70

PUBLIC LAW 460-MAR. 31, 1966

[70 ST A T.

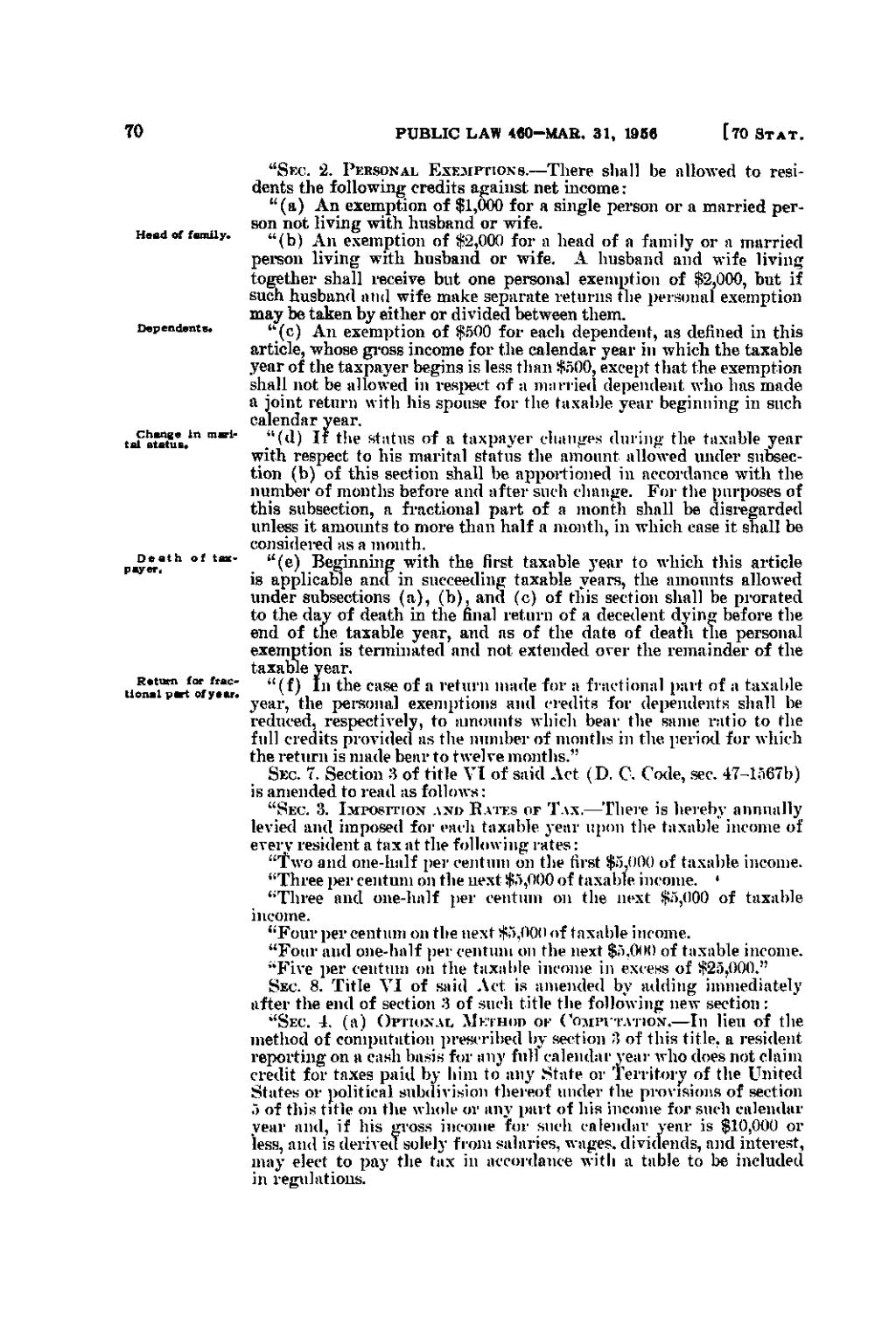

"SEC. 2. PERSONAL EXEMPTIONS.—There shall be allowed to resi-

Head of family.

Dependents.

Change i n marital status.

O e a t h o f taxpayer.

Return for fractional part of year.

dents the following credits against net income: " (a) An exemption of $1,000 for a single person or a married person not living with husband or wife. "(b) An exemption of $2,000 for a head of a family or a married person living with husband or wife. A husband and wife living together shall receive but one personal exemption of $2,000, but if such husband and wife make separate returns the personal exemption may be taken by either or divided between them. "(c) An exemption of $500 for each dependent, as defined in this article, whose gross income for the calendar year in which the taxable year of the taxpayer begins is less than $500, except that the exemption shall not be allowed in respect of a married dependent who has made a joint return with his spouse for the taxable year beginning in such calendar year. " (d) If the status of a taxpayer changes during the taxable year with respect to his marital status the amount allowed under subsection (b) of this section shall be apportioned in accordance with the number of months befoie and after such change. For the purposes of this subsection, a fractional part of a month shall be disregarded unless it amounts to more than half a month, in which case it shall be considered as a month. "(e) Beginning with the first taxable year to which this article is applicable and in succeeding taxable years, the amounts allowed under subsections (a), (b), and (c) of this section shall be prorated to the day of death in the final return of a decedent dying before the end of the taxable year, and as of the date of death the personal exemption is terminated and not extended over the remainder of the taxable year. "(f) I n the case of a return made for a fractional part of a taxable year, the personal exemptions and credits for dependents shall be reduced, respectively, to amounts which bear the same ratio to the full credits provided as the number of months in the period for which the return is made bear to twelve months." SEC. 7. Section 3 of title VI of said Act (D. C. Code, sec. 4T-1567b) is amended to read as follows: " SEC. 3. iMPOsmoN AND EATES OF TAX.—There is hereby annually

levied and imposed for each taxable year upon the taxable income of every resident a tax at the following rates: "Two and one-half per centum on the first $5,000 of taxable income. "Three per centum on the next $5,000 of taxable income. ' "Three and one-half per centum on the next $5,000 of taxable income. "Four per centum on the next $5,000 of taxable income. "Four and one-half per centum on the next $5,000 of taxable income. "Five per centum on the taxable income in excess of $25,000." SEC. 8. Title VI of said Act is amended by adding immediately after the end of section 3 of such title the following new section: "SEC. 4. (a) OPTIONAL METHOD OF CO:MPI"IAITON.—In lieu of the method of computation prescribed by section 3 of this title, a resident reporting on a cash basis for any full calendar year who does not claim credit for taxes paid by him to any State or Territory of the United States or political subdivision thereof under the provisions of section 5 of this title on the whole or any part of his income for such calendar year and, if his gross income for such calendar year is $10,000 or less, and is derived solely from salaries, wages, dividends, and interest, may elect to pay the tax in accordance with a table to be included in regulations.

�