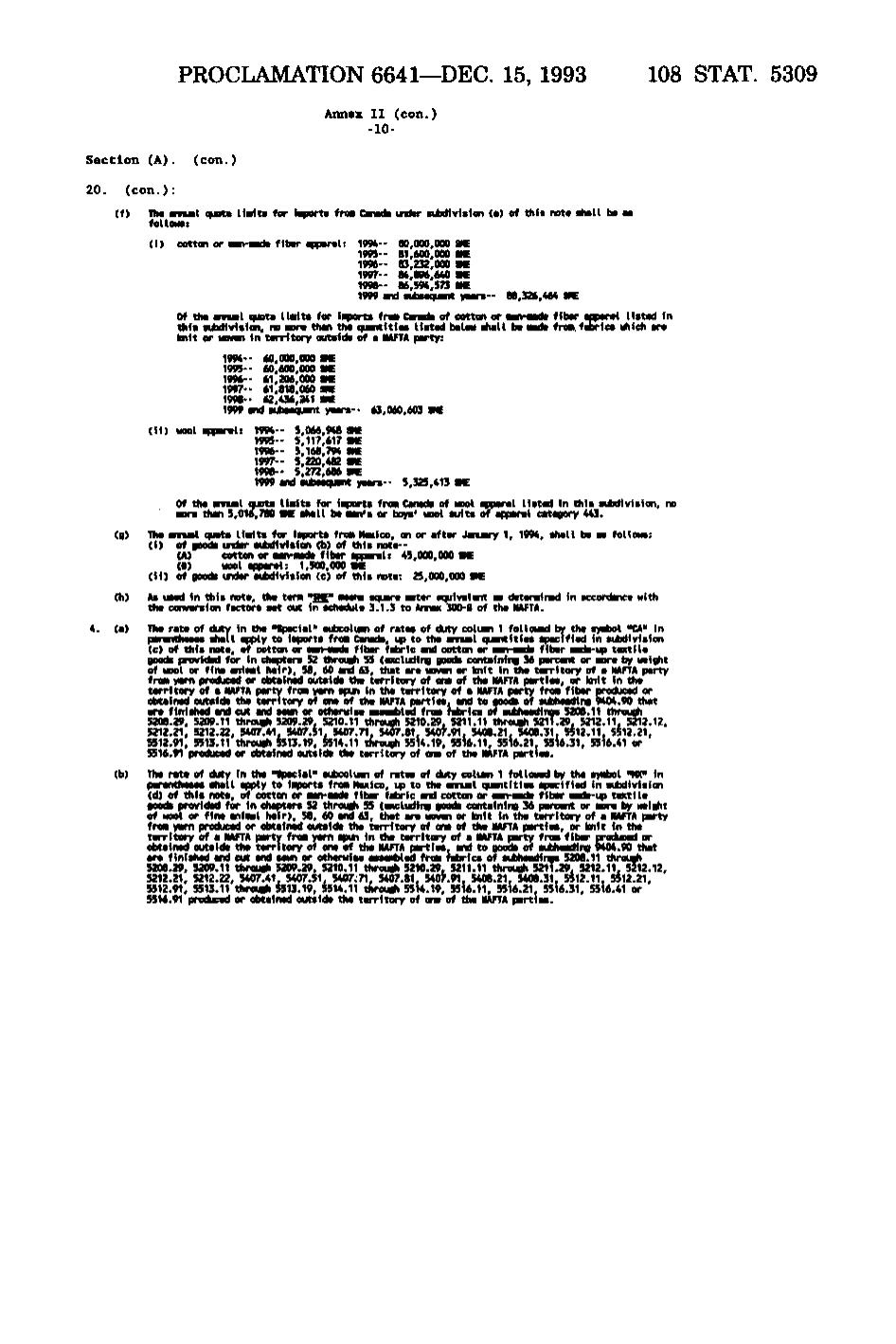

PROCLAMATION 6641—DEC. 15, 1993 108 STAT. 5309 Annex II (con.) -10- Section (A), (con.) 20. (con.): (f) Tht annuil quota Ualts for imports frea Canadi mder subdivision (a) of this note shall be as foU ous: ({) cotton or aan-Mde fiber ipparel: 1994- 80,000,000 SHE 1995- 81,600,000 SK 1996" 83,232,000 SHE 1997" 84.096,640 SHE 1996" 86.594.573 SME 1999 and stiisaqjcnt years-- 88.326,464 SME Of the annual quota Units for imports frcn Canada of cotton or Ban-aade fiber apparel listed in this subdivision, no more than the quantities listed beloM shall be aade frca. fabrics liiich are icnit or uoMn in territory outside of a MAFTA party: 1994" 60,000,000 SME 1995" 60,600,000 SW 1996" 61,206,000 SK 1997" 61,818,060 SK 1998" 62,436,241 SK 1999 and stAsequent yeers-- 63,060.603 SK (ii) Hool apparel: 1994-- 5.066.948 SK 1995" 5,117.617 SK 1996" 5.168.794 SK 1997" 5.220.482 SK 1996" 5.272,686 SK 1999 and sutaequent years- 5,325.413 SK Of the annual quota liaits for iaports from Canada of uool apparal listed in this sUxlivision, no more than 5.016.780 SK shall be aen's or boys' wool suits of apparel category 443. (g) The annuat quota liaits for iaports from Mexico, on or after January 1. 1994,shall be as fotlous: (i) of goods under siliivision (b) of this note— (A) cotton or aan-aade fiber apparel: 45,000,000 SK (B> uool apparel: 1,500,000 SK (ii) of goods mder sUidivisian (c) of this note: 25,000,000 SK (h) As used in this note, the tens *SK" aeans square neter equivalent as deterained in accordance with the conversion factors set out in schedule 3.1.3 to Annex 300-B of the NAFTA. 4. (a) The rate of duty in the "Special"' stixolum of rates of duty colum 1 folloued by the syefcol "CA" in parentheses shall apply to iiaports from Canada, if> to the amuat quantities specified in subdivision (c) of this note, of cotton or mn-made fiber fabric and cotton or nan-made fiber mede-if) textile goods provided for in chapters 52 through 55 (excluding goods containing 36 percent or nore by Height of uool or fine aninal hair), 58, 60 and 63, that are uoven or knit in the territory of a NAFTA party from yam produced or obtained outside the territory of one of the NAFTA perties, or knit inthe territory of a NAFTA party frca >am spui in the territory of a NAFTA party from fiber produced or obtained outaide the territory of one of the NAFTA parties, and to goods of sUbheading 9404.90 that are finished and cut ind sem or otheruise assasfcted from fabrics of si±headings 5208.11 through 5208.29. 5209.11 througfi 5209.29, 5210.11 through 5210.29, 5211.11 through 5211.29, 5212.11, 5212.12. 5212.21. 5212.22, 5407.41, 5407.51, 5407.71, 5407.81, 5407.91, 5408.21, 5408.31, 5512.11, 5512.21, 5512.91, 5513.11 through 5513.19, 5514.11 through 5514.19, 5516.11, 5516.21, 5516.31, 5516.41 or 5516.91 produced or obtained outside the territory of one of the NAFTA parties. (b) The rate of duty in the "Special* siix:olunn of rates of duty coluin 1 folloued by the syntiol "MX"in parentheses shall apply to inports from Mexico, up to the annual quantities specified in siixiivisian (d) of this note, of cotton or nen-aadc fiber fabric and cotton or aan-aade fiber aade-up textile 'goods provided for in chapters 52 through 55 (excluding goods containing 36 percent or more by Height of uool or fine eniaal hair), 58, 60 and 63. that are uoven or knit in the territory of a NAFTA party from yam produced or obtained outside the territory of one of the NAFTA parties, or knit in the territory of a NAFTA party from yam spin in the territory of a NAFTA party frca fiber produced or obtained outside the territory of one of the NAFTA parties, and to goods of subheading 9404.90 that are finished and cut and seun or otheruise assembled from febrics of siliieadinga 5208.11 through 5206.29, 5209.11 through 5209.29, 5210.11 through 5210.29. 5211.11 through 5211.29. 5212.11. 5212.12. 5212.21. 5212.22. 5407.41, 5407.51, 5407.71, 5407.81, 5407.91, 5408.21, 5408.31, 5512.11, 5512.21. 5512.91. 5513.11 through 5513.19. 5514.11 through 5514.19. 5516.11. 5516.21. 5516.31. 5516.41 or 5516.91 produced or cbteined outside the territory of one of the NAFTA parties.

�