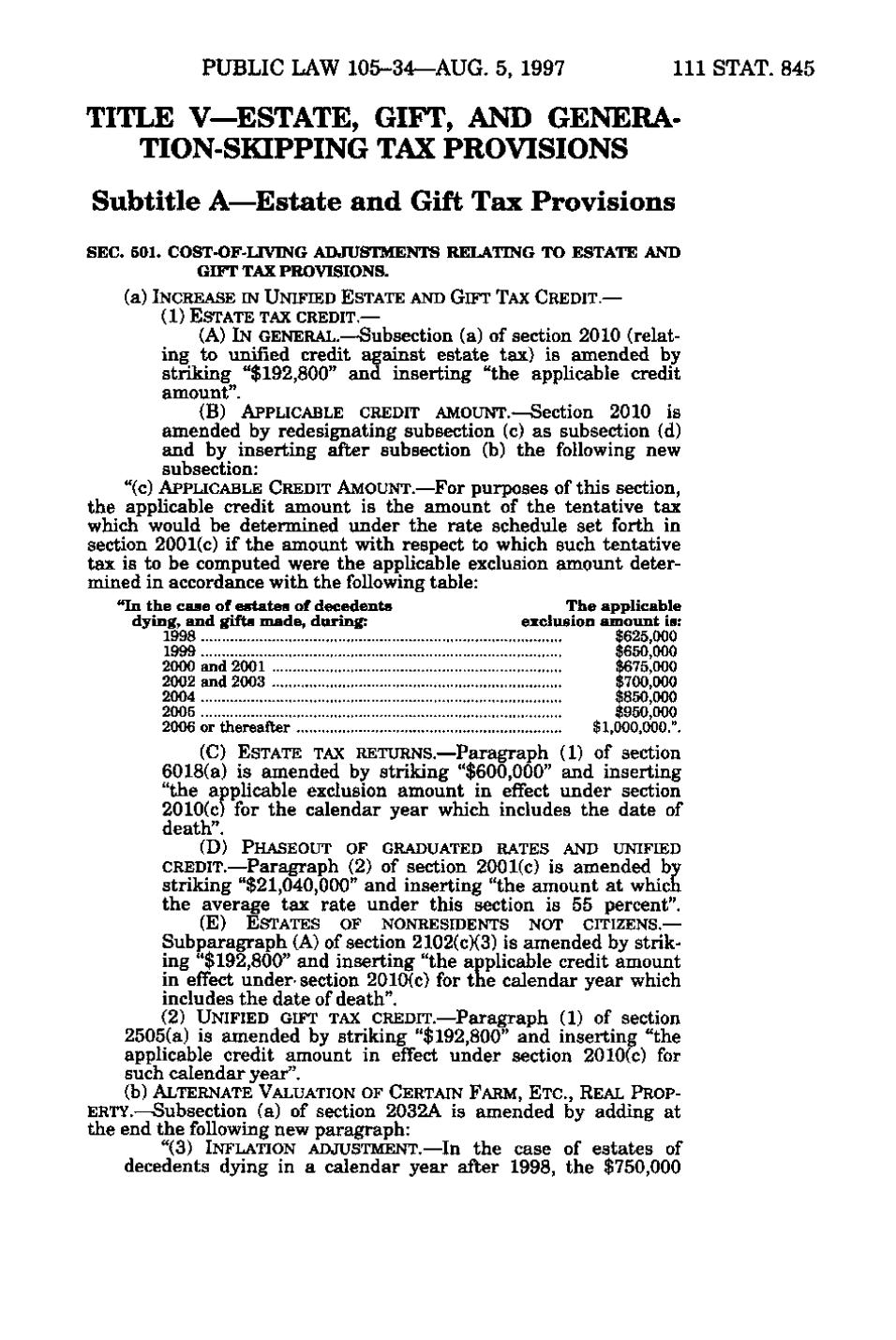

PUBLIC LAW 105-34—AUG. 5, 1997 111 STAT. 845 TITLE V—ESTATE, GIFT, AND GENERA- TION-SKIPPING TAX PROVISIONS Subtitle A—Estate and Gift Tax Provisions SEC. 501. COST-OF-LIVING ADJUSTMENTS RELATING TO ESTATE AND GIFT TAX PROVISIONS. (a) INCREASE IN UNIFIED ESTATE AND GIFT TAX CREDIT. — (1) ESTATE TAX CREDIT.— (A) IN GENERAL.—Subsection (a) of section 2010 (relating to unified credit against estate tax) is amended by striking "$192,800" and inserting "the applicable credit amount". (B) APPLICABLE CREDIT AMOUNT.— Section 2010 is amended by redesignating subsection (c) as subsection (d) and by inserting after subsection (b) the following new subsection: "(c) APPLICABLE CREDIT AMOUNT.— For purposes of this section, the applicable credit amount is the amount of the tentative tax which would be determined under the rate schedule set forth in section 2001(c) if the amount with respect to which such tentative tax is to be computed were the applicable exclusion amount determined in accordance with the following table: "In the case of estates of decedents The applicable dying, and gifts made, during: exclusion amount is: 1998 $625,000 1999 $650,000 2000 and 2001 $675,000 2002 and 2003 $700,000 2004 $850,000 2005 $950,000 2006 or thereafter $1,000,000. ". (C) ESTATE TAX RETURNS.— Paragraph (1) of section 6018(a) is amended by striking "$600,000" and inserting "the applicable exclusion amount in effect under section 2010(c) for the calendar year which includes the date of death". (D) PHASEOUT OF GRADUATED RATES AND UNIFIED CREDIT.— Paragraph (2) of section 2001(c) is amended by striking "$21,040,000" and inserting "the amount at which the average tax rate under this section is 55 percent". (E) ESTATES OF NONRESIDENTS NOT CITIZENS.— Subparagraph (A) of section 2102(c)(3) is amended by striking "$192,800" and inserting "the applicable credit amount in effect under* section 2010(c) for the calendar year which includes the date of death". (2) UNIFIED GIFT TAX CREDIT.— Paragraph (1) of section 2505(a) is amended by striking "$192,800 " and inserting "the applicable credit amount in effect under section 2010(c) for such calendar year". (b) ALTERNATE VALUATION OF CERTAIN FARM, ETC., R EA L P ROP- ERTY.— Subsection (a) of section 2032A is amended by adding at the end the following new paragraph: "(3) INFLATION ADJUSTMENT. —In the case of estates of decedents dying in a calendar year after 1998, the $750,000

�