552

Ante, p. 550,

26 ulc 97T* 84^s ^*^'o68^'

PUBLIC LAW 92-178-DEC. 10, 1971

[85 STAT.

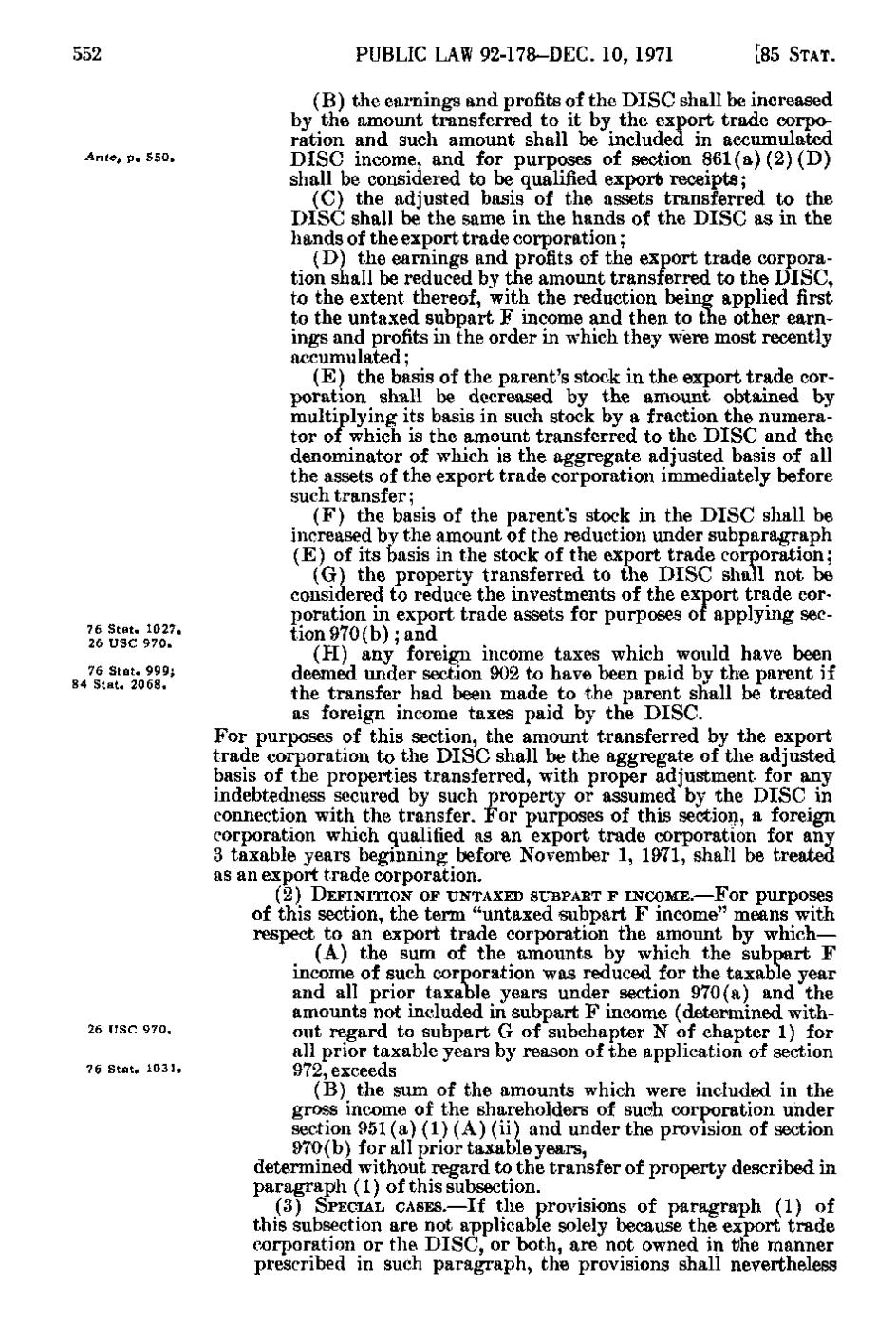

(B) the earnings and profits of the D I S C shall be increased by the amount transferred to it by the export trade corporation and such amount shall be included in accumulated D I S C iucome, and for purposes of section 8 6 1 (a)(2)(D) shall be considered to be qualified export receipts; (C) the adjusted basis of the assets transferred to the D I S C shall be the same in the hands of the D I S C as in the hands of the export trade corporation; (D) the earnings and profits of the export trade corporation shall be reduced by the amount transferred to the D I S C, to the extent thereof, with the reduction being applied first to the untaxed subpart F income and then to the other earnings and profits in the order in which they were most recently accumulated; (E) the basis of the parent's stock in the export trade corporation shall be decreased by the amount obtained by multiplying its basis in such stock by a fraction the numerator of which is the amount transferred to the D I S C and the denominator of which is the aggregate adjusted basis of all the assets of the export trade corporation immediately before such transfer; (F) the basis of the parent's stock in the D I S C shall be increased by the amount of the reduction under subparagraph (E) of its basis in the stock of the export trade corporation; (G) the property transferred to the D I S C shall not be considered to reduce the investments of the export trade corporation in export trade assets for purposes of applying secti«n 970 (b); and (H) any foreign income taxes which would have been deemed under section 902 to have been paid by the parent if the transfer had been made to the parent shall be treated as foreign income taxes paid by the DISC. For purposes of this section, the amount transferred by the export trade corporation to the D I S C shall be the aggregate of the adjusted basis of the properties transferred, with proper adjustment for any indebtedness secured by such property or assumed by the D I S C in connection with the transfer. For purposes of this section, a foreign corporation which qualified as an export trade corporation for any 3 taxable years beginning before November 1, 1971, shall be treated as an export trade corporation. (2) DEFINITION OF UNTAXED SUBPART F INCOME.—For purposes

26 USC 970. 76 Stat. 1031.

of this section, the term "untaxed subpart F income" means with respect to an export trade corporation the amount by which— (A) the sum of the amounts by which the subpart F income of such corporation was reduced for the taxable year and all prior taxable years under section 970(a) and the amounts not included in subpart F income (determined without regard to subpart G of subchapter N of chapter 1) for all prior taxable years by reason of the application of section 972, exceeds (B) the sum of the amounts which were included in the gross income of the shareholders of such corporation under section 951(a)(1)(A) (ii) and under the provision of section 970(b) for all prior taxable years, determined without regard to the transfer of property described in paragraph (1) of this subsection. (3) SPECIAL CASES.—If the provisions of paragraph (1) of this subsection are not applicable solely because the export trade corporation or the D I S C, or both, are not owned in the manner prescribed in such paragraph, the provisions shall nevertheless

�