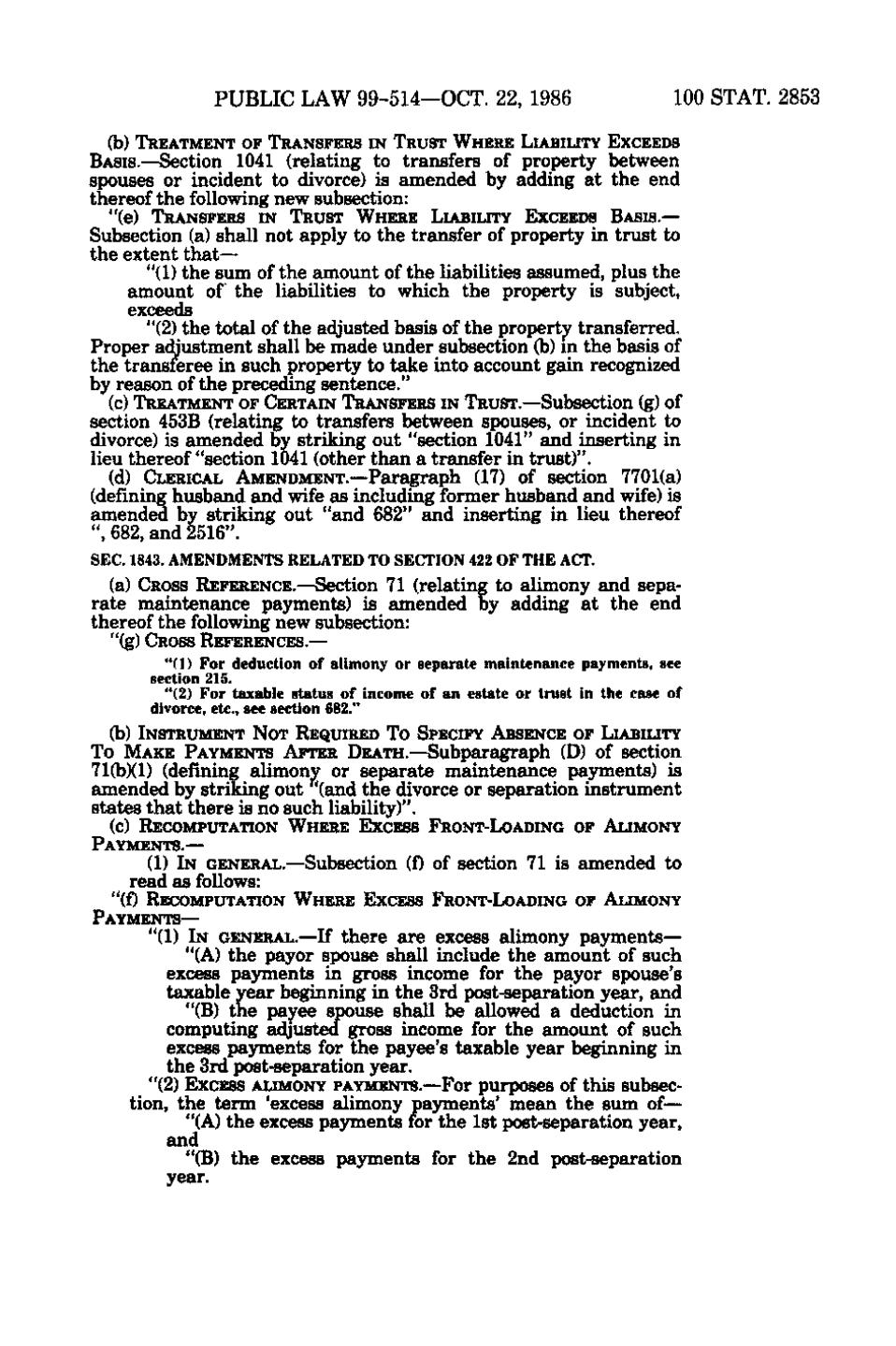

PUBLIC LAW 99-514—OCT. 22, 1986

100 STAT. 2853

(b) TREATMENT OF TRANSFERS IN TRUST WHERE LIABILITY EXCEEDS

BASIS.—Section 1041 (relating to transfers of property between spouses or incident to divorce) is amended by adding at the end thereof the following new subsection: "(e) TRANSFERS IN TRUST WHERE LIABILITY EXCEEDS BASIS.—

Subsection (a) shall not apply to the transfer of property in trust to the extent that— "(1) the sum of the amount of the liabilities assumed, plus the amount of the liabilities to which the property is subject, exceeds "(2) the total of the adjusted basis of the property transferred. Proper adjustment shall be made under subsection (b) in the basis of the transferee in such property to take into account gain recognized by reason of the preceding sentence." (c) TREATMENT OF CERTAIN TRANSFERS IN TRUST.—Subsection (g) of

section 453B (relating to transfers between spouses, or incident to divorce) is amended by striking out "section 1041" and inserting in lieu thereof "section 1041 (other than a transfer in trust)". (d) CLERICAL AMENDMENT.—Paragraph (17) of section 7701(a) (defining husband and wife as including former husband and wife) is amended by striking out "and 682" and inserting in lieu thereof ", 682, and 2516". SEC. 1843. AMENDMENTS RELATED TO SECTION 422 OF THE ACT.

(a) CROSS REFERENCE.—Section 71 (relating to alimony and separate maintenance payments) is amended by adding at the end thereof the following new subsection: "(g) CROSS REFERENCES.— "(1) For deduction of alimony or separate maintenance payments, see section 215. "(2) For taxable status of income of an estate or trust in the case of divorce, etc., see section 682." (b) INSTRUMENT NOT REQUIRED TO SPECIFY ABSENCE OF LIABILITY To MAKE PAYMENTS AFTER DEATH.—Subparagraph (D) of section

710t))(l) (defining alimony or separate maintenance payments) is amended by striking out (and the divorce or separation instrument states that there is no such liability)". (c) RECOMPUTATION WHERE EXCESS FRONT-LOADING OF ALIMONY PAYMENTS.—

(1) IN GENERAL.—Subsection (f) of section 71 is amended to read as follows: "(f) RECOMPUTATION WHERE EXCESS FRONT-LOADING OF AUMONY PAYMENTS—

"(1) IN GENERAL.—If there are excess alimony payments— "(A) the payor spouse shall include the amount of such excess payments in gross income for the payor spouse's taxable year beginning in the 3rd post-separation year, and "(B) the payee spouse shall be allowed a deduction in computing adjusted gross income for the amount of such excess payments for the payee's taxable year beginning in the 3rd post-separation year. "(2) EXCESS AUMONY PAYMENTS.—For purposes of this subsection, the term 'excess alimony payments' mean the sum of— "(A) the excess payments for the 1st post-separation year, and "(B) the excess payments for the 2nd post-separation year.

�