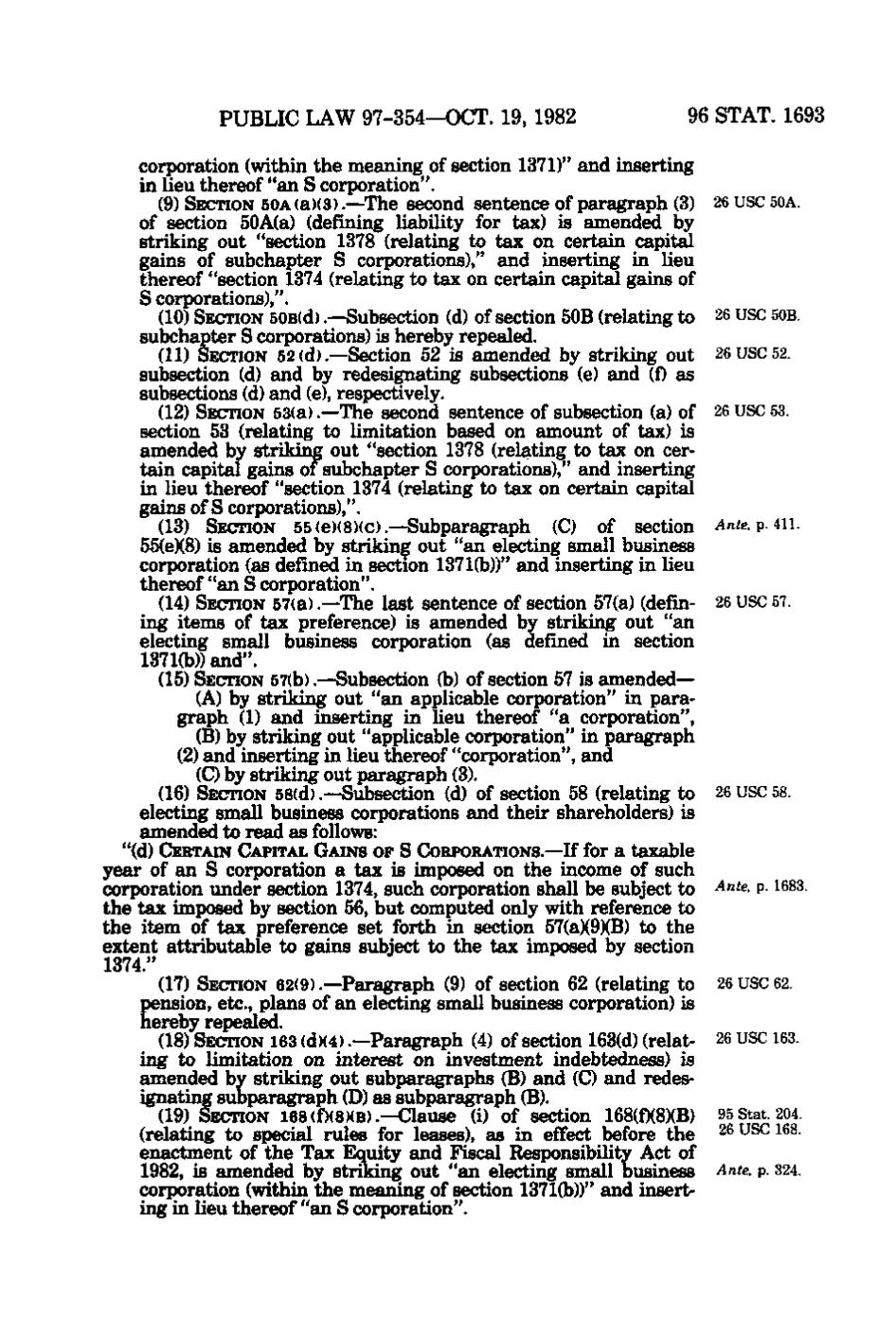

PUBLIC LAW 97-354—OCT. 19, 1982

96 STAT. 1693

corporation (within the meaning of section 1371)" and inserting in lieu thereof "an S corporation". (9) SECTION 50A (a)(3).—The second sentence of paragraph (3) of section 50A(a) (defining Hability for tax) is amended by striking out "section 1378 (relating to tax on certain capital gains of subchapter S corporations)," and inserting in lieu thereof "section 1374 (relating to tax on certain capital gains of S corporations),". (10) SECTION 50B(d).—Subsection (d) of section 50B (relating to subchapter S corporations) is hereby repealed. (11) SECTION 52(d).—Section 52 is amended by striking out subsection (d) and by redesignating subsections (e) and (f) as subsections (d) and (e), respectively. (12) SECTION 53(a).—The second sentence of subsection (a) of section 53 (relating to limitation based on amount of tax) is amended by striking out "section 1378 (relating to tax on certain capital gains of subchapter S corporations)," and inserting in lieu thereof "section 1374 (relating to tax on certain capital gains of S corporations),". (13) SECTION 55(e)(8)(c).—Subparagraph (C) of section 55(e)(8) is amended by striking out "an electing small business corporation (as defined in section 1371(b))" and inserting in lieu thereof "an S corporation". (14) SECTION 57(a).—The last sentence of section 57(a) (defming items of tax preference) is amended by striking out "an electing small business corporation (as defined in section 1371(b)) and". (15) SECTION 57(b).—Subsection (b) of section 57 is amended— (A) by striking out "an applicable corporation" in paragraph (1) and inserting in lieu thereof "a corporation", (B) by striking out "applicable corporation" in paragraph (2) and inserting in lieu thereof "corporation", and (C) by striking out paragraph (3). (16) SECTION 58(d).—Subsection (d) of section 58 (relating to electing small business corporations and their shareholders) is amended to read as follows:

26 USC 50A.

26 USC 50B. 26 USC 52. 26 USC 53.

^n^, p. 4ii.

26 USC 57.

26 USC 58.

"(d) CERTAIN CAPITAL GAINS OF S CORPORATIONS.—If for a taxable

year of an S corporation a tax is imposed on the income of such corporation under section 1374, such corporation shall be subject to ^"^«' P 1683. the tax imposed by section 56, but computed only with reference to the item of tax preference set forth in section 57(a)(9)(B) to the extent attributable to gains subject to the tax imposed by section 1374." (17) SECTION 62(9).—Paragraph (9) of section 62 (relating to 26 USC 62. pension, etc., plans of an electing small business corporation) is hereby repealed. (18) SECTION I 6 3 (d)(4).—Paragraph (4) of section 163(d) (relat- 26 USC 163. ing to limitation on interest on investment indebtedness) is amended by striking out subparagraphs (B) and (C) and redesignating subparagraph (D) as subparagraph (B). (19) SECTION 168(f)(8)(B).—Clause (i) of section 168(f)(8)(B) 95 Stat. 204. (relating to special rules for leases), as in effect before the ^^ ^^^ ^^^ enactment of the Tax Equity and Fiscal Responsibility Act of 1982, is amended by striking out "an electing small business Ante, p. 324. corporation (within the meaning of section 1371(b))" and inserting in lieu thereof "an S corporation".

�