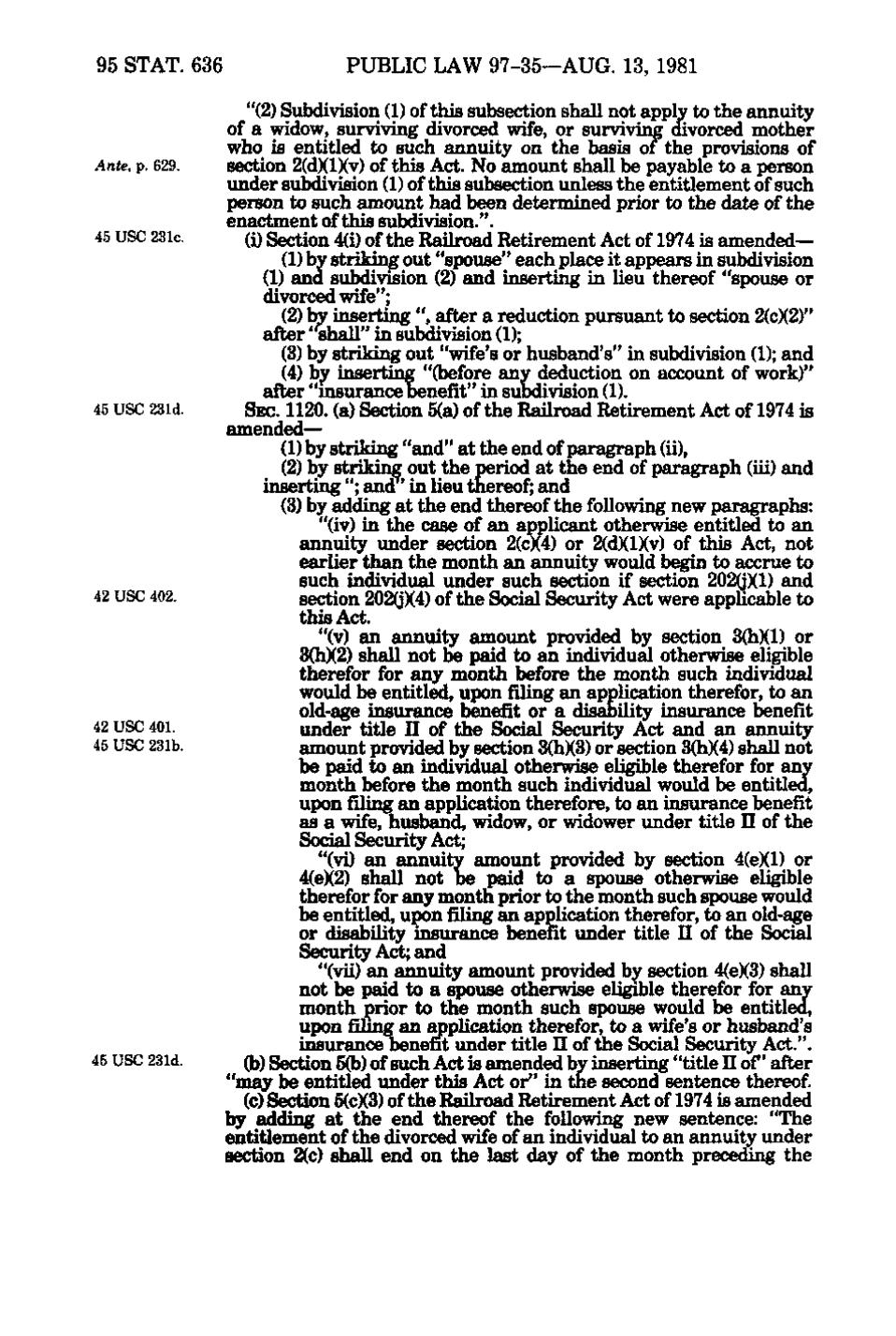

PUBLIC LAW 97-35—AUG. 13, 1981 "(2) Subdivision (1) of this subsection shall not apply to the annuity of a widow, surviving divorced wife, or surviving divorced mother who is entitled to such annuity on the basis of the provisions of section 2(d)(l)(v) of this Act. No amount shall be payable to a person under subdivision (1) of this subsection unless the entitlement of such person to such amount had been determined prior to the date of the enactment of this subdivision.". (i) Section 4(i) of the Railroad Retirement Act of 1974 is amended— (1) by striking out "spouse" each place it appears in subdivision (1) and subdivision (2) and inserting in lieu thereof "spouse or divorced wife"; (2) by inserting ", after a reduction pursuant to section 2(c)(2)" after "shall" in subdivision (1); (3) by striking out "wife's or husband's" in subdivision (1); and (4) by inserting "(before any deduction on account of work)" after "insurance benefit" in subdivision (1). SEC. 1120. (a) Section 5(a) of the Railroad Retirement Act of 1974 is amended— (1) by striking "and" at the end of paragraph (ii), (2) by striking out the period at the end of paragraph (iii) and inserting "; and in lieu thereof; and (3) by adding at the end thereof the following new pargigraphs: "(iv) in the case of an applicant otherwise entitled to an annuity under section 2(c)(4) or 2(d)(l)(v) of this Act, not earlier than the month an annuity would begin to accrue to such individual under such section if section 202(j)(l) and section 202(j)(4) of the Social Security Act were applicable to this Act. "(v) an annuity amount provided by section 3(h)(l) or 3(h)(2) shall not be paid to an individual otherwise eligible therefor for any month before the month such individual would be entitled, upon filing an application therefor, to an old<age insurance benefit or a disability insurance benefit under title II of the Social Security Act and an annuity amount provided by section 3(h)(3) or section 3(h)(4) shall not be paid to an individual otherwise eligible therefor for any month before the month such individual would be entitled, upon filing an application therefore, to an insurance benefit as a wife, husband, widow, or widower under title II of the Social Security Act; "(vi) an annuity amount provided by section 4(e)(l) or 4(e)(2) shall not be paid to a spouse otherwise eligible therefor for any month prior to the month such spouse would be entitled, upon filing an application therefor, to an old-age or disability insurance benefit under title II of the Social Security Act; and "(vii) an annuity amount provided by section 4(e)(3) shall not be paid to a spouse otherwise eligible therefor for any month prior to the month such spouse would be entitled, upon filing an application therefor, to a wife's or husband's insurance benefit under title II of the Social Security Act.". (b) Section 5(b) of such Act is amended by inserting "title II o f after "may be entitled under this Act or" in the second sentence thereof. (c) Section 5(c)(3) of the Rsdlroad Retirement Act of 1974 is amended by adding at the end thereof the following new sentence: "The entitlement of the divorced wife of an individual to an annuity under section 2(c) shall end on the last day of the month preceding the

�