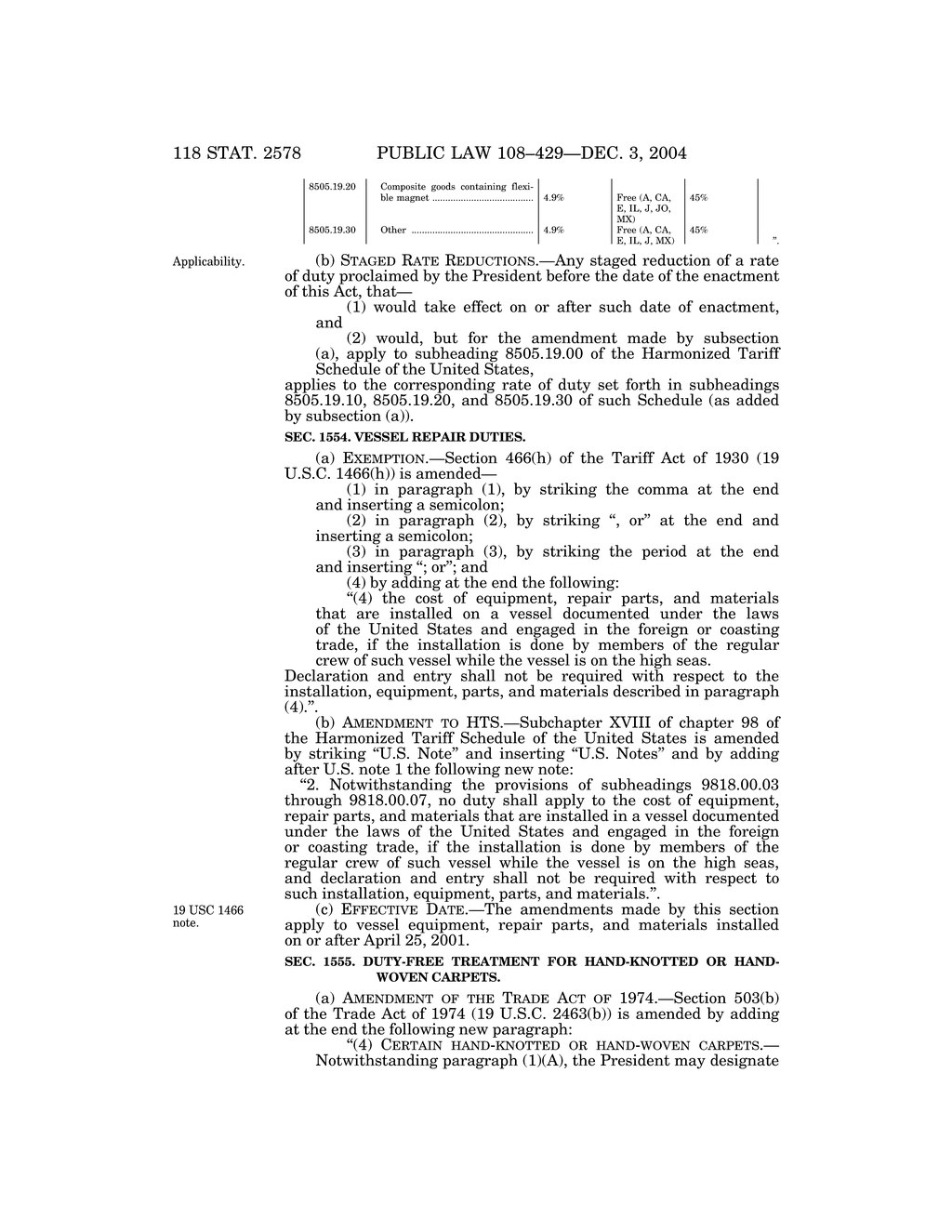

118 STAT. 2578 PUBLIC LAW 108–429—DEC. 3, 2004 8505.19.20 Composite goods containing flexi ble magnet ....................................... 4.9% Free (A, CA, E, IL, J, JO, MX) 45% 8505.19.30 Other ............................................... 4.9% Free (A, CA, E, IL, J, MX) 45% ’’. (b) STAGED RATE REDUCTIONS.—Any staged reduction of a rate of duty proclaimed by the President before the date of the enactment of this Act, that— (1) would take effect on or after such date of enactment, and (2) would, but for the amendment made by subsection (a), apply to subheading 8505.19.00 of the Harmonized Tariff Schedule of the United States, applies to the corresponding rate of duty set forth in subheadings 8505.19.10, 8505.19.20, and 8505.19.30 of such Schedule (as added by subsection (a)). SEC. 1554. VESSEL REPAIR DUTIES. (a) EXEMPTION.—Section 466(h) of the Tariff Act of 1930 (19 U.S.C. 1466(h)) is amended— (1) in paragraph (1), by striking the comma at the end and inserting a semicolon; (2) in paragraph (2), by striking ‘‘, or’’ at the end and inserting a semicolon; (3) in paragraph (3), by striking the period at the end and inserting ‘‘; or’’; and (4) by adding at the end the following: ‘‘(4) the cost of equipment, repair parts, and materials that are installed on a vessel documented under the laws of the United States and engaged in the foreign or coasting trade, if the installation is done by members of the regular crew of such vessel while the vessel is on the high seas. Declaration and entry shall not be required with respect to the installation, equipment, parts, and materials described in paragraph (4).’’. (b) AMENDMENT TO HTS.—Subchapter XVIII of chapter 98 of the Harmonized Tariff Schedule of the United States is amended by striking ‘‘U.S. Note’’ and inserting ‘‘U.S. Notes’’ and by adding after U.S. note 1 the following new note: ‘‘2. Notwithstanding the provisions of subheadings 9818.00.03 through 9818.00.07, no duty shall apply to the cost of equipment, repair parts, and materials that are installed in a vessel documented under the laws of the United States and engaged in the foreign or coasting trade, if the installation is done by members of the regular crew of such vessel while the vessel is on the high seas, and declaration and entry shall not be required with respect to such installation, equipment, parts, and materials.’’. (c) EFFECTIVE DATE.—The amendments made by this section apply to vessel equipment, repair parts, and materials installed on or after April 25, 2001. SEC. 1555. DUTY FREE TREATMENT FOR HAND KNOTTED OR HAND WOVEN CARPETS. (a) AMENDMENT OF THE TRADE ACT OF 1974.—Section 503(b) of the Trade Act of 1974 (19 U.S.C. 2463(b)) is amended by adding at the end the following new paragraph: ‘‘(4) CERTAIN HAND KNOTTED OR HAND WOVEN CARPETS.— Notwithstanding paragraph (1)(A), the President may designate 19 USC 1466 note. Applicability.

�