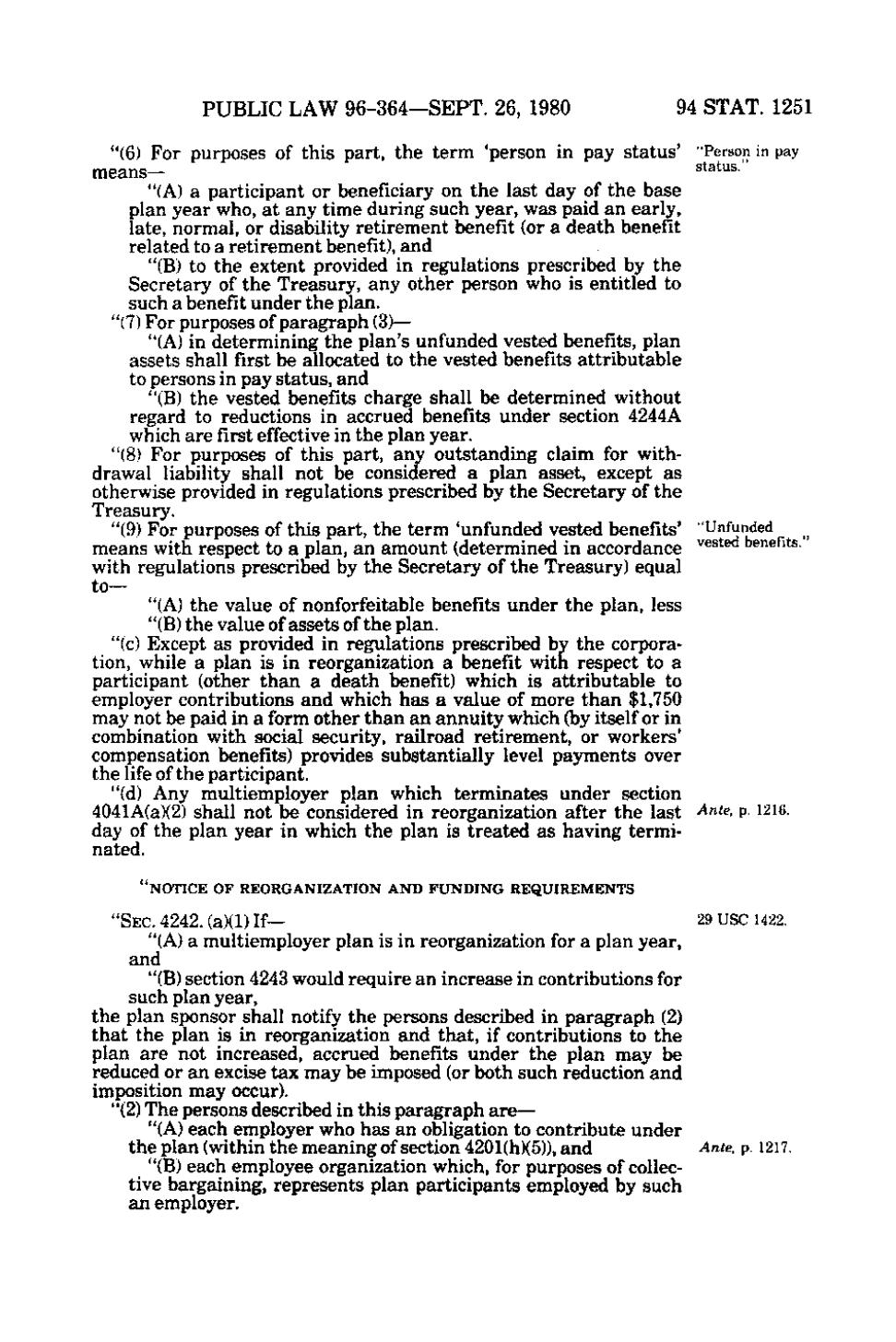

PUBLIC LAW 96-364—SEPT. 26, 1980

94 STAT. 1251

"(6) For purposes of this part, the term 'person in pay status' "Person in pay means— status." "(A) a participant or beneficiary on the last day of the base plan year who, at any time during such year, was paid an early, late, normal, or disability retirement benefit (or a death benefit related to a retirement benefit), and "(B) to the extent provided in regulations prescribed by the Secretary of the Treasury, any other person who is entitled to such a benefit under the plan. "(7) For purposes of paragraph (3)— "(A) in determining the plan's unfunded vested benefits, plan assets shall first be allocated to the vested benefits attributable to persons in pay status, and "(B) the vested benefits charge shall be determined without regard to reductions in accrued benefits under section 4244A which are first effective in the plan year. '" "(8) For purposes of this part, any outstanding claim for withdrawal liability shall not be considered a plan asset, except as otherwise provided in regulations prescribed by the Secretary of the Treasury. "(9) For purposes of this part, the term 'unfunded vested benefits' "Unfunded means with respect to a plan, an amount (determined in accordance vested benefits. with regulations prescribed by the Secretary of the Treasury) equal to— "(A) the value of nonforfeitable benefits under the plan, less ' '(B) the value of assets of the plan. "(c) Except as provided in regulations prescribed by the corporation, while a plan is in reorganization a benefit with respect to a participant (other than a death benefit) which is attributable to employer contributions and which has a value of more than $1,750 may not be paid in a form other than an annuity which Oay itself or in combination with social security, railroad retirement, or workers' compensation benefits) provides substantially level payments over the life of the participant. "(d) Any multiemployer plan which terminates under section 4041A(a)(2) shall not be considered in reorganization after the last ^«<e, p. 1216. day of the plan year in which the plan is treated as having terminated. NOTICE OF REORGANIZATION AND FUNDING REQUIREMENTS

"SEC. 4242. (a)(1) If— 29 USC 1422. "(A) a multiemployer plan is in reorganization for a plan year, and "(B) section 4243 would require an increase in contributions for such plan year, the plan sponsor shall notify the persons described in paragraph (2) that the plan is in reorganization and that, if contributions to the plan are not increased, accrued benefits under the plan may be reduced or an excise tax may be imposed (or both such reduction and imposition may occur). "(2) The persons described in this paragraph are— "(A) each employer who has an obligation to contribute under the plan (within the meaning of section 4201(h)(5)), and Ante, p. 1217. "(B) each employee organization which, for purposes of collective bargaining, represents plan participants employed by such an employer.

�