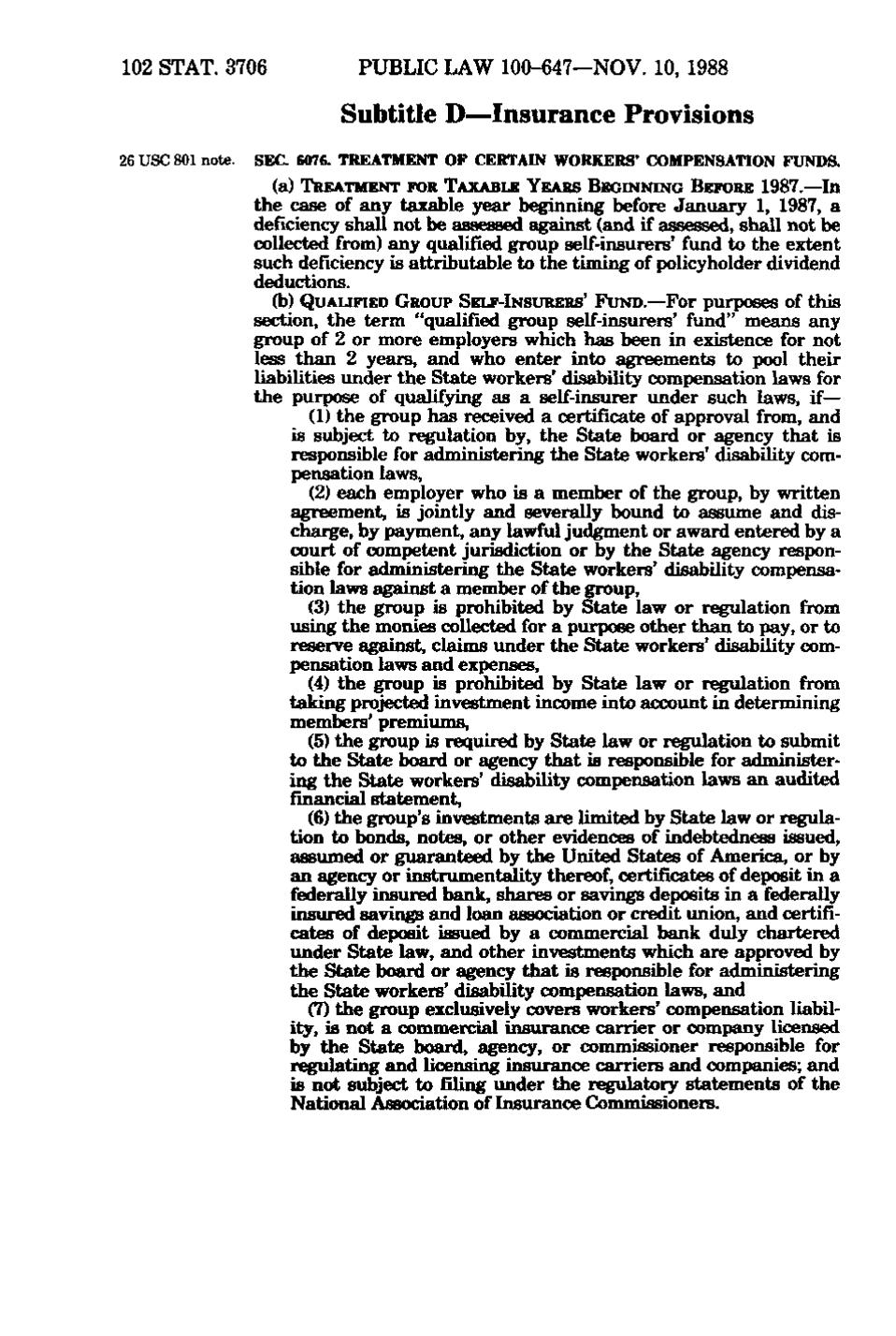

102 STAT. 3706

PUBLIC LAW 100-647—NOV. 10, 1988

Subtitle D—Insurance Provisions 26 USC 801 note.

SEC. 6076. TREATMENT OF CERTAIN WORKERS' COMPENSATION FUNDS.

(a) TREATMENT FOR TAXABLE YEARS BEGINNING BEFORE 1987.—In the case of any taxable year beginning before January 1, 1987, a deficiency shall not be assessed against (and if assessed, shall not be collected from) any qualified group self-insurers' fund to the extent such deficiency is attributable to the timing of policyholder dividend deductions. (b) QUALIFIED GROUP SELF-INSURERS' FUND.—For purposes of this section, the term "qualified group self-insurers' fund" means any group of 2 or more employers which has been in existence for not less than 2 years, and who enter into agreements to pool their liabilities under the State workers' disability compensation laws for the purpose of qualifying as a self-insurer under such laws, if— (1) the group has received a certificate of approval from, and is subject to regulation by, the State board or agency that is responsible for administering the State workers' disabliity compensation laws, (2) each employer who is a member of the group, by written agreement, is jointly and severally bound to assume and discharge, by payment, any lawful judgment or award entered by a court of competent jurisdiction or by the State agency responsible for administering the State workers' disability compensation laws against a member of the group, (3) the group is prohibited by State law or r ^ u l a t i o n from using the monies collected for a purpose other than to pay, or to reserve against, claims under the State workers' disability compensation laws and expenses, (4) the group is prohibited by State law or r ^ u l a t i o n from taking projected investment income into account in determining members' premiums, (5) the group is required by State law or r ^ u l a t i o n to submit to the State board or agency that is responsible for administering the State workers' disability compensation laws an audited financial statement, (6) the group's investments are limited by State law or r ^ u l a tion to bonds, notes, or other evidences of indebtedness issued, assumed or guaranteed by the United States of America, or by an agency or instrumentsdity thereof, certificates of deposit in a federally insured bank, shares or savings deposits in a federally insured savings and loan association or credit union, and certificates of deposit issued by a commercial bank duly chartered under State law, and other investments which are approved by the State board or agency that is responsible for administering the State workers' disability compensation laws, and (7) the group exclusively covers workers' compensation liability, is not a commercial insurance carrier or company licensed by the State board, agency, or commissioner responsible for r ^ u l a t i n g and licensing insurance carriers and companies; and is not subject to filing under the r ^ u l a to r y statements of the National Association of Insurance Commissioners.

�