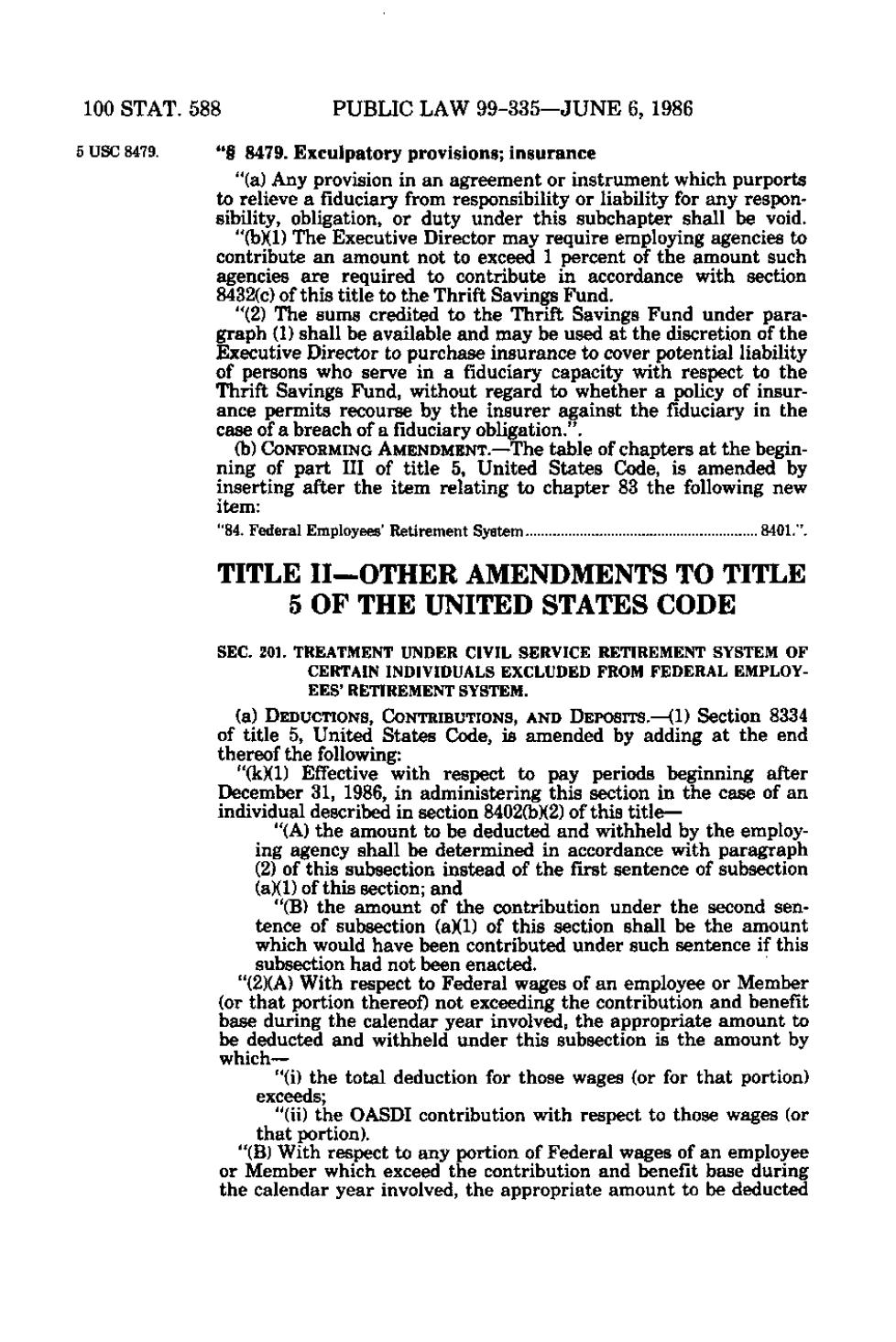

100 STAT. 588 5 USC 8479.

PUBLIC LAW 99-335—JUNE 6, 1986

"§ 8479. Exculpatory provisions; insurance "(a) Any provision in an agreement or instrument which purports to relieve a fiduciary from responsibility or liability for any responsibility, obligation, or duty under this subchapter shall be void. "(b)(1) The Executive Director may require employing agencies to contribute an amount not to exceed 1 percent of the amount such agencies are required to contribute in accordance with section 8432(c) of this title to the Thrift Savings Fund. "(2) The sums credited to the Thrift Savings Fund under paragraph (1) shall be available and may be used at the discretion of the Executive Director to purchase insurance to cover potential liability of persons who serve in a fiduciary capacity with respect to the Thrift Savings Fund, without regard to whether a policy of insurance permits recourse by the insurer against the fiduciary in the case of a breach of a fiduciary obligation.". (b) CONFORMING AMENDMENT.—The table of chapters at the beginning of part III of title 5, United States Code, is amended by inserting after the item relating to chapter 83 the following new item: "84. Federal Employees' Retirement System

8401.".

TITLE II—OTHER AMENDMENTS TO TITLE 5 OF THE UNITED STATES CODE SEC. 201. TREATMENT UNDER CIVIL SERVICE RETIREMENT SYSTEM OF CERTAIN INDIVIDUALS EXCLUDED FROM FEDERAL EMPLOYEES' RETIREMENT SYSTEM.

(a) DEDUCTIONS, CONTRIBUTIONS, AND DEPOSITS.—(1) Section 8334 of title 5, United States Code, is amended by adding at the end thereof the following: "(k)(l) Effective with respect to pay periods beginning after December 31, 1986, in administering this section in the case of an individual described in section 8402(b)(2) of this title— "(A) the amount to be deducted and withheld by the employing agency shall be determined in accordance with paragraph (2) of this subsection instead of the first sentence of subsection (a)(1) of this section; and "(B) the amount of the contribution under the second sentence of subsection (a)(1) of this section shall be the amount which would have been contributed under such sentence if this subsection had not been enacted. "(2)(A) With respect to Federal wages of an employee or Member (or that portion thereof) not exceeding the contribution and benefit base during the calendar year involved, the appropriate amount to be deducted and withheld under this subsection is the amount by which— "(i) the total deduction for those wages (or for that portion) exceeds; "(ii) the OASDI contribution with respect to those wages (or that portion). "(B) With respect to any portion of Federal wages of an employee or Member which exceed the contribution and benefit base during the calendar year involved, the appropriate amount to be deducted

�