94 STAT. 908

26 USC 501.

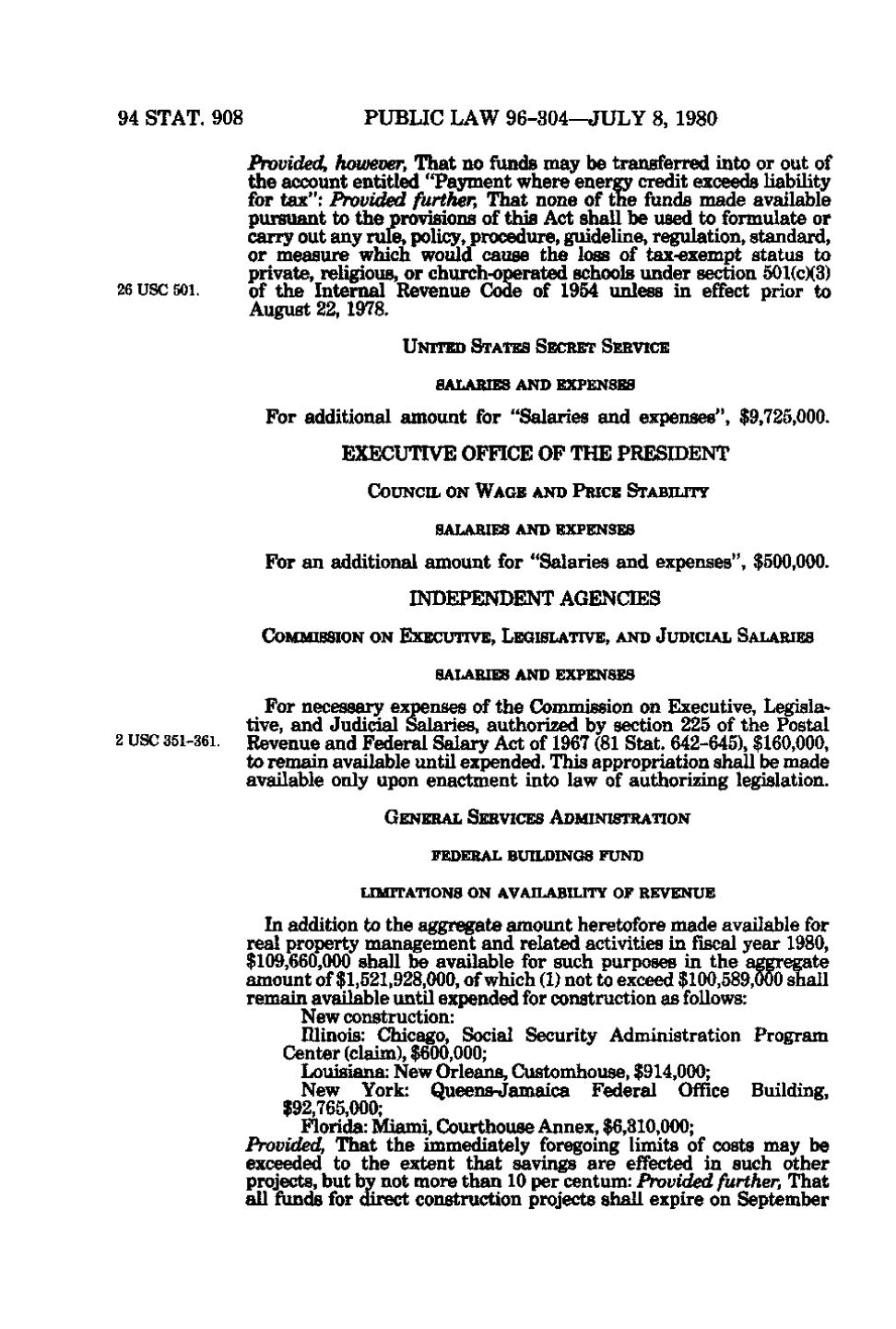

PUBLIC LAW 96-304—JULY 8, 1980 Provided, however. That no funds may be transferred into or out of the account entitled "Payment where energy credit exceeds liability for tax": Provided further. That none of the funds made available pursuant to the provisions of this Act shall be used to formulate or carry out any rule, policy, procedure, guideline, regulation, standard, or measure which would cause the loss of tax-exempt status to private, religious, or church-operated schools under section 501(c)(3) of the Internal Revenue Code of 1954 unless in effect prior to August 22, 1978. UNITED STATES SECRET SERVICE SALARIES AND EXPENSES

For additional amount for "Salaries and expenses", $9,725,000. EXECUTIVE OFFICE OF THE PRESIDENT COUNCIL ON WAGE AND PRICE STABILITY SALARIES AND EXPENSES

For an additional amount for "Salaries and expenses", $500,000. INDEPENDENT AGENCIES COMMISSION ON EXECUTIVE, LEGISLATIVE, AND JUDICIAL SALARIES SALARIES AND EXPENSES

For necessary expenses of the Commission on Executive, Legislative, and Judicial Salaries, authorized by section 225 of the Postal 2 USC 351-361. Revenue and Federal Salary Act of 1967 (81 Stat. 642-645), $160,000, to remain available until expended. This appropriation shall be made available only upon enactment into law of authorizing legislation. GENERAL SERVICES ADMINISTRATION FEDERAL BUILDINGS FUND LIMITATIONS O N AVAILABILITY OF REVENUE

In addition to the aggregate amount heretofore made available for real property management and related activities in fiscal year 1980, $109,660,000 shall be available for such purposes in the aggregate amount of $1,521,928,000, of which (1) not to exceed $100,589,000 shall remain available until expended for construction as follows: New construction: Illinois: Chicago, Social Security Administration Program Center (claim), $600,000; Louisiana: New Orleans, Customhouse, $914,000; New York: Queens-Jamedca Federal Office Building, $92,765,000; Florida: Miami, Courthouse Annex, $6,310,000; Provided, That the immediately foregoing limits of costs may be exceeded to the extent that savings are effected in such other projects, but by not more than 10 per centum: Provided further. That all funds for direct construction projects shall expire on September

�