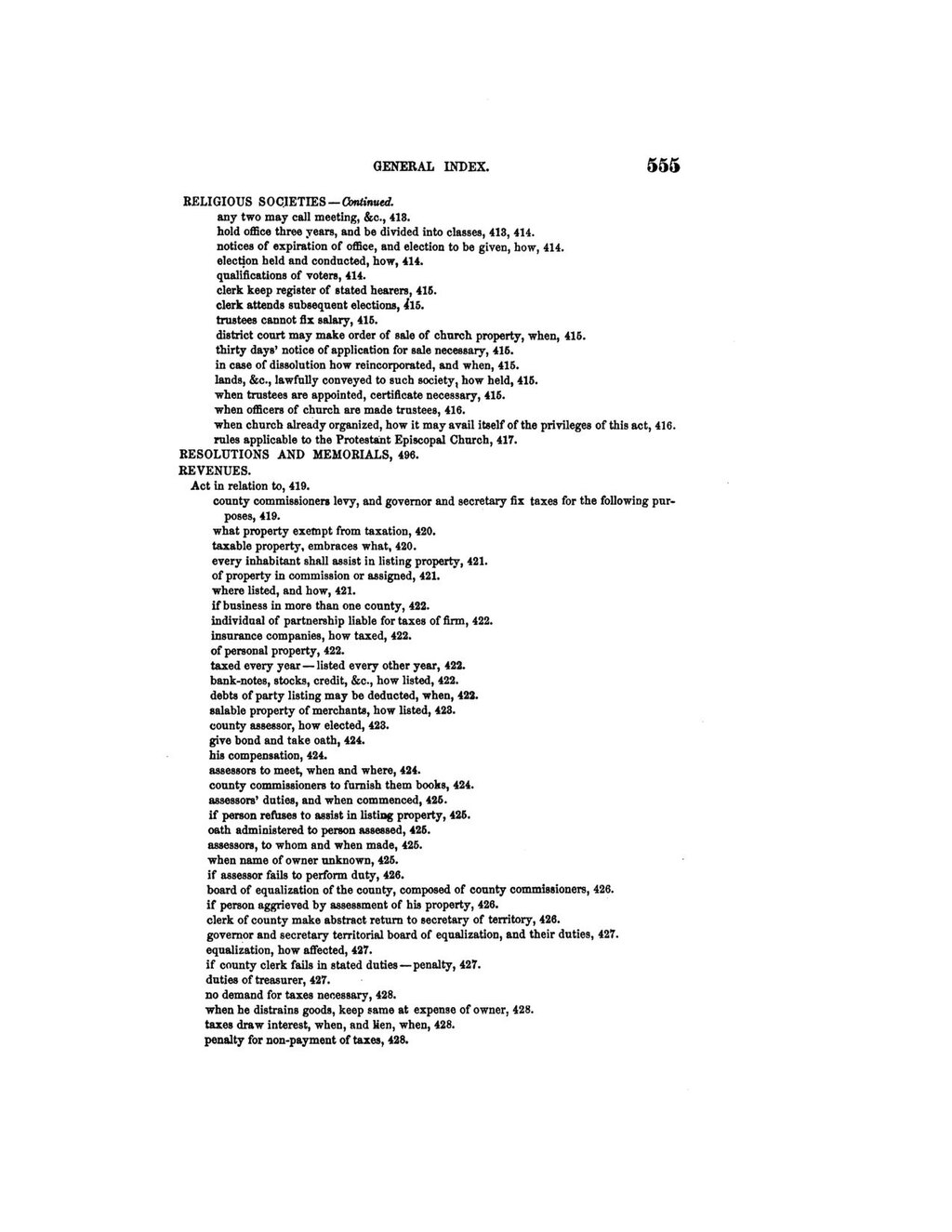

GENERAL INDEX. 555 lands, 40W, 421. RELIGIOUS SOCIETIES - Continued. any two may call meeting, &c., 418. hold office three years, and be divided into classes, 413, 414. notices of expiration of office, and election to be given, how, 414. electỉon held and conducted, how, 414. qualifications of clerk keep register of stated hearers, 416. clerk attends subsequent elections, 115. district court may make order of sale of church property, when, 416. Sairty days' notice of in case of dissolution how reincorporated, and when, 415. &c., , lawfully conveyed to such society, how held, 416. when trustees are appointed, certificate necessary, 415. when officers of church are made trustees, 416. when church already organized, how it may avail itself of the privileges of this act, 416. rules applicable to the Protestant Episcopal Church, 417. RESOLUTIONS AND MEMORIALS, 496. REVENUES. Act in relation to, 419. county commissioners lovy, and governor and secretary fix taxes for the following pur- poses, 419. what property exempt from taxation, 420. taxable property, embraces what, 420. every inhabitant shall assist in listing property, 121. of property in commission or assigned, 421. where listed, , and how, if business in more than one county, 422. individual of partnership liable for taxes of firm, 422. insurance companies, how taxed, 422. of personal property, 422. - listed every other year, 422. bank-notes, stocks, credit, &c., how listed, 422. debts of party listing may be deducted, when, 422. salable property of merchants, how listed, 428. county assessor, how elected, 423. give bond and take oath, 424. his compensation, 424. Assessors to meet, when and where, 424. county commissioners to furnish them books, 424. Assessors' duties, and when commenced, 426. if person refuses to assist in listing property, 426. oath administered to person assessed, 125. assessors, to whom and when made, 425. when name of owner unknown, 425. if assessor fails to perform duty, 426. board of equalization of the of the county, composed of county commissioners, 426. if person aggrieved by assessment of his property, 426. clerk of county make abstract return to secretary of territory, 426. and secretary territorial board of equalization, and their duties, 427. equalization, how affected, 427. if county clerk fails in stated duties - penalty, 427. duties of treasurer, 427. no demand for taxes necessary, 428. when he distrains goods, keep same at expense of owner, 428. taxes draw interest, when, and lien, when, 428. penalty for non-payment of taxes, 428. taxed every: governor