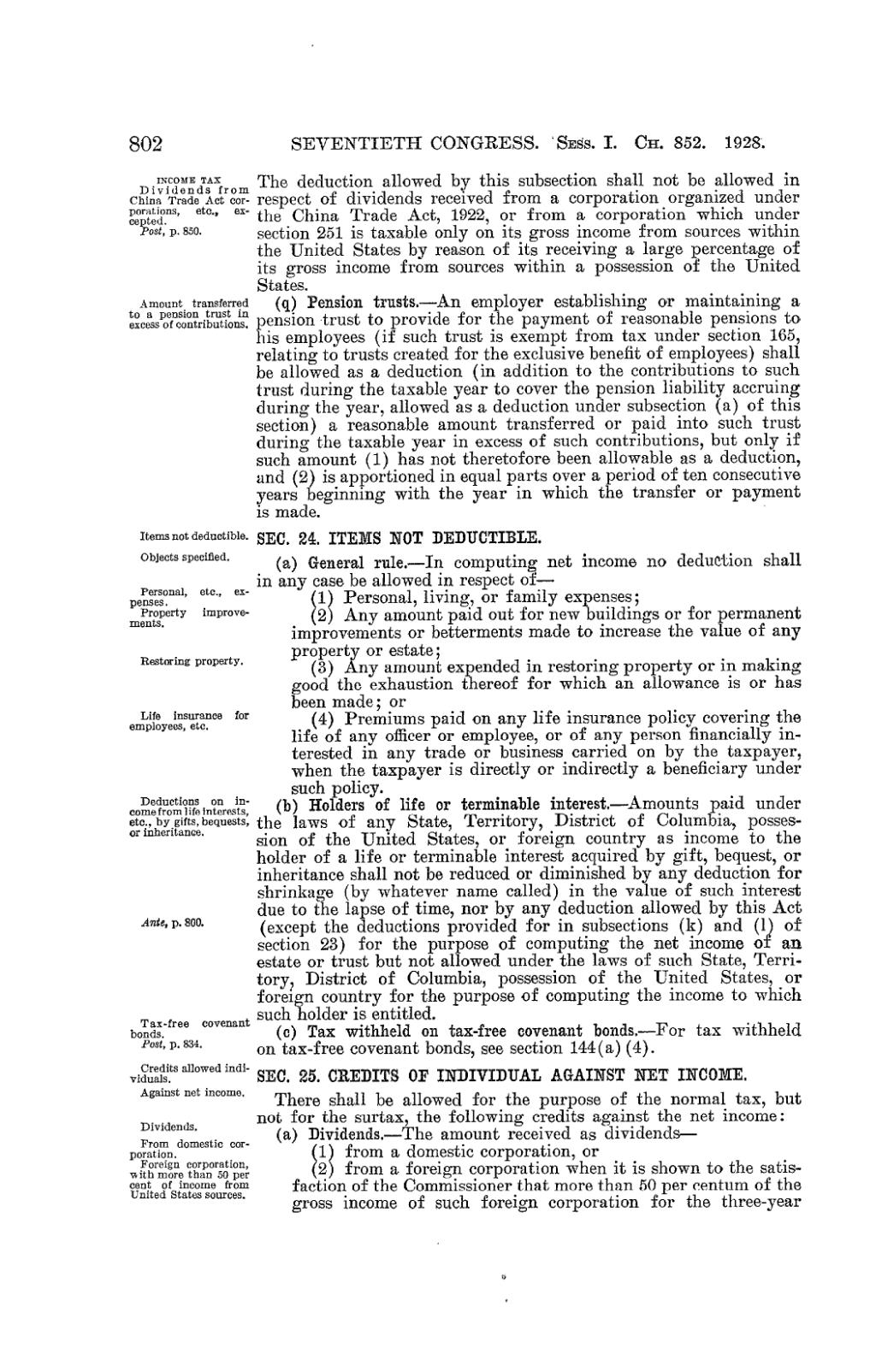

802 INC OME TAX Dividends from Chi na T rade Act cor- porations , etc ., ex- cepted . Post, p. 850 . Amount transferred to a pension trust in excess of contributions . Items not deductible . Objects specified . Personal, etc ., ex- penses . Property improve- ments. Restori ng property . Li fe insu rance for employees, etc . De du cti ons on in- come from life interests, etc ., by gifts, bequests, or inhe ritance . Ante, p. 800. Tax-free covenant bonds. Post, p. 834 . Credits allowed indi- viduals . Against net income . Div iden ds . From domestic cor- poration . Foreign corporation, with more than 50 per cent of income f rom United States sources . SEVENTIETH CONGRESS . `SEss . I. Cii. 852 . 1928 . The deduction allowed by this subsection shall not be allowed in re spect of divid ends recei ved from a cor pora tion organ ized unde r the China Trade Act, 1922, or from a corporation which under section 251 is taxable only on its gross income from sources within the United States by reason of its receiving a large percentage of its gross income from sources within a possession of the United States . (q) Pension trusts .-An employer establishing or maintaining a pension trust to provide for the payment of reasonable pensions to . his employees (if such trust is exempt from tax under section 165, rel ating to trusts cr eated for the excl usive ben efit of e mployees) shall be allowed as a deduction (in addition to the contributions to such trust during the taxable year to cover the pension liability accruing dur ing th e year , allo wed as a ded uction under subsec tion ( a) of this se ction ) a reaso nable amou nt t ransf erred or paid into such trus t during the taxable year in excess of such contributions, but only if such amount (1) has not theretofore been allowable as a deduction, and (2) is apportioned in equal parts over a period of ten consecutive years beginning with the year in which the transfer or payment is made . SEC . 24 . ITEMS NOT DEDUCTIBLE . (a) General rule.-In computing net income no deduction shall in any case be allowed in respect of- t Persona l, liv ing, o r fami ly exp enses ; (2) Any amount paid out for new buildings or for permanent improvements or betterments made to increase the value of any property or estate ; (3) Any amount expended in restoring property or in making good the exhaustion thereof for which an allowance is or has been made ; or (4) Premiums paid on any life insurance policy covering the life of any officer or employee, or of any person financially in- terested in any trade or business carried on by the taxpayer, when the taxpayer is directly or indirectly a beneficiary under such po licy . (b) holders of life or terminable interest .-Amounts paid under the laws of any State, Territory, District of Columbia, posses- sion of the United States, or foreign country as income to the holder of a life or terminable interest acquired by gift, bequest, or inheritance shall not be reduced or diminished by any deduction for shrinkage (by whatever name called) in the value of such interest due to the lapse of time, nor by any deduction allowed by this Act (except the deductions provided for in subsections (k) and (1 of section 23) for the purpose of computing the net income o an estate or trust but not allowed under the laws of such State, Terri- tory, District of Columbia, possession of the United States, or foreign country for the purpose of computing the income to which suc h holder is entitl ed . (c) Tax withheld on tax-free covenant bonds .-For tax withheld on tax-free covenant bonds, see section 144(a) (4) . SEC. 25 . CREDITS OF INDIVIDUAL AGAINST NET INCOME . There shall be allowed for the purpose of the normal tax, but not for the surtax, the following credits against the net income (a) Dividends .-The amount received as dividends- (1) from a domestic corporation, or (2 from a foreign corporation when it is shown to the satis- faction of the Commissioner that more than 50 per centum of the gross income of such foreign corporation for the three-year

�