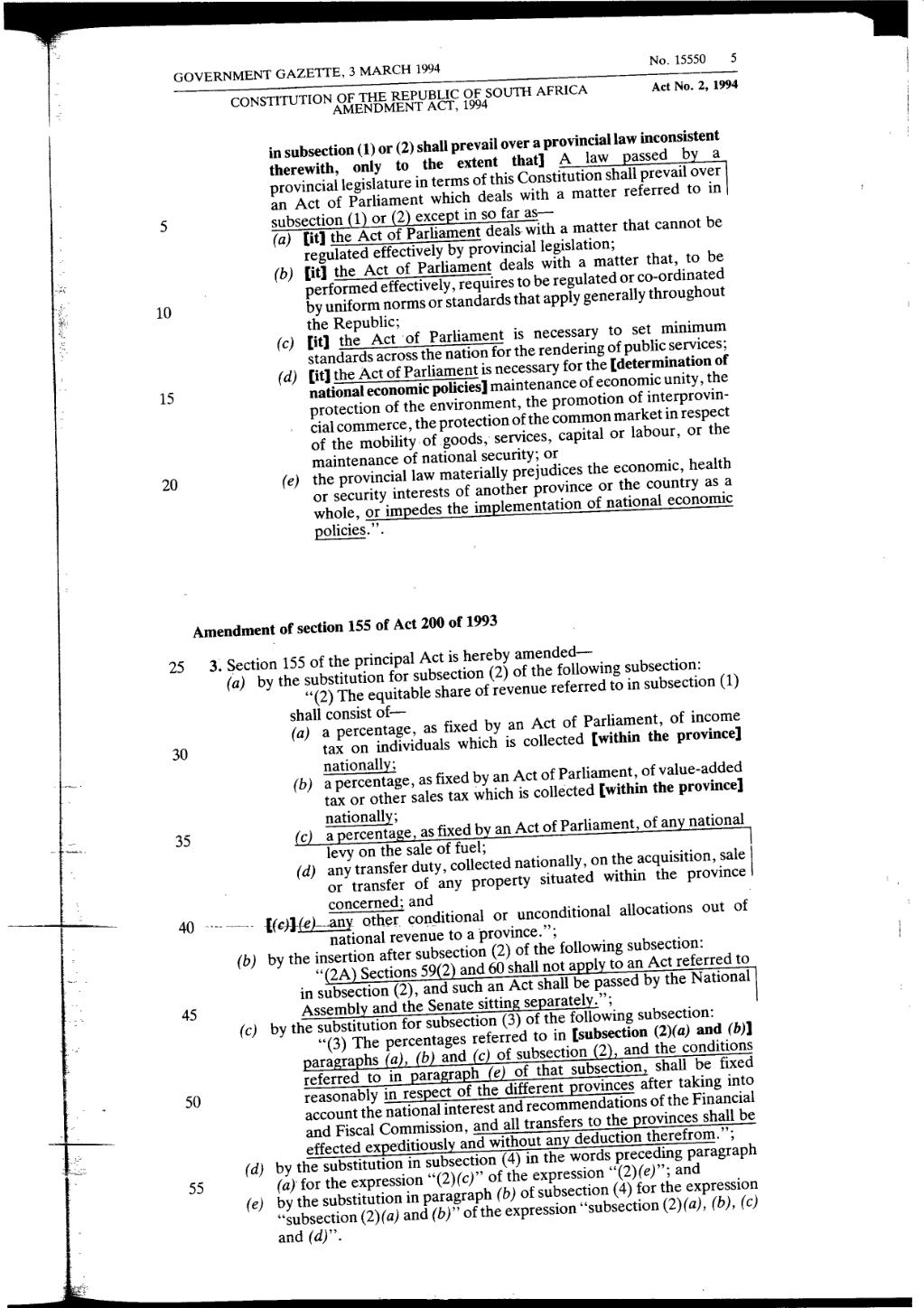

| Constitution of the Republic of South Africa Amendment Act, 1994 | Act No. 2, 1994 |

in subsection (1) or (2) shall prevail over a provincial law inconsistent therewith, only to the extent that] A law passed by a provincial legislature in terms of this Constitution shall prevail over an Act of Parliament which deals with a matter referred to in subsection (1) or (2) except in so far as—

(a)

[it] the Act of Parliament deals with a matter that cannot be regulated effectively by provincial legislation;(b)

[it] the Act of Parliament deals with a matter that, to be performed effectively, requires to be regulated or co-ordinated by uniform norms or standards that apply generally throughout the Republic;(c)

[it] the Act of Parliament is necessary to set minimum standards across the nation for the rendering of public services;(d)

[it] the Act of Parliament is necessary for the [determination of national economic policies] maintenance of economic unity, the protection of the environment, the promotion of interprovincial commerce, the protection of the common market in respect of the mobility of goods, services, capital or labour, or the maintenance of national security; or(e)

the provincial law materially prejudices the economic, health or security interests of another province or the country as a whole, or impedes the implementation of national economic policies.”.

Amendment of section 155 of Act 200 of 1993

3. Section 155 of the principal Act is hereby amended—

(a)

by the substitution for subsection (2) of the following subsection:“(2) The equitable share of revenue referred to in subsection (1) shall consist of—

(a)

a percentage, as fixed by an Act of Parliament, of income tax on individuals which is collected [within the province] nationally;(b)

a percentage, as fixed by an Act of Parliament, of value-added tax or other sales tax which is collected [within the province] nationally;(c)

a percentage, as fixed by an Act of Parliament, of any national levy on the sale of fuel;(d)

any transfer duty, collected nationally, on the acquisition, sale or transfer of any property situated within the province concerned; and[(c)](e)

any other conditional or unconditional allocations out of national revenue to a province.”;(b)

by the insertion after subsection (2) of the following subsection:“(2A) Sections 59(2) and 60 shall not apply to an Act referred to in subsection (2), and such an Act shall be passed by the National Assembly and the Senate sitting separately.”;

(c)

by the substitution for subsection (3) of the following subsection:“(3) The percentages referred to in [subsection (2)(a) and (b)] paragraphs (a), (b) and (c) of subsection (2), and the conditions referred to in paragraph (e) of that subsection, shall be fixed reasonably in respect of the different provinces after taking into account the national interest and recommendations of the Financial and Fiscal Commission, and all transfers to the provinces shall be effected expeditiously and without any deduction therefrom.”;

(d)

by the substitution in subsection (4) in the words preceding paragraph (a) for the expression “(2)(c)” of the expression “(2)(e)”; and(e)

by the substitution in paragraph (b) of subsection (4) for the expression “subsection (2)(a) and (b)” of the expression “subsection (2)(a), (b), (c) and (d)”.