96 STAT. 904

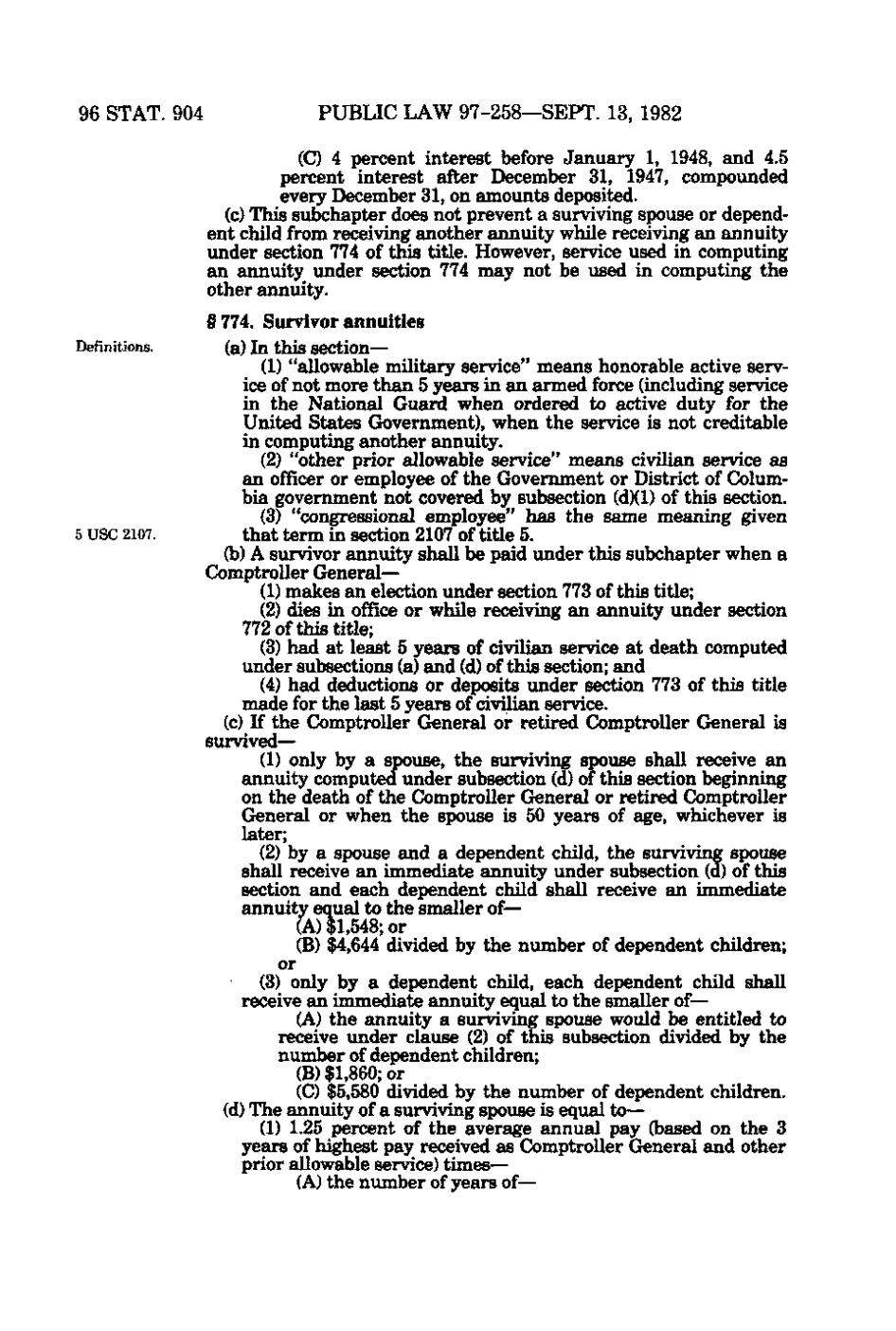

PUBLIC LAW 97-258—SEPT. 13, 1982 (C) 4 percent interest before January 1, 1948, and 4.5 percent interest after December 31, 1947, compounded every December 31, on amounts deposited, (c) This subchapter does not prevent a surviving spouse or dependent child from receiving another annuity while receiving an annuity under section 774 of this title. However, service used in computing an annuity under section 774 may not be used in computing the other annuity.

Definitions.

5 USC 2107.

§774. Survivor annuities (a) In this section— (1) "allowable military service" means honorable active service of not more than 5 years in an armed force (including service in the National Guard when ordered to active duty for the United States Government), when the service is not creditable in computing another annuity. (2) "other prior sillowable service" means civilian service as an officer or employee of the Government or District of Columbia government not covered by subsection (d)(1) of this section. (3) "congressional employee" has the same meaning given that term in section 2107 of title 5. (jo) A survivor annuity shall be paid under this subchapter when a Comptroller General— (1) makes an election under section 773 of this title; (2) dies in office or while receiving an annuity under section 772 of this title; (3) had at least 5 years of civilian service at death computed under subsections (a) and (d) of this section; and (4) had deductions or deposits under section 773 of this title made for the last 5 years of civilian service. (c) If the Comptroller General or retired Comptroller General is survived— (1) only by a spouse, the surviving spouse shall receive an annuity computed under subsection (d) of this section beginning on the death of the Comptroller General or retired Comptroller General or when the spouse is 50 years of age, whichever is later; (2) by a spouse and a dependent child, the surviving spouse shall receive an immediate annuity under subsection (d) of this section and each dependent child shall receive an immediate annuity equal to the smaller of— (A) $1,548; or (B) $4,644 divided by the number of dependent children; or (3) only by a dependent child, each dependent child shall receive an immediate annuity equal to the smaller of—(A) the annuity a surviving spouse would be entitled to receive under clause (2) of this subsection divided by the number of dependent children; (B) $1,860; or (C) $5,580 divided by the number of dependent children. (d) The annuity of a surviving spouse is equal to— (1) 1.25 percent of the average annual pay (based on the 3 years of highest pay received as Comptroller General and other prior allowable service) times— (A) the number of years of—

�