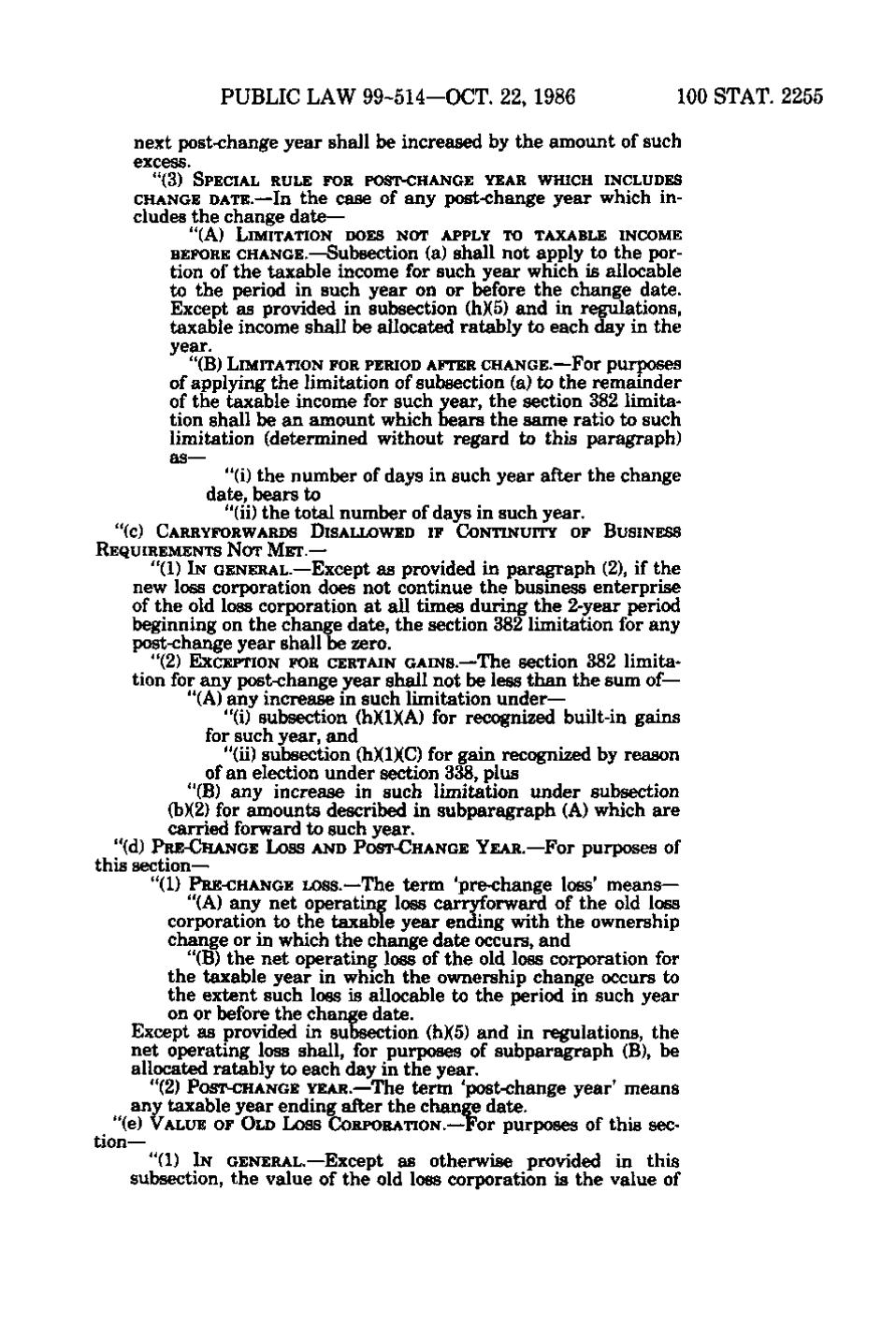

PUBLIC LAW 99-514—OCT. 22, 1986

100 STAT. 2255

next post-change year shall be increased by the amount of such excess. "(3) SPECIAL RULE FOR POST-CHANGE YEAR WHICH INCLUDES

CHANGE DATE.—In the case of any post-change year which includes the change date— "(A) LIMITATION DOES NOT APPLY TO TAXABLE INCOME BEFORE CHANGE.—Subsection (a) shall not apply to the por-

s { -»•

tion of the taxable income for such year which is allocable to the period in such year on or before the change date. Except as provided in subsection (h)(5) and in regulations, taxable income shall be allocated ratably to each day in the

A:

year. "(B) LIMITATION FOR PERIOD AFTER CHANGE.—For purposes

of applying the limitation of subsection (a) to the remainder of the taxable income for such year, the section 382 limitation shall be an amount which bears the same ratio to such limitation (determined without regard to this paragraph) as— "(i) the number of days in such year after the change date, bears to "(ii) the total number of days in such year. "(c) CARRYFORWARDS DISALLOWED IF CONTINUITY OF BUSINESS REQUIREMENTS NOT MET.—

"(1) IN GENERAL.—Except as provided in paragraph (2), if the new loss corporation does not continue the business enterprise of the old loss corporation at all times during the 2-year period beginning on the change date, the section 382 limitation for any post-change year shall be zero. "(2) EXCEPTION FOR CERTAIN GAINS.—The section 382 limitation for any post-change year shall not be less than the sum of^ "(A) any increase in such limitation under— ?^> "(i) subsection (h)(l)(A) for recognized built-in gains for such year, and ri "(ii) subsection (h)(l)(C) for gain recognized by reason of an election under section 338, plus "(B) any increase in such limitation under subsection (b)(2) for amounts described in subparagraph (A) which are carried forward to such year. "(d) PRE-CHANGE Loss AND POST-CHANGE YEAR.—For purposes of this section— "(1) PRE-CHANGE LOSS.—The term *pre-change loss' means— "(A) any net operating loss carryforward of the old loss corporation to the taxable year ending with the ownership f' change or in which the change date occurs, and "(B) the net operating loss of the old loss corporation for the taxable year in which the ownership change occurs to the extent such loss is allocable to the period in such year on or before the change date. Except as provided in subsection (h)(5) and in regulations, the net operating loss shall, for purposes of subparagraph (B), be allocated ratably to each day in the year. "(2) POST-CHANGE YEAR.—The term 'post-change year' means any taxable year ending after the change date. "(e) VALUE OF OLD Loss CORPORATION.—For purposes of this section— "(1) IN GENERAL.—Except as otherwise provided in this subsection, the value of the old loss corporation is the value of

�