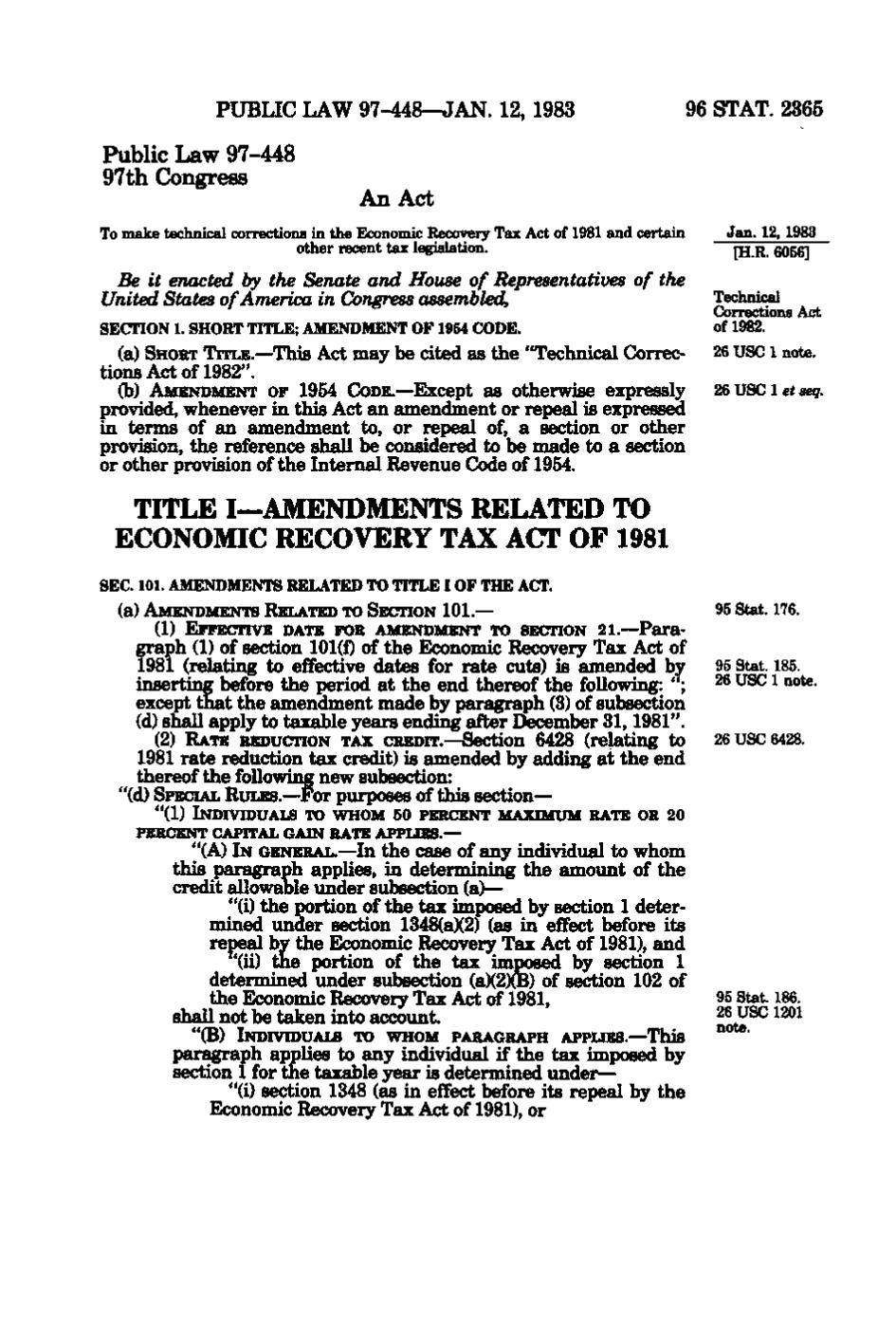

PUBLIC LAW 97-448—JAN. 12, 1983

96 STAT. 2365

Public Law 97-448 97th Congress An Act To make technical corrections in the Economic Recovery Tax Act of 1981 and certain other recent tax legislation.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled.

Jan. 12, 198^} [H.R. 6056]

Technical CoiTFGCtlOIlS ^{*fc

SECTION 1. SHORT TITLE; AMENDMENT OF 1954 CODE.

of 1982.

(a) SHORT TITLE.—This Act may be cited as the "Technical Corrections Act of 1982". (b) AMENDMENT OF 1954 CODE.—Except as otherwise expressly provided, whenever in this Act an amendment or repeal is expressed in terms of an amendment to, or repeal of, a section or other provision, the reference shall be considered to be made to a section or other provision of the Internal Revenue Code of 1954.

26 USC l note, 26 USC let«eg.

TITLE I—AMENDMENTS RELATED TO ECONOMIC RECOVERY TAX ACT OF 1981 SEC. 101. AMENDMENTS RELATED TO TITLE I OF THE ACT. (a) AMENDMENTS RELATED TO SECTION 101.— (1) EFFECTIVE DATE FOR AMENDMENT TO SECTION 21.—Para-

graph (1) of section 101(f) of the Economic Recovery Tax Act of 1981 (relating to effective dates for rate cuts) is amended by inserting before the period at the end thereof the following: "; except that the amendment made by paragraph (3) of subsection (d) shall apply to taxable years ending after December 31, 1981". (2) RATE REDUCTION TAX CREDIT.—Section 6428 (relating to 1981 rate reduction tsix credit) is amended by adding at the end thereof the following new subsection: "(d) SPECIAL RULES.—For purposes of this section—

95 Stat. 176. 95 Stat. 185. 26 USC l note, 26 USC 6428.

"(1) INDIVIDUALS TO WHOM 50 PERCENT MAXIMUM RATE OR 20 PERCENT CAPITAL GAIN RATE APPLIES.—

"(A) IN GENERAL.—In the case of any individual to whom this paragraph applies, in determining the amount of the credit allowable under subsection (a)— "(i) the portion of the tax imposed by section 1 determined under section 1348(a)(2) (as in effect before its repeal by the Economic Recovery Tax Act of 1981), and '(ii) the portion of the tax imposed by section 1 determined under subsection (a)(2)(B) of section 102 of the Economic Recovery Tax Act of 1981, shall not be taken into account. "(B) INDIVIDUALS TO WHOM PARAGRAPH APPLIES.—This

paragraph applies to any individual if the tax imposed by section 1 for the taxable year is determined under— "(i) section 1348 (as in effect before its repeal by the Economic Recovery Tax Act of 1981), or

95 Stat. 186. ? ^. ^ ^ ^^^^ note.

�