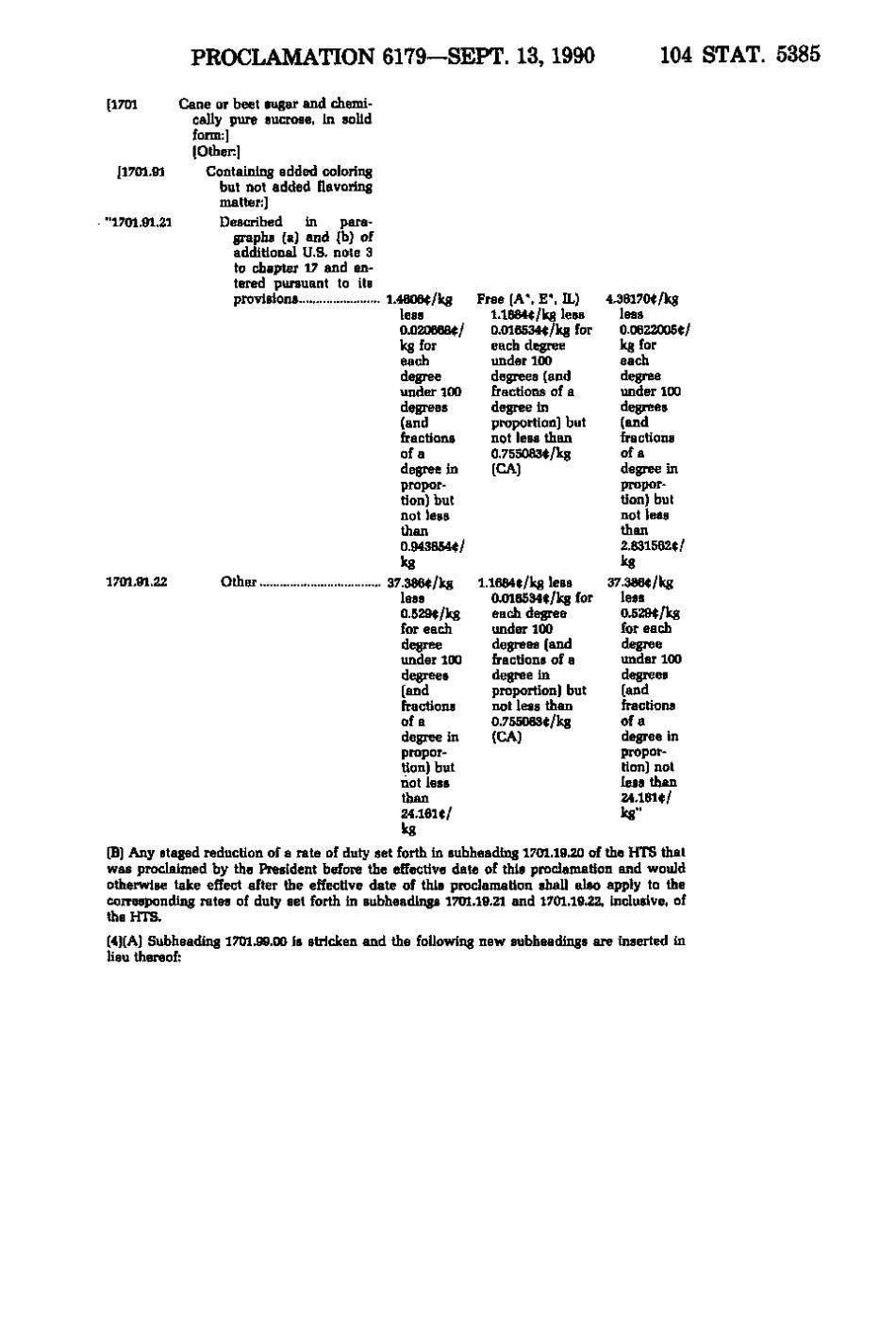

PROCLAMATION 6179—SEPT. 13, 1990 104 STAT. 5385 [1701 [1701.91 "1701.91.21 Cane or beet sugar and chemically pure sucrose, in solid form:] [Other:] Containing added coloring but not added flavoring matter:] Described in paragraphs (a) and (b] of additional U.S. note 3 to chapter 17 and entered pursuant to its provisions 1701.91.22 Other. 1.4606<t/kg less 0.020668^/ kg for ea ch degree under 100 degrees (and fractions ofa degree in pr opo r- tion] but not less than 0.943854«(/ kg 37.386<t/kg less 0.529(|:/kg for each degree under 100 degrees (and fractions ofa degree in pro por - tion] but not less than 24.161(t/ kg Free (A*. E*. IL) l.lB84^/kg less 0.016534(r/kg for each degree under 100 degrees (and fractions of a degree in proportion] but not less than 0.755083<t/kg (CA) 1.1684(|;/kg less 0.018534(t/kg for each degree under 100 degrees (and fractions of a degree in proportion) but not less than 0.755083<;/kg (CA] 4.38170(t/kg less 0.0622005(1;/ kg for ea ch degree under 100 degrees (and fractions ofa degree in propor - tion ] but not less than 2.831562$/ kg 37.386<t/kg less 0.52g((/kg for each degree under 100 degrees (and fractions ofa degree in propo r- tion] not less than 24.161(f/ kg" (B] Any staged reduction of a rate of duty set forth in subheading 1701.19.20 of the HTS that was proclaimed by the President before the effective date of this proclamation and would otherwise take effect after the effective date of this proclamation shall also apply to the corresponding rates of duty set forth in subheadings 1701.19.21 and 1701.19.22, inclusive, of the HTS. (4)(A] Subheading 1701.99.00 is stricken and the following new subheadings are inserted in lieu thereof:

�