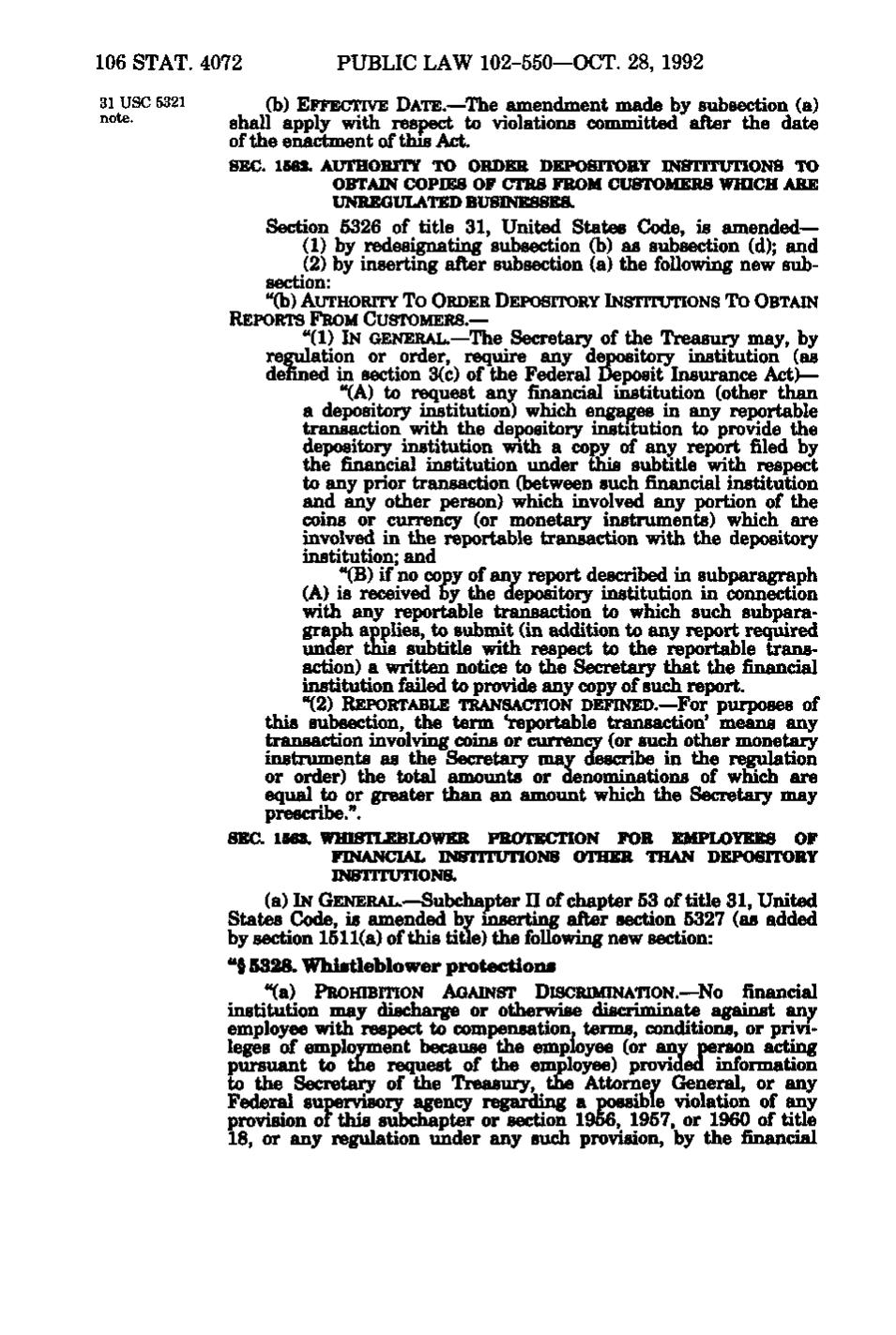

106 STAT. 4072 PUBLIC LAW 102-550—OCT. 28, 1992 31 USC 5321 (b) EFFECTIVE DATE.— The amendment made by subsection (a) ^°^- shall apply with respect to violations conmiitted after the date of the enactment of this Act. SEC. 1S62. AUTHORITY TO ORDER DEPOSITORY INSTITUTIONS TO OBTAIN COPIES OF CTRS FROM CUSTOMERS WHICH ARE UNREGULATED BUSINESSES. Section 5326 of title 31, United States Code, is amended— (1) by redesignating subsection (b) as subsection (d); and (2) by inserting after subsection (a) the following new subsection: "(b) AUTHORITY TO ORDER DEPOSITORY INSTITUTIONS To OBTAIN REPORTS FROM CUSTOMERS. — "(1) IN GENERAL.—The Secretary of the Treasury may, by regulation or order, require any depository institution (as denned in section 3(c) of the Federal Deposit Insurance Act)— "(A) to request any financial institution (other than a depository institution) which engages in any reportable transaction with the depository institution to provide the depository institution with a copy of any report filed by the financial institution under this subtitle with respect to any prior transaction (between such financial institution and any other person) which involved any portion of the coins or currency (or monetary instruments) which are involved in the reportable transaction with the depository institution; and "(B) if no copy of any repK)rt described in subparagraph (A) is received by the oepository institution in connection with any reportable transaction to which such subparagraph applies, to submit (in addition to any report required under this subtitle with respect to the reportable transaction) a written notice to the Secretary that the financial institution failed to provide any copy of such report. " (2) REPORTABLE TRANSACTION DEFINED.— For purposes of this subsection, the term ^reportable transaction' means any transaction involving coins or currency (or such other monetary instruments as the Secretary may describe in the re^ilation or order) the total amounts or denominations of wmch are equal to or greater than an amount which the Secretary may prescribe.". SEC. 1568. WmSTLEBLOWER PROTECTION FOR EMPLOYEES OF FINANCIAL INSTITUTIONS OTHER THAN DEPOSITORY INSTITUTIONa (a) IN GENERAL.—Subchapter II of chapter 53 of title 31, United States Code, is amended by inserting after section 5327 (as added by section 1511(a) of this title) the following new section:

- § 5328. Whistleblower protections

"(a) PRomBiTiON AGAINST DISCRIMINATION. —NO financial institution may discharge or otherwise discriminate against any employee with respect to compensation, terms, conditions, or privileges of employment because the employee (or any person acting pursuant to the request of the employee) provided information to the Secretary of the Treasury, the Attorney General, or any Federal supervisory agency regarding a possible violation of any provision of this subchapter or section 1956, 1957, or 1960 of title 18, or any regulation under any such provision, by the financial

�