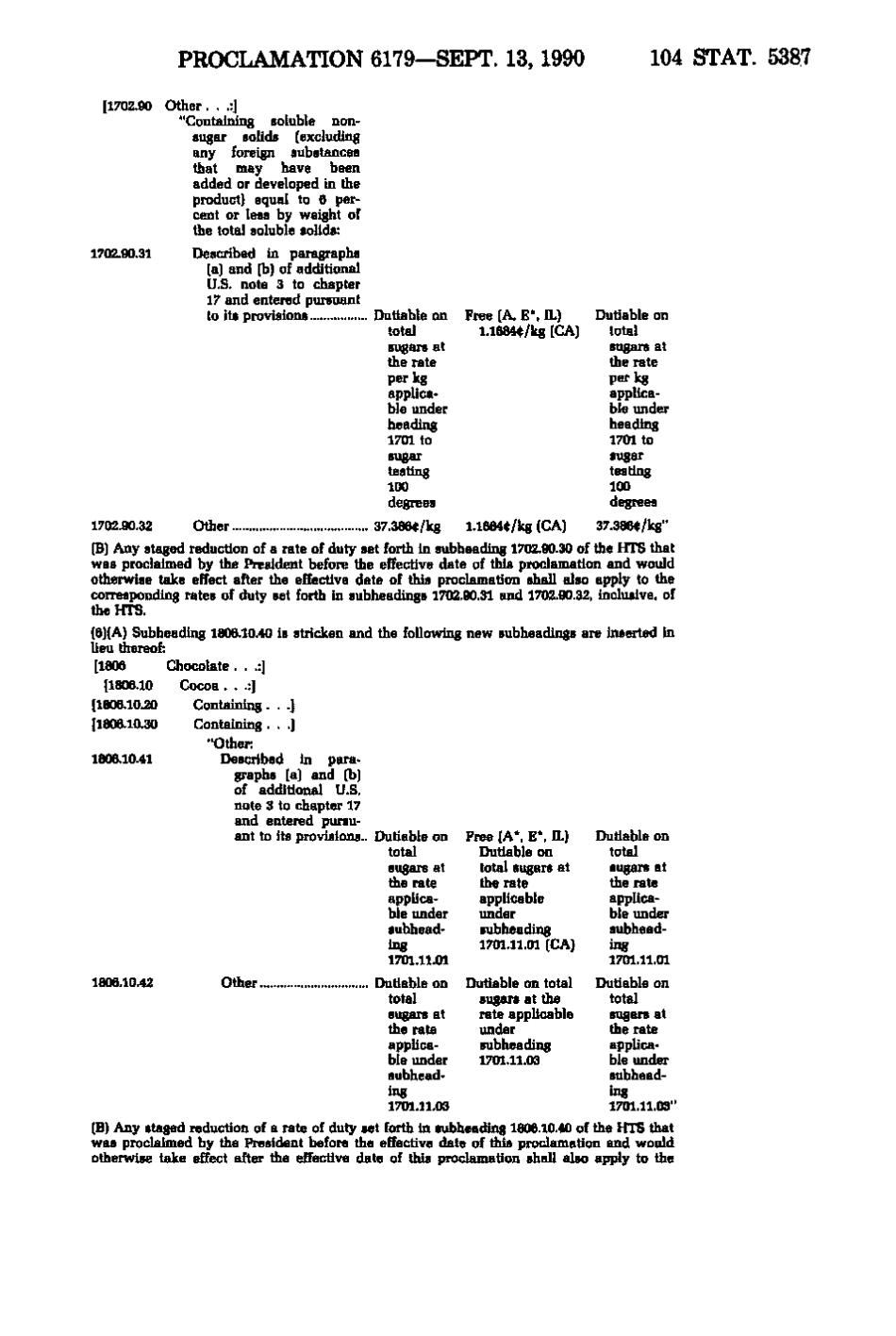

PROCLAMATION 6179—SEPT. 13, 1990 104 STAT. 5387 Free (A, E*, IL) 1.1684$/kg (CA) [1702.90 Other...:] "Containing soluble nonsugar solids (excluding any foreign substances that may have been added or developed in the product] equal to 6 percent or less by weight of the total soluble solids: 1702.90.31 Described in paragraphs (a] and (b) of additional U.S. note 3 to chapter 17 and entered pursuant to its provisions Dutiable on total sugars at the ra te per kg applicable under heading 1701 to sugar testi ng 100 degrees 1702.90.32 Other 37.386(t/kg 1.1684(t/kg (CA) 37.386(t/kg" (B) Any staged reduction of a rate of duty set forth in subheading 1702.90.30 of the HTS that was proclaimed by the President before the effective date of this proclamation and would otherwise take effect after the effective date of this proclamation shall also apply to the corresponding rates of duty set forth in subheadings 1702.90.31 and 1702.90.32, inclusive, of the HTS. (6](A] Subheading 1806.10.40 is stricken and the following new subheadings are inserted in lieu diereof: Dutiable on total sugars at the rate per kg applicable under heading 1701 to sugar testing 100 degrees [1806 [1806.10 [1806.10.20 [1806.10.30 1806.10.41 Chocolate...:] Cocoa...:] Containing...] Containing...] "Other: Described in paragraphs (a) and (b) of additional U.S. note 3 to chapter 17 and entered pursuant to its provisions.. Dutiable on total sugars at the rate applicable under subheading 1701.11.01 Free (A*, E*, IL) Dutiable on total sugars at the rate applicable under subheading 1701.11.01 (CA) Dutiable on total sugars at the rate applicable under subheading 1701.11.01 1806.10.42 Other Dutiable on Dutiable on total Dutiable on total sugars at the rate applicable under subheading 1701.11.03 sugars at the rate applicable under subheading 1701.11.03 total sugars at the rate applicable under subheading 1701.11.03" (B) Any staged reduction of a rate of duty set forth in subheading 1806.10.40 of the HTS that was proclaimed by the President before the effective date of this proclamation and would otherwise take effect after the effective date of this proclamation shall also apply to the

�