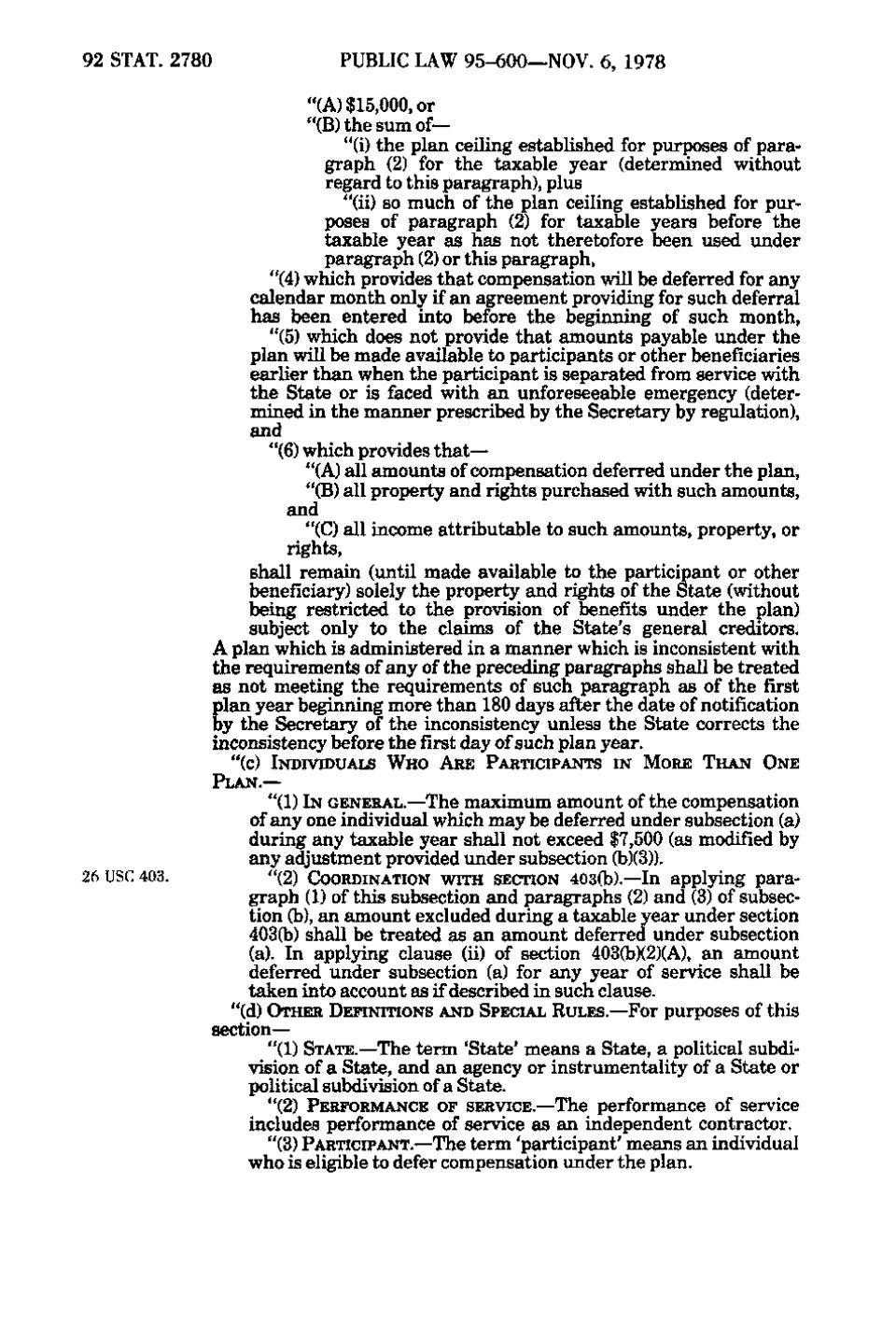

92 STAT. 2780 i,

PUBLIC LAW 95-600—NOV. 6, 1978 "(A) $15,000, or "(B) the sum of— "(i) the plan ceiHng established for purposes of paragraph (2) for the taxable year (determined without regard to this paragraph), plus "(ii) so much of the plan ceiling established for purposes of paragraph (2) for taxable years before the taxable year as has not theretofore been used under paragraph (2) or this paragraph, "(4) which provides that compensation will be deferred for any calendar month only if an agreement providing for such deferral has been entered into before the beginning of such month, "(5) which does not provide that amounts payable under the plan will be made available to participants or other beneficiaries earlier than when the participant is separated from service with the State or is faced with an unforeseeable emergency (determined in the manner prescribed by the Secretary by regulation), and "(6) which provides that— "(A) all amounts of compensation deferred under the plan, "(B) all property and rights purchased with such amounts, and "(C) all income attributable to such amounts, property, or rights, shall remain (until made available to the participant or other beneficiary) solely the property and rights of the State (without being restricted to the provision of benefits under the plan) subject only to the claims of the State's general creditors. A plan which is administered in a manner which is inconsistent with the requirements of any of the preceding paragraphs shall be treated as not meeting the requirements of such paragraph as of the first plan year beginning more than 180 days after the date of notification by the Secretary of the inconsistency unless the State corrects the inconsistency before the first day of such plan year. "(c) INDIVIDUALS WHO ARE PARTICIPANTS IN MORE THAN O N E PLAN.—

26 USC 403.

"(1) IN GENERAL.—The maximum amount of the compensation of any one individual which may be deferred under subsection (a) during any taxable year shall not exceed $7,500 (as modified by any adjustment provided under subsection (b)(3)). "(2) COORDINATION WITH SECTION 403(b).—In applying paragraph (1) of this subsection and paragraphs (2) and (3) of subsection (b), an amount excluded during a taxable year under section 403(b) shall be treated as an amount deferred under subsection (a). In applying clause (ii) of section 403(b)(2)(A), an amount deferred under subsection (a) for any year of service shall be taken into account as if described in such clause. "(d) OTHER DEFINITIONS AND SPECIAL RULES.—For purposes of this section— "(1) STATE.—The term 'State' means a State, a political subdivision of a State, and an agency or instrumentality of a State or political subdivision of a State. "(2) PERFORMANCE OF SERVICE.—The performance of service

includes performance of service as an independent contractor. "(3) PARTICIPANT.—The term 'participant' means an individual who is eligible to defer compensation under the plan.

�