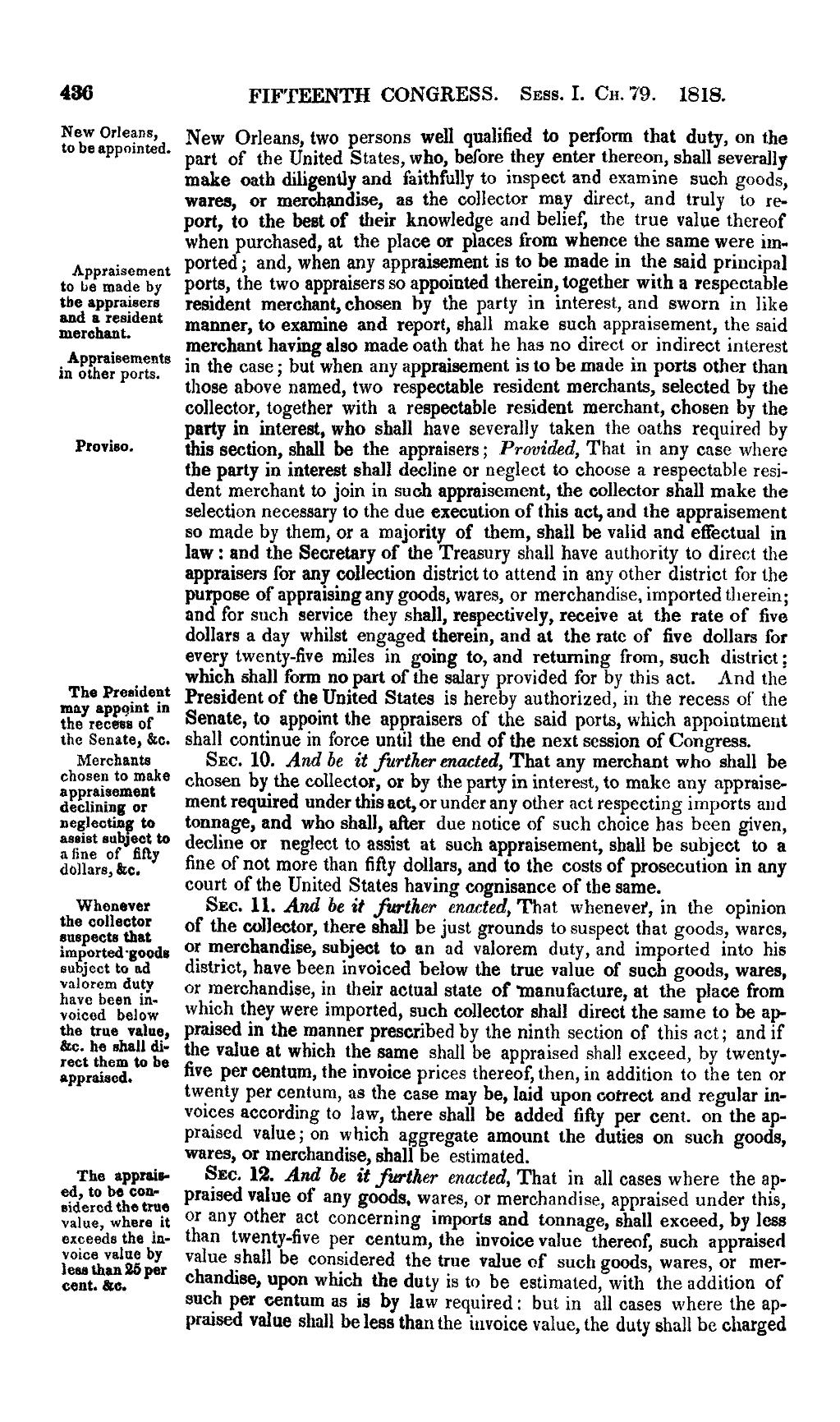

New Orleans, two persons well qualified to perform that duty, on the part of the United States, who, before they enter thereon, shall severally make oath diligently and faithfully to inspect and examine such goods, wares, or merchandise, as the collector may direct, and truly to report, to the best of their knowledge and belief, the true value thereof when purchased, at the place or places from whence the same were imported; and, when any appraisement is toAppraisement to be made by the appraisers and a resident merchant.

Appraisements in other ports. be made in the said principal ports, the two appraisers to appointed therein, together with a respectable resident merchant, chosen by the party in interest, and sworn in like manner, to examine and report, shall make such appraisement, the said merchant having also made oath that he has no direct or indirect interest in the case; but when any appraisement is to be made in ports other than those above named, two respectable resident merchants, selected by the collector, together with a respectable resident merchant, chosen by the party in interest, who shall have severally taken the oaths required by this section, shall be the appraisers;Proviso. Provided, That in any case where the party in interest shall decline or neglect to choose a respectable resident merchant to join in such appraisement, the collector shall make the selection necessary to the due execution of this act, and the appraisement so made by them, or a majority of them, shall be valid and effectual in law: and the Secretary of the Treasury shall have authority to direct the appraisers for any collection district to attend in any other district for the purpose of appraising any goods, wares, or merchandise, imported therein; and for such service they shall, respectively, receive at the rate of five dollars a day whilst engaged therein, and at the rate of five dollars for every twenty-five miles in going to, and returning from, such district; which shall form no part of the salary provided by this act. And the President of the United States is hereby authorized,The President may appoint in the recess of the Senate, &c. in the recess of the Senate, to appoint the appraisers of the said ports, which appointment shall continue in force until the end of the next session of Congress.

Merchants chosen to make appraisement declining or neglecting to assist subject to a fine of fifty dollars, &c.Sec. 10. And be it further enacted, That any merchant who shall be chosen by the collector, or by the party in interest, to make any appraisement required under this act, or under any other act respecting imports and tonnage, and who shall, after due notice of such choice has been given, decline or neglect to assist at such appraisement, shall be subject to a fine of not more than fifty dollars, and to the costs of prosecution in any court of the United States having cognisance of the same.

Whenever the collector suspects that imported goods subject to ad valorem duty have been invoiced below the true value, &c. he shall direct them to be appraised.Sec. 11. And be it further enacted, That whenever, in the opinion of the collector, there shall be just grounds to suspect that goods, wares, or merchandise, subject to an ad valorem duty, and imported into his district, have been invoiced below the true value of such goods, wares, or merchandise, in their actual state of manufacture, at the place from which they were imported, such collector shall direct the same to be appraised in the manner prescribed by the ninth section of this act; and if the value at which the same shall be appraised shall exceed, by twenty-five per centum, the invoice prices thereof, then, in addition to the ten or twenty per centum, as the case may be, laid upon correct and regular invoices according to law, there shall be added fifty per cent. on the appraised value; on which aggregate amount the duties on such goods, wares, or merchandise, shall be estimated.

The appraised, to be considered the true value, where it exceeds the invoice value by less than 25 per cent. &c.Sec. 12. And be it further enacted, That in all cases where the appraised value of any goods, wares, or merchandise, appraised under this, or any other act concerning imports and tonnage, shall exceed, by less than twenty-five per centum, the invoice value thereof, such appraised value shall be considered the true value thereof, such appraised value shall be considered the true value of such goods, wares, or merchandise, upon which the duty is to be estimated, with the addition of such per centum as is by law required: but in all cases where the appraised value shall be less than the invoice value, the duty shall be charged