PUBLIC LAW 95-521—OCT. 26, 1978

92 STAT. 1855

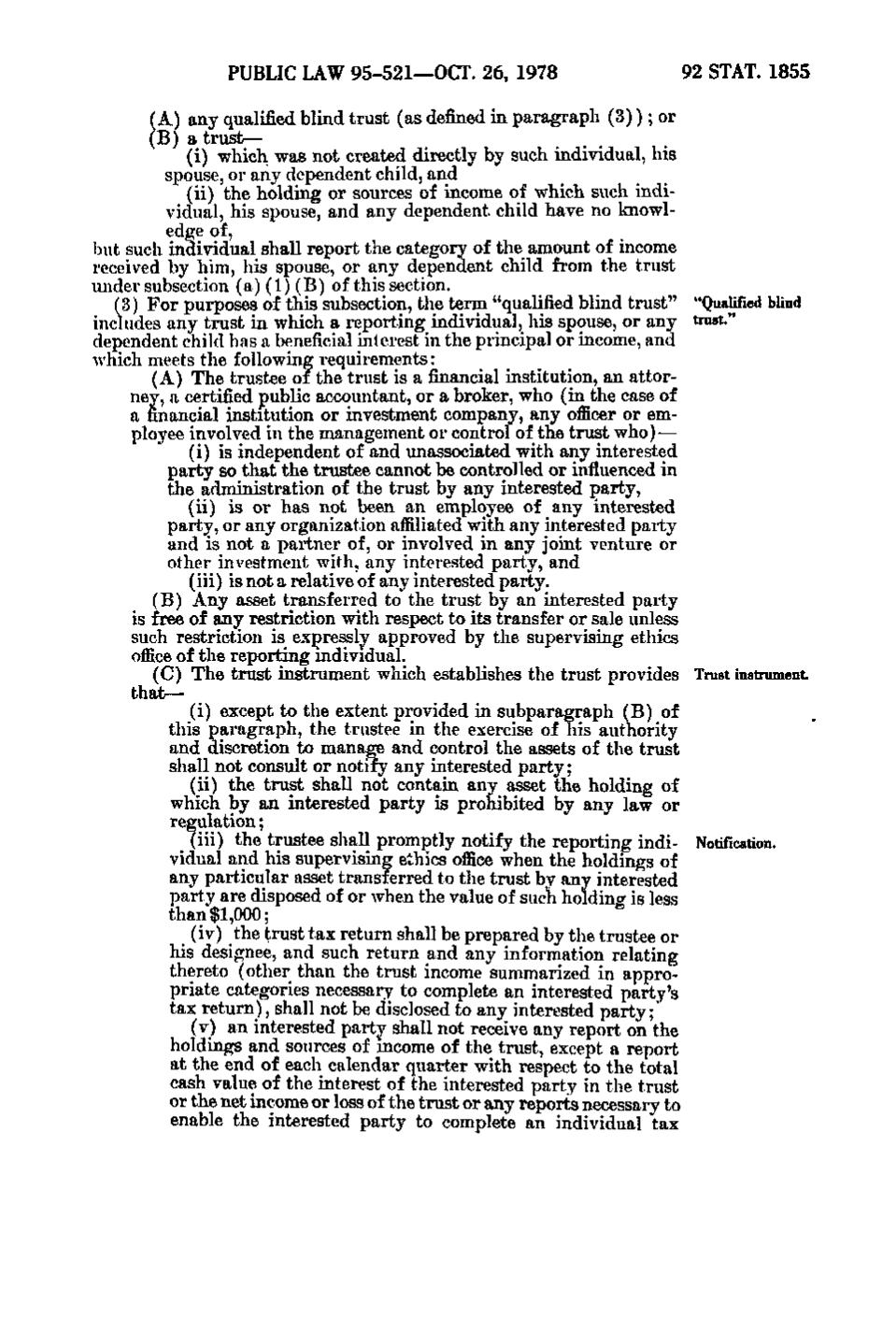

(A) any qualified blind trust (as defined in paragraph (3)); or (B) a trust— (i) which was not created directly by such individual, his spouse, or any dependent child, and (ii) the holding or sources of income of which such individual, his spouse, and any dependent child have no knowledge of, but such individual shall report the category of the amount of income received by him, his spouse, or any dependent child from the trust under subsection (a)(1)(B) of this section. (3) For purposes of this subsection, the term "qualified blind trust" "Qualified blind includes any trust in which a reporting individual, his spouse, or any trust." dependent child has a beneficial interest in the principal or income, and which meets the following requirements: (A) The trustee of the trust is a financial institution, an attorney, a certified public accountant, or a broker, who (in the case of a financial institution or investment company, any officer or employee involved in the management or control of the trust who) — (i) is independent of and unassociated with any interested party so that the trustee cannot be controlled or influenced in the administration of the trust by any interested party, (ii) is or has not been an employee of any interested party, or any organization affiliated with any interested party and is not a partner of, or involved in any joint venture or other investment with, any interested party, and (iii) is not a relative of any interested party. (B) Any asset transferred to the trust by an interested party is free of any restriction with respect to its transfer or sale unless such restriction is expressly approved by the supervising ethics office of the reporting individual. (C) The trust instrument which establishes the trust provides Trust instrument that— (i) except to the extent provided in subparagraph (B) of this paragraph, the trustee in the exercise of his authority and discretion to manage and control the assets of the trust shall not consult or notify any interested party; (ii) the trust shall not contain any asset the holding of which by an interested party is prohibited by any law or regulation; (iii) the trustee shall promptly notify the reporting indi- Notification, vidual and his supervising ethics office when the holdings of any particular asset transferred to the trust by any interested party are disposed of or when the value of such holding is less than $1,000; (iv) the trust tax return shall be prepared by the trustee or his designee, and such return and any information relating thereto (other than the trust income summarized in appropriate categories necessary to complete an interested party's tax return), shall not be disclosed to any interested party; (v) an interested part^ shall not receive any report on the holdings and sources of income of the trust, except a report at the end of each calendar quarter with respect to the total cash value of the interest of the interested party in the trust or the net income or loss of the trust or any reports necessary to enable the interested party to complete an individual tax

�