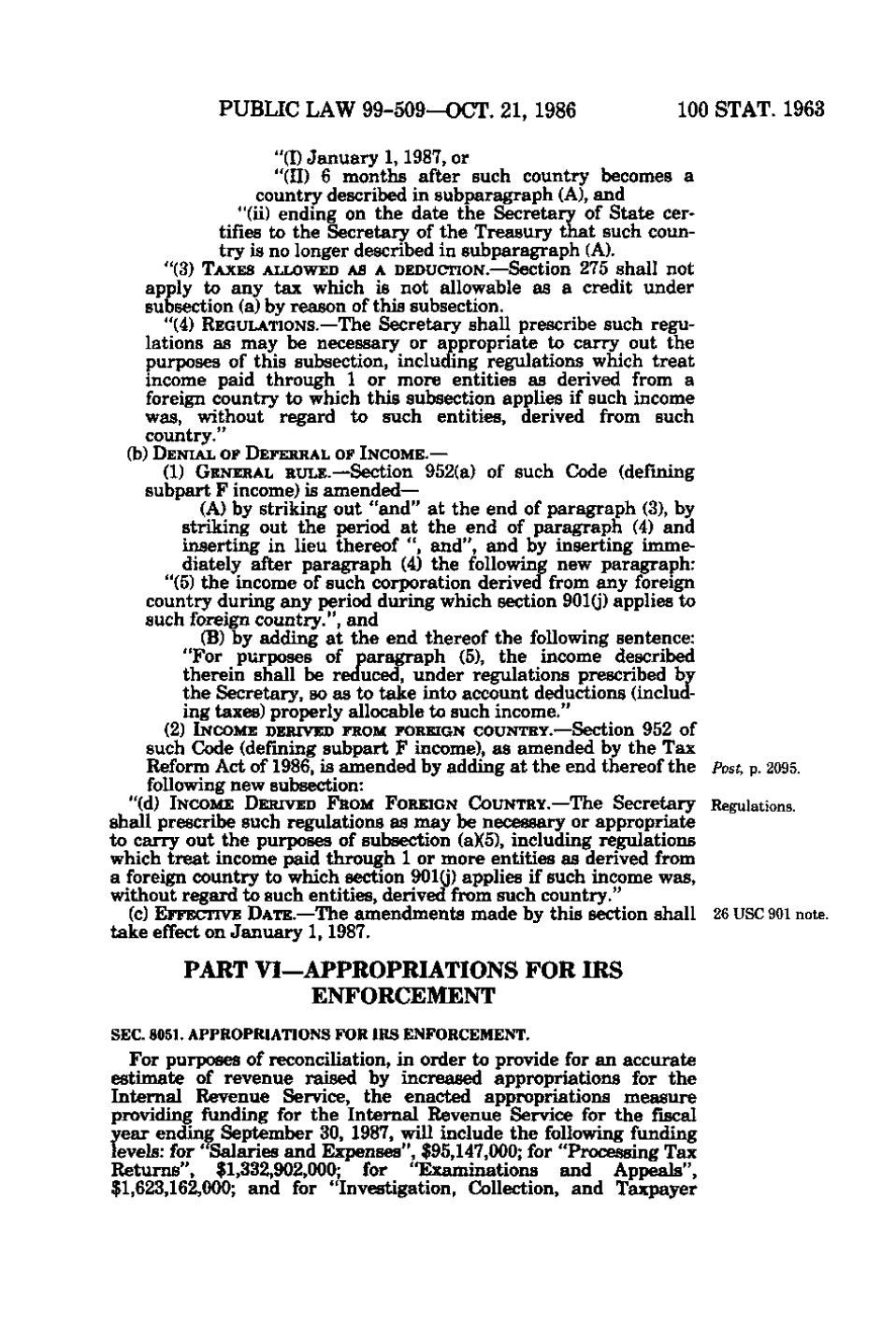

PUBLIC LAW 99-509—OCT. 21, 1986

100 STAT. 1963

"(I) January 1, 1987, or "(II) 6 months after such country becomes a country described in subparagraph (A), and "(ii) ending on the date the Secretary of State certifies to the Secretary of the Treasury that such country is no longer described in subparagraph (A). '<. "(3) TAXES ALLOWED AS A DEDUCTION.—Section 275 shall not apply to any tax which is not allowable as a credit under subsection (a) by reason of this subsection. "(4) REGULATIONS.—The Secretary shall prescribe such regulations as may be necessary or appropriate to carry out the purposes of this subsection, including regulations which treat income paid through 1 or more entities as derived from a foreign country to which this subsection applies if such income was, without regard to such entities, derived from such country."

,. ^

(b) DENIAL OF DEFERRAL OF INCOME.— (1) GENERAL RULE.—Section 952(a) of such Code (defining

subpart F income) is amended— (A) by striking out "and" at the end of paragraph (3), by striking out the period at the end of paragraph (4) and . > inserting in lieu thereof ", and", and by inserting immediately after paragraph (4) the following new paragraph: "(5) the income of such corporation derived from any foreign country during any period during which section 9010*) applies to such foreign country.", and (B) by adding at the end thereof the following sentence: "For purposes of paragraph (5), the income described therein shall be reduced, under regulations prescribed by the Secretary, so as to take into account deductions (including taxes) properly allocable to such income." (2) INCOME DERIVED FROM FOREIGN COUNTRY.—Section 952 of

such Code (defining subpart F income), as amended by the Tax Reform Act of 1986, is amended by adding at the end thereof the Post, p. 2095. following new subsection: "(d) INCOME DERIVED FROM FOREIGN COUNTRY.—The Secretary Regulations. shall prescribe such regulations as may be necessary or appropriate to carry out the purposes of subsection (a)(5), including regulations which treat income paid through 1 or more entities as derived from a foreign country to which section 901(j) applies if such income was, without regard to such entities, derived from such country." (c) EFFECTIVE DATE.—The amendments made by this section shall 26 USC 901 note. take effect on January 1, 1987.

PART VI—APPROPRIATIONS FOR IRS ENFORCEMENT SEC. 8051. APPROPRIATIONS FOR IRS ENFORCEMENT.

For purposes of reconciliation, in order to provide for an accurate estimate of revenue raised by increased appropriations for the Internal Revenue Service, the enacted appropriations measure providing funding for the Internal Revenue Service for the fiscal rear ending September 30, 1987, will include the following funding evels: for "Salaries and Expenses", $95,147,000; for "Processing Tax Returns", $1,332,902,000; for "Examinations and Appeals", $1,623,162,000; and for "Investigation, Collection, and Taxpayer

't,'.

{

,.

.

�