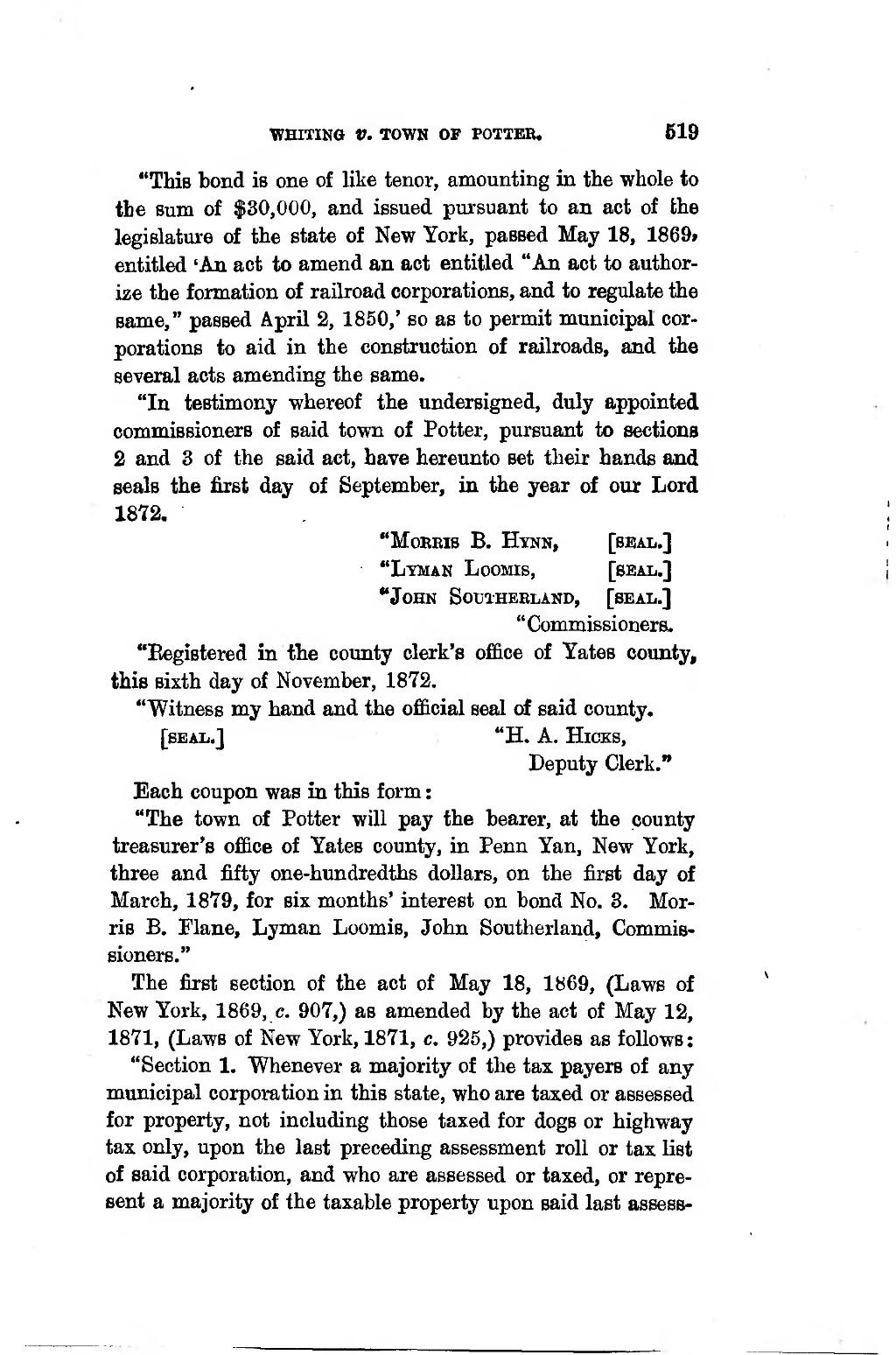

WHITING V. TOWN OP POTTER. 519 �"This bond is one of like tenor, amounting in the whole to the sum of $30,000, and issued pursuant to an act of lihe legislature of the etate of New York, passed May 18, 1869» entitled 'An act to amend an act entitled "An act to author- ize the formation of railroad corporations, and to regulate the same," passed April 2, 1850,' so as to permit municipal cor- porations to aid in the construction of railroads, and the several acts amending the same. �"In testimony whereof the undersigned, duly appointed commissioners of said town of Potter, pursuant to sections 2 and 3 of the said act, bave hereunto set their hands and seals the first day of September, in the year of our Lord 1872. �"Morris B. Hynn, [seal.] �"Lyman Loomis, [beau.] �"John Souiherland, [seal.] �"Commissioners. �"Eegistered in the county clerk's office of Yates county, �this sixth day of November, 1872. �"Witness my hand and the officiai seal of said county. [seal.] "H. A. HioKs, �Deputy Clerk." Each coupon was in this form : �"The town of Potter will pay the bearer, at the county treasurer's office of Yates county, in Peun Yan, New York, three and fifty one-hundredths dollars, on the first day of March, 1879, for six months' interest on bond No. 3. Mor- ris B. Flane, Lyman Loomis, John Southerland, Commis- sioners." �The first section of the act of May 18, 1869, (Laws of New York, 1869, c. 907,) as amended by the act of May 12, 1871, (Laws of New York, 1871, e. 925,) provides as foUows: "Section 1. Whenever a majority of the tax payers of any municipal corporation in this state, who are taxed or assessed for property, not including those taxed for dogs or highway tax only, upon the last preceding assessment roll or tax list of said corporation, and who are assessed or taxed, or repre- sent a majority of the taxable property upon said last assess- ����