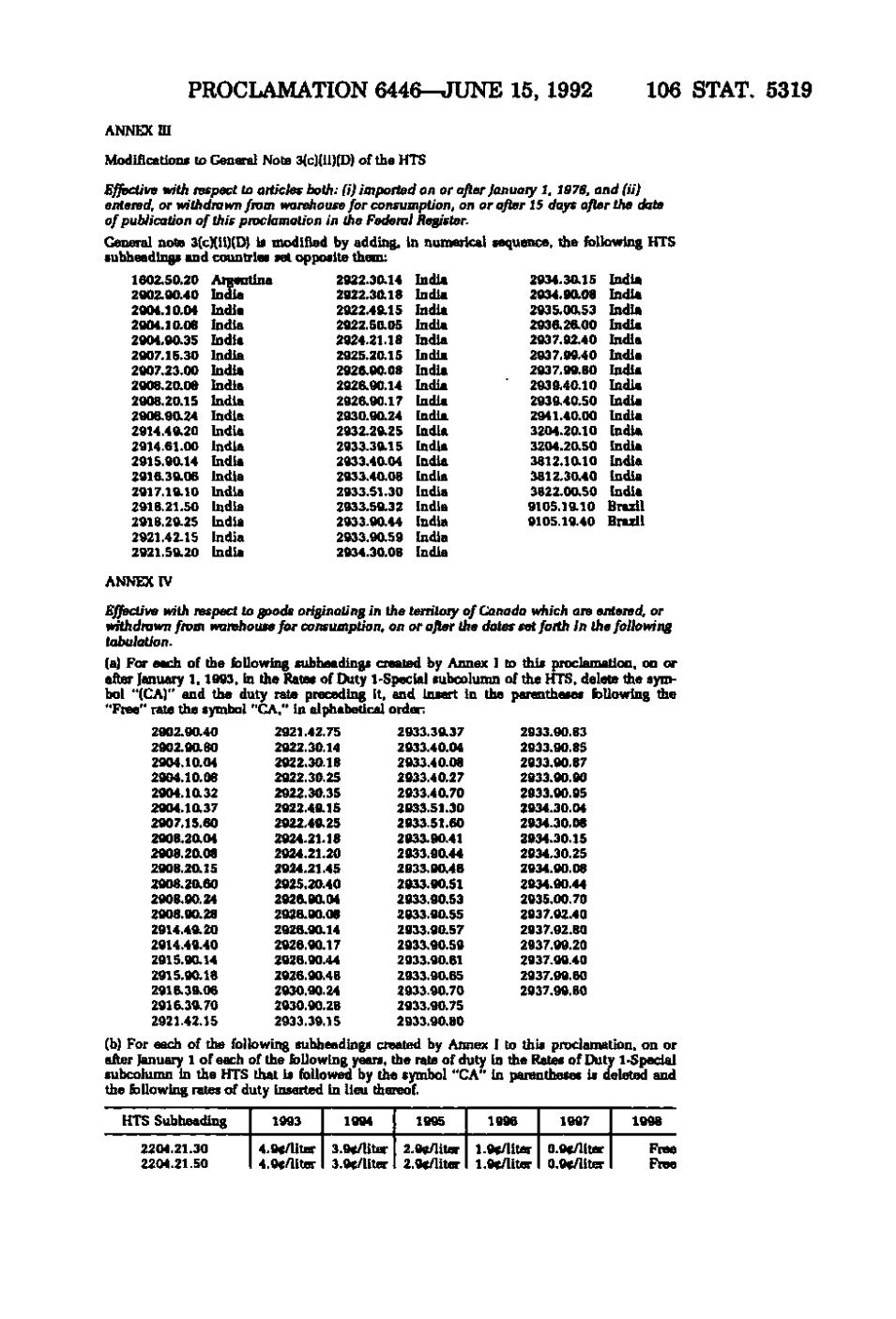

PROCLAMATION 6446-JUNE 15, 1992 106 STAT. 6319 ANNEXm Modifications to General Note 3(c)(ii)(D) of the HTS Effective with respect to articles both: (i) imported on or after January 1, 1976, and (ii) entered, or withdrawn from warehouse for consumption, on or after 15 days after the date of publication of this proclamation in the Federal Register. General note 3(c)(ii)(D) is modiAed by adding, in numerical sequence, the following HTS subheadings and countries set opposite them: 1602.50.20 2902.90.40 2904.10.04 2904.10.08 2904.90.35 2907.15.30 2907.23.00 2908.20.08 2908.20.15 2908.90.24 2914.49.20 2914.61.00 2915.90.14 2916.39.06 2917.19.10 2918.21.50 2918.29.25 2921.42.15 2921.59.20 ANNEX IV Aigentina India India India India India India India India India India India India India India India India India India 2922.30.14 2922.30.18 2922.49.15 2922.50.05 2924.21.18 2925.20.15 2926.90.08 2926.90.14 2926.90.17 2930.90.24 2932.29.25 2933.39.15 2933.40.04 2933.40.08 2033.51.30 2933.59.32 2933.90.44 2933.90.59 2934.30.08 India India India India India India India India India India India India India India India India India India India 2934.30.15 2934.90.08 2935.00.53 2936.26.00 2937.92.40 2037.99.40 2937.99.60 2939.40.10 2939.40.50 2941.40.00 3204.20.10 3204.20.50 3812.10.10 3812.30.40 3822.00.50 9105.19.10 9105.19.40 India India India India India India India India India India India India India India India Brazil Brazil Effective with respect to goods originating in the territory of Canada which are entered, or withdrawn from warehouse for consumption, on or after the dates set forth in the following tabulation. (a) For each of the following subheadings created by Annex I to this proclamation, on or after January 1, 1993, in the Rates of Duty 1-Special subcolumn of the HTS, delete the symbol "(CA)" and the duty rate preceding it, and insert in the parraitheses following the "Free" rate the symbol "CA," in alphabetical ord^*: 2902.90.40 2902.90.80 2904.10.04 2904.10.08 2904.10.32 2904.10.37 2907.15.60 2908.20.04 2908.20.08 2908.20.15 2908.20.60 2908.90.24 2908.90.28 2914.49.20 2914.49.40 2915.90.14 2915.90.18 2916.39.06 2916.39.70 2921.42.15 2921.42.75 2922.30.14 2922.30.18 2922.30.25 2922.30.35 2922.49.15 2922.40.25 2924.21.18 2924,21.20 2924.21.45 2925.20.40 2926.90.04 2926.90.08 2926.90.14 2926.90.17 2926.90.44 2926.90.48 2930.90.24 2930.90.28 2933.39.15 2933.39.37 2933.40.04 2933.40.08 2933.40.27 2933.40.70 2933.51.30 2933.51.60 2933.90.41 2933.90.44 2933.90.46 2933.90.51 2933.90.53 2933.90.55 2933.90.57 2933.90.59 2933.90.61 2933.90.65 2933.90.70 2933.90.75 2933.90.80 2933.90.83 2933.90.85 2933.90.87 2933.90.90 2933.90.95 2934.30.04 2934.30.08 2934.30.15 2934.30.25 2934.90.08 2934.90.44 2935.00.70 2937.92.40 2937.92.80 2937.99.20 2937.99.40 2937.99.60 2937.99.80 (b) For each of the following subheadings created by Aimex I to this proclamation, on or after January 1 of each of the following years, the rate of duty in the Rates of Duty 1-Special subcolumn in the HTS that is followed by the symbol "CA" in parentheses is deleted and the following rates of duty inserted in lieu thereof. HTS Subheading 2204.21.30 2204.21.50 1993 4.9«/liter 4.9«/liter 1994 3.00/litw 3.9«/liter 1995 2.9«/liter 2.9e/lit«- 1996 1.9«/liter 1.9«/liter 1997 0.9«/liter 0.9c/liter 1998 Free Free

�