96 STAT. 568 26 USC 7275 ^°^^-

PUBLIC LAW 97-248—SEPT. 3, 1982 (2) EFFECTIVE DATE.—The amendment m a d e by subsection (a) shall apply with respect to transportation beginning after the date of the e n a c t m e n t of this Act. PART II—COMMUNICATIONS SERVICES

26 USC 4251.

SEC. 282. EXTENSION OF EXCISE TAX ON COMMUNICATIONS SERVICES. (a) IN GENERAL.—Section 4251 (relating to imposition of tax on communications services) is amended by striking o u t subsections (a) and (b) and inserting the following n e w subsections: "(a) T A X IMPOSED.—

"(1) IN GENERAL.—There is hereby imposed on a m o u n t s paid for communications services a tax equal to the applicable percentage of a m o u n t s so paid. "(2) PAYMENT OF TAX.—The tax imposed by this section shall be paid by the person paying for such services. "(b) DEFINITIONS. — " For purposes of subsection (a)— "(1) COMMUNICATIONS SERVICES. — " The term ' c o m m u n i c a t i o n s

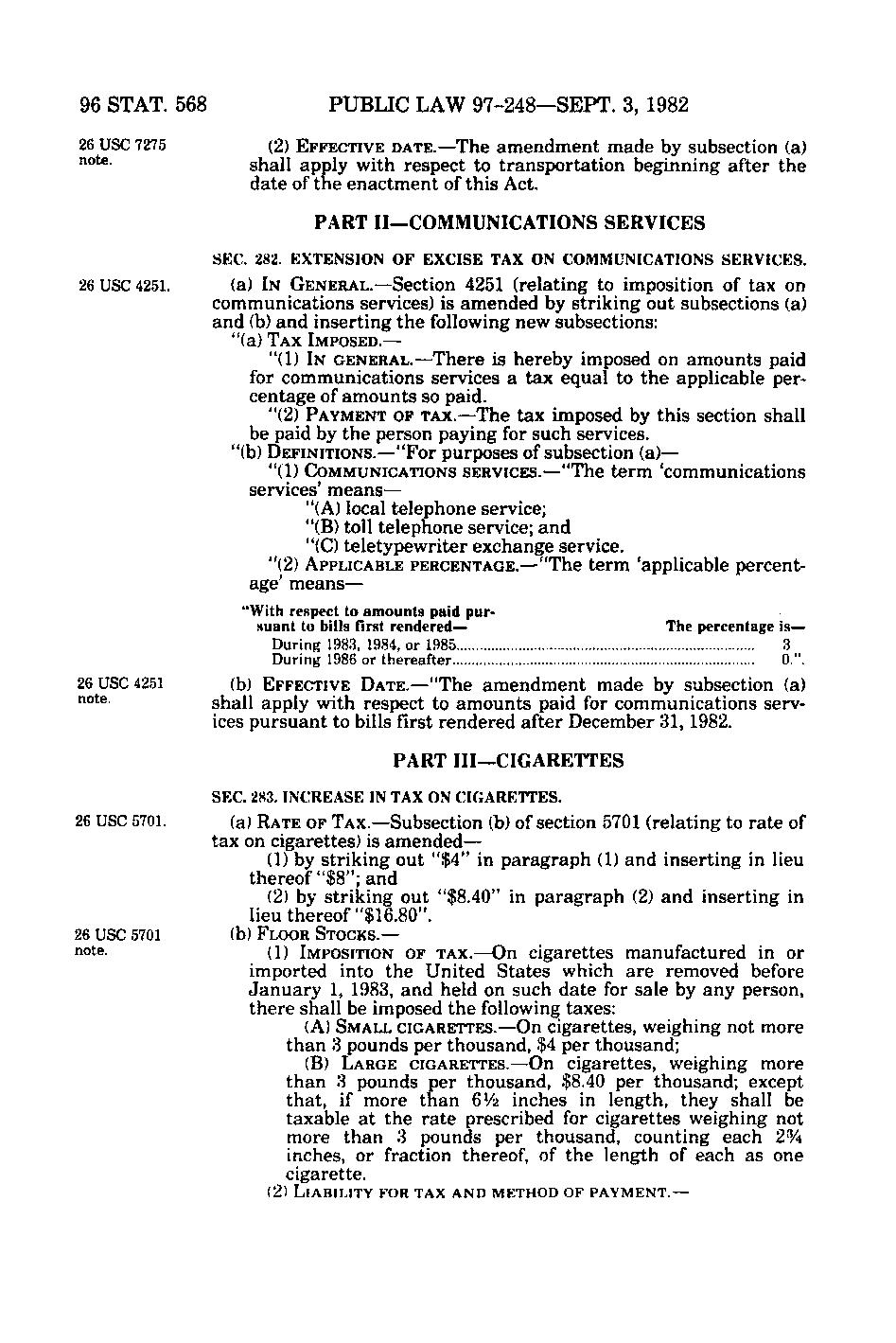

services' means — "(A) local telephone service; "(B) toll telephone service; and "(C) teletypewriter e x c h a n g e service. "(2) APPLICABLE P E R C E N T A G E. — " The term 'applicable percent-

age' means — "With respect to amounts paid pursuant to bills first rendered— During 1983, 1984, or 1985 During 1986 or thereafter

26 USC 4251 ^^^^-

The percentage is— 3 0.".

(b) EFFECTIVE D A T E. — " The amendment m a d e by subsection (a) shall apply with respect to a m o u n t s paid for communications services pursuant to bills first rendered after December 31, 1982. PART III—CIGARETTES

26 USC 5701.

26 USC 5701 note.

SEC. 283. INCREASE IN TAX ON CIGARETTES. (a) RATE OF TAX.—Subsection (b) of section 5701 (relating to r a t e of tax on cigarettes) is amended— (1) by striking out " $ 4 " in paragraph (1) and inserting in lieu thereof "$8"; and (2) by striking o u t "$8.40" in paragraph (2) and inserting in lieu thereof "$16.80". (b) FLOOR STOCKS.— (1) IMPOSITION OF TAX.—On c i g a r e t t e s m a n u f a c t u r e d

in or

imported into the United States which a r e removed before January 1, 1983, and held on such date for sale by any person, the r e shall be imposed the following taxes: (A) SMALL CIGARETTES.—On cigarettes, weighing not more

than 3 pounds per thousand, $4 per thousand; (B) LARGE CIGARETTES.—On

cigarettes, weighing

more

than 3 pounds per thousand, $8.40 per thousand; except that, if more than 6V2 inches in length, they shall be taxable a t the r a t e prescribed for cigarettes weighing not more than 3 pounds per thousand, counting each 2 % inches, or fraction thereof, of the length of each as one cigarette. (2) LIABILITY FOR TAX AND METHOD OF PAYMENT.—

�