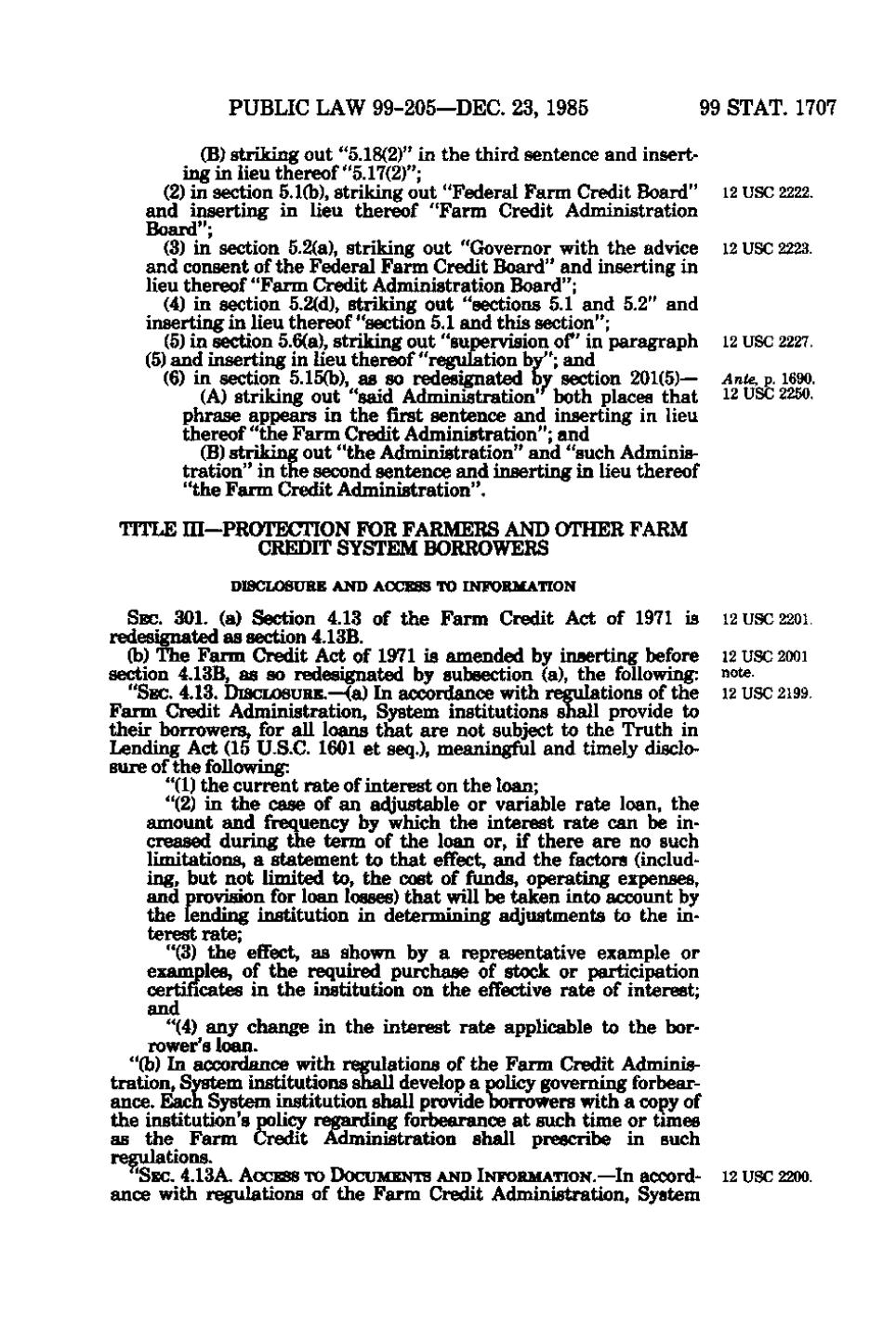

PUBLIC LAW 99-205—DEC. 23, 1985 (B) striking out "5.18(2)" in the third sentence and inserting in lieu thereof "5.17(2)"; (2) in section 5.1(b), striking out "Federal Farm Credit Board" and inserting in lieu thereof "Farm Credit Administration Board"; (3) in section 5.2(a), striking out "Governor with the advice and consent of the Federal Farm Credit Board" and inserting in lieu thereof "Farm Credit Administration Board"; (4) in section 5.2(d), striking out "sections 5.1 and 5.2" and inserting in lieu thereof "section 5.1 and this section"; (5) in section 5.6(a), striking out "supervision o f in paragraph (5) and inserting in lieu thereof "regulation by"; and (6) in section 5.15(b), as so redesignated by section 201(5)— (A) striking out "said Administration both places that phrase appears in the first sentence and inserting in lieu thereof "the Farm Credit Administration"; and (B) striking out "the Administration" and "such Administration" in the second sentence and inserting in lieu thereof "the Farm Credit Administration".

99 STAT. 1707

12 USC 2222. 12 USC 2223.

12 USC 2227. Ante, p. 1690. 12 USC 2250.

- r

TITLE m—PROTECTION FOR FARMERS AND OTHER FARM CREDIT SYSTEM BORROWERS DISCLOSURE AND ACCESS TO INFORMATION

SEC. 301. (a) Section 4.13 of the Farm Credit Act of 1971 is 12 USC 2201. redesignated as section 4.13B. (b) The Farm Credit Act of 1971 is amended by inserting before 12 USC 2001 section 4.13B, as so redesignated by subsection (a), the following: note. "SEC. 4.13. DiscLOSURE.-;-(a) In accordance with r^ulations of the 12 USC 2199. Farm Credit Administration, System institutions shall provide to their borrowers, for all loans that are not subject to the Truth in Lending Act (15 US.C. 1601 et seq.), meaningful and timely disclosure of the following: "(1) the current rate of interest on the loan; "(2) in the case of an adjustable or variable rate loan, the ftii amount and frequency by which the interest rate can be increased during the term of the loan or, if there are no such limitations, a statement to that effect, and the factors (including, but not limited to, the cost of funds, operating expenses, and provision for loan losses) that will be taken into account by the lending institution in determining adjustments to the interest rate; "(3) the effect, as shown by a representative example or examples, of the required purchase of stock or participation certificates in the institution on the effective rate of interest; and "(4) any change in the interest rate applicable to the borrower's loan. "(b) In accordance with r^ulations of the Farm Credit Administration, System institutions shall develop a policy governing forbearance. Each System institution shall provide borrowers with a copy of the institution's policy r ^ a r d i n g forbearance at such time or times as the Farm Credit Administration shall prescribe in such regulations. "SEC. 4.13A. ACCESS TO DOCUMENTS AND INFORMATION.—In accord- 12 USC 2200 ance with r^ulations of the Farm Credit Administration, System

�