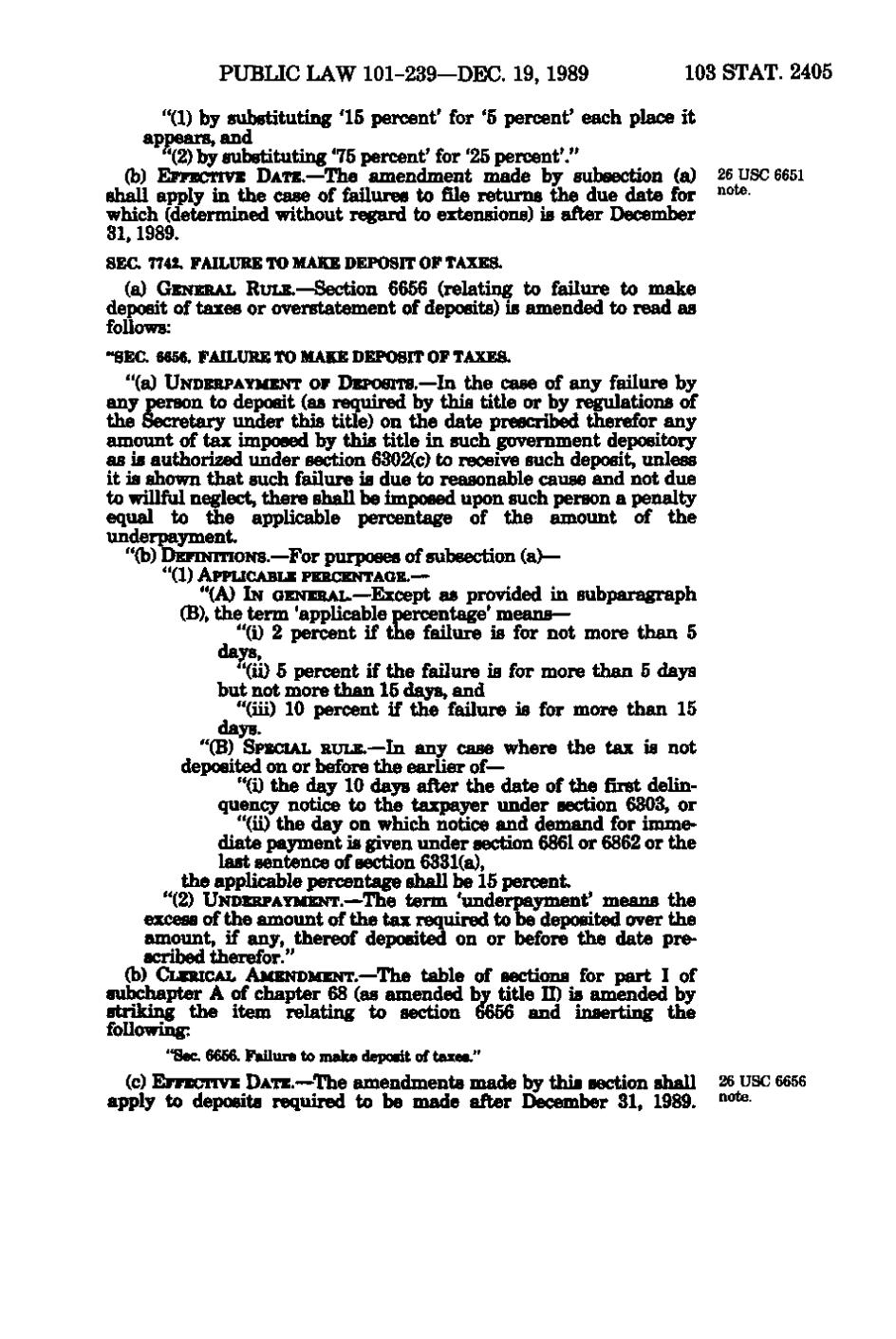

PUBLIC LAW 101-239—DEC. 19, 1989 103 STAT. 2405 "(1) by substituting '15 percent' for *5 percent' each place it appears, and "(2) by substituting '75 percent' for '25 percent'." (b) EFFECTIVE DATE. —The amendment made by subsection (a) 26 USC 6651 shall apply in the case of failures to file returns the due date for ^°^- which (determined without regard to extensions) is after December 31, 1989. SEC. 7742. FAILURE TO MAKE DEPOSIT OF TAXES. (a) GENERAL RULE. —Section 6656 (relating to failure to make deposit of taxes or overstatement of deposits) is amended to read as follows: "SEC. 6656. FAILURE TO MAKE DEPOSIT OF TAXES. "(a) UNDERPAYMENT OF DEPOSITS. —In the case of any failure by any person to deposit (as required by this title or by regulations of the Secretary under this title) on the date prescribed therefor any amount of tax imposed by this title in such government depository as is authorized under section 6302(c) to receive such deposit, unless it is shown that such failure is due to reasonable cause and not due to willful neglect, there shall be imp<Med upon such person a penalty equal to the applicable percentage of the amount of the underpayment. "(b) DEFINITIONS. —For purposes of subsection (a)— "(1) APPLICABLE PERCENTAGE.— "(A) IN GENERAL.—Except as provided in subparagraph (B), the term 'applicable percentage' means— "(i) 2 percent if the failure is for not more than 5 days, "(ii) 5 percent if the failure is for more than 5 days but not more than 15 days, and "(iii) 10 percent if the failure is for more than 15 days. "(B) SPECIAL RULE. — In any case where the tax is not deposited on or before the earlier of— "(i) the day 10 days after the date of the first delin- quency notice to the taxpayer under section 6303, or "(ii) the day on which notice and demand for imme- diate payment is given under section 6861 or 6862 or the last sentence of section 6331(a), the applicable percentage shall be 15 percent. "(2) UNDERPAYMENT. —The term 'underpayment' means the excess of the amount of the tax required to be deposited over the amount, if any, thereof deposited on or before the date pre- scribed therefor." (b) CLERICAL AMENDMENT.— The table of sections for part I of subchapter A of chapter 68 (as amended l^ title II) is amended by striking the item relating to section 6656 and inserting the following: "Sec. 6656. Failure to make deposit of taxes." (c) EFFECTIVE DATE.— The amendments made by this section shall 26 USC 6656 apply to deposits required to be made after December 31, 1989. ^°^-

�