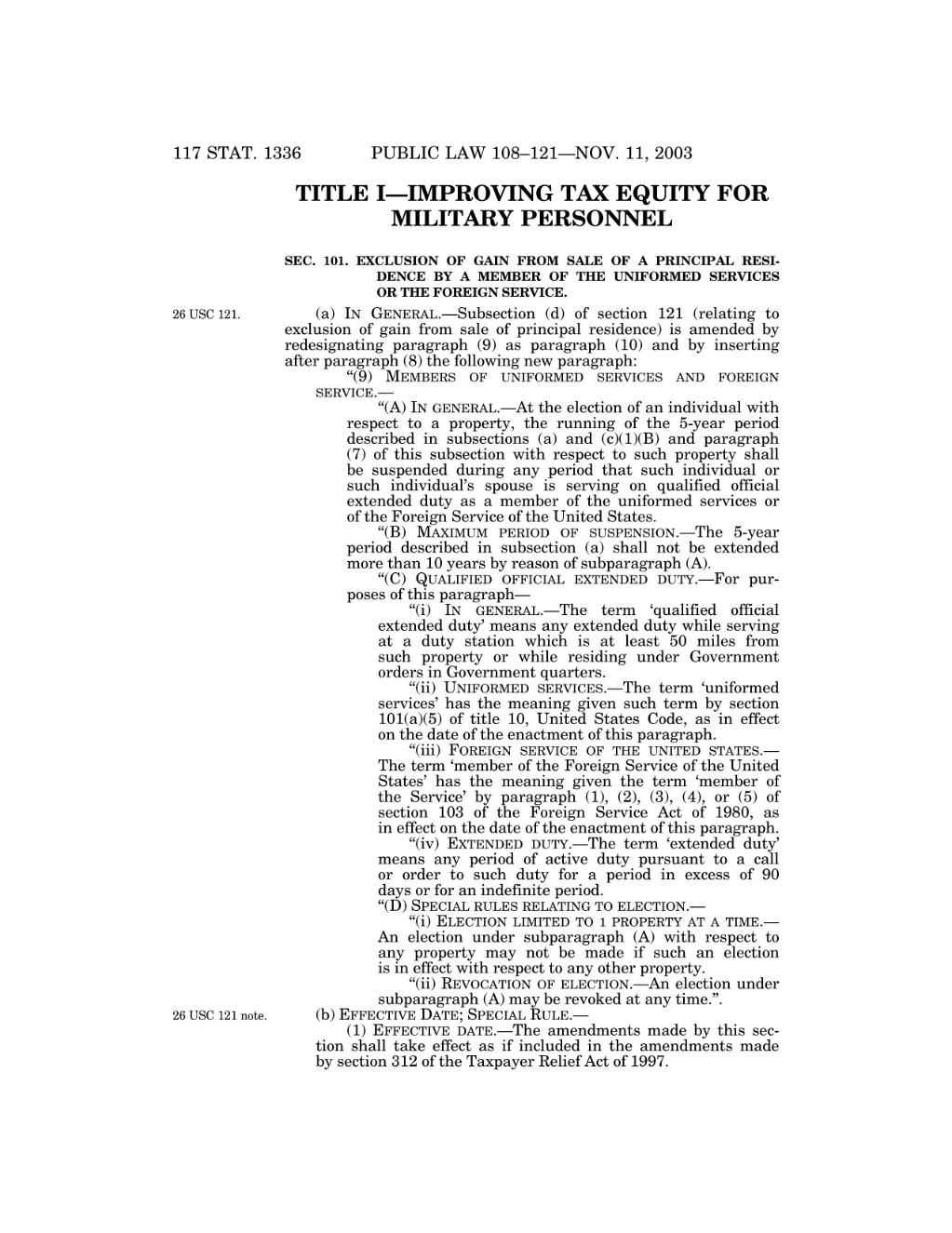

117 STAT. 1336

PUBLIC LAW 108–121—NOV. 11, 2003

TITLE I—IMPROVING TAX EQUITY FOR MILITARY PERSONNEL SEC. 101. EXCLUSION OF GAIN FROM SALE OF A PRINCIPAL RESIDENCE BY A MEMBER OF THE UNIFORMED SERVICES OR THE FOREIGN SERVICE. 26 USC 121.

26 USC 121 note.

VerDate 11-MAY-2000

10:15 Aug 27, 2004

(a) IN GENERAL.—Subsection (d) of section 121 (relating to exclusion of gain from sale of principal residence) is amended by redesignating paragraph (9) as paragraph (10) and by inserting after paragraph (8) the following new paragraph: ‘‘(9) MEMBERS OF UNIFORMED SERVICES AND FOREIGN SERVICE.— ‘‘(A) IN GENERAL.—At the election of an individual with respect to a property, the running of the 5-year period described in subsections (a) and (c)(1)(B) and paragraph (7) of this subsection with respect to such property shall be suspended during any period that such individual or such individual’s spouse is serving on qualified official extended duty as a member of the uniformed services or of the Foreign Service of the United States. ‘‘(B) MAXIMUM PERIOD OF SUSPENSION.—The 5-year period described in subsection (a) shall not be extended more than 10 years by reason of subparagraph (A). ‘‘(C) QUALIFIED OFFICIAL EXTENDED DUTY.—For purposes of this paragraph— ‘‘(i) IN GENERAL.—The term ‘qualified official extended duty’ means any extended duty while serving at a duty station which is at least 50 miles from such property or while residing under Government orders in Government quarters. ‘‘(ii) UNIFORMED SERVICES.—The term ‘uniformed services’ has the meaning given such term by section 101(a)(5) of title 10, United States Code, as in effect on the date of the enactment of this paragraph. ‘‘(iii) FOREIGN SERVICE OF THE UNITED STATES.— The term ‘member of the Foreign Service of the United States’ has the meaning given the term ‘member of the Service’ by paragraph (1), (2), (3), (4), or (5) of section 103 of the Foreign Service Act of 1980, as in effect on the date of the enactment of this paragraph. ‘‘(iv) EXTENDED DUTY.—The term ‘extended duty’ means any period of active duty pursuant to a call or order to such duty for a period in excess of 90 days or for an indefinite period. ‘‘(D) SPECIAL RULES RELATING TO ELECTION.— ‘‘(i) ELECTION LIMITED TO 1 PROPERTY AT A TIME.— An election under subparagraph (A) with respect to any property may not be made if such an election is in effect with respect to any other property. ‘‘(ii) REVOCATION OF ELECTION.—An election under subparagraph (A) may be revoked at any time.’’. (b) EFFECTIVE DATE; SPECIAL RULE.— (1) EFFECTIVE DATE.—The amendments made by this section shall take effect as if included in the amendments made by section 312 of the Taxpayer Relief Act of 1997.

Jkt 019194

PO 00000

Frm 00288

Fmt 6580

Sfmt 6581

D:\STATUTES\2003\19194PT2.001

APPS10

PsN: 19194PT2

�