508

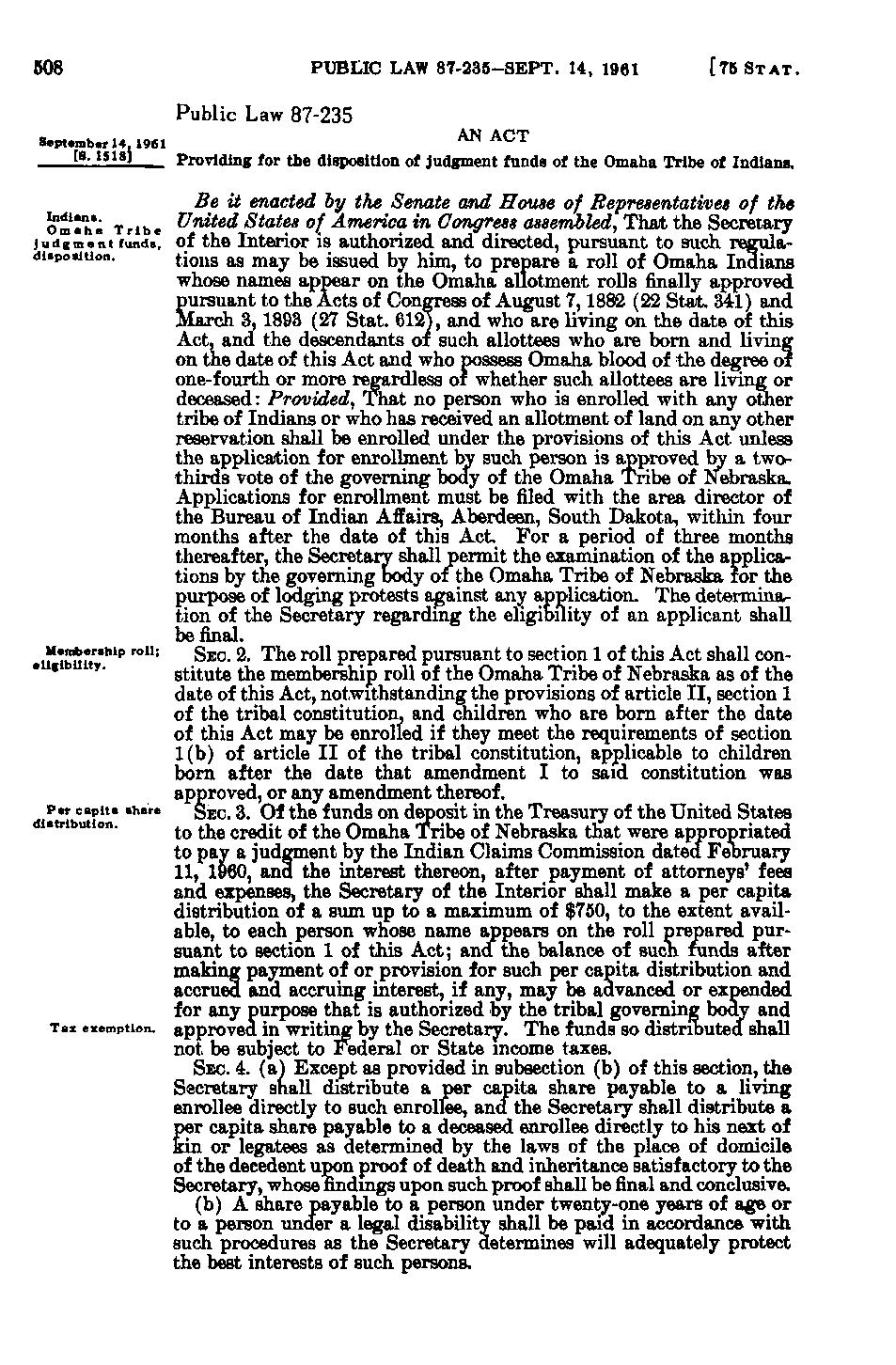

PUBLIC LAW 87-235-SEPT. 14, 1961

[75

ST A T.

Public Law 87-235 September 14 1961

^^- ^^^^J Indians. Omaha Tribe j u d g m e n t funds, disposition.

Mend>ership roll; eligibility.

Per capita share distribution.

Tax exemption.

^^

^^'^

Providing for the disposition of judgment funds of the Omaha Tribe of Indians.

Be it enacted by the Senate and Hotcse of Representatives of the United States of America in Congress assembled, That the Secretary of the Interior is authorized and directed, pursuant to such regulations as may be issued by him, to prepare a roll of Omaha Indians whose names appear on the Omaha allotment rolls finally approved pursuant to the Acts of Congress of August 7, 1882 (22 Stat. 341) and March 3, 1893 (27 Stat. 612], and who are living on the date of this Act, and the descendants oi such allottees who are born and living on the date of this Act and who possess Omaha blood of the decree or one-fourth or more regardless of whether such allottees are living or deceased: Provided, That no person who is enroUwi with any other tribe of Indians or who has received an allotment of land on any other reservation shall be enrolled under the provisions of this Act unless the application for enrollment by such person is approved W a twothirds vote of the governing body of the Omaha Tribe of Nebraskapplications for enrollment must be filed with the area director of the Bureau of Indian Affairs, Aberdeen, South Dakota, within four months after the date of this Act. For a period of three months thereafter, the Secretary shall permit the examination of the applications by the governing body of the Omaha Tribe of Nebraska for the purpose of Icwiging protests against any application. The determination of the Secretary regarding the eligibility of an applicant shall be final. SEC. 2. The roll prepared pursuant to section 1 of this Act shall constitute the membership roll of the Omaha Tribe of Nebraska as of the date of this Act, notwithstanding the provisions of article II, section 1 of the tribal constitution, and children who are born after the date of this Act may be enrolled if they meet the requirements of section 1(b) of article II of the tribal constitution, applicable to children born after the date that amendment I to said constitution was approved, or any amendment thereof. SEC. 3. Of the funds on deposit in the Treasury of the United States to the credit of the Omaha Tribe of Nebraska that were appropriated to pav a judgment by the Indian Claims Commission dated February 11, 1960, and the interest thereon, after payment of attorneys' fees and expenses, the Secretary of the Interior shall make a per capita distribution of a sum up to a maximum of $750, to the extent available, to each person whose name appears on the roll prepared pursuant to section 1 of this Act; and the balance of such funds after making payment of or provision for such per capita distribution and accrued and accruing interest, if any, may be advanced or expended for any Durpose that is authorized by the tribal governing body and approved in writing by the Secretary. The funds so distributed shall not be subject to Federal or State income taxes. SEC. 4. (a) Except as provided in subsection (b) of this section, the Secretary shall distribute a per capita share payable to a living enrollee directly to such enrolfee, and the Secretary shall distribute a per capita share payable to a deceased enrollee directly to his next of kin or legatees as determined by the laws of the place of domicile of the decedent upon proof of death and inheritance satisfactory to the Secretary, whose findings upon such proof shall be final and conclusive. (b) A share payable to a person under twenty-one years of age or to a person under a legal disability shall be paid in accordance with such procedures as the Secretary aetermines will adequately protect the best interests of such persons.

�