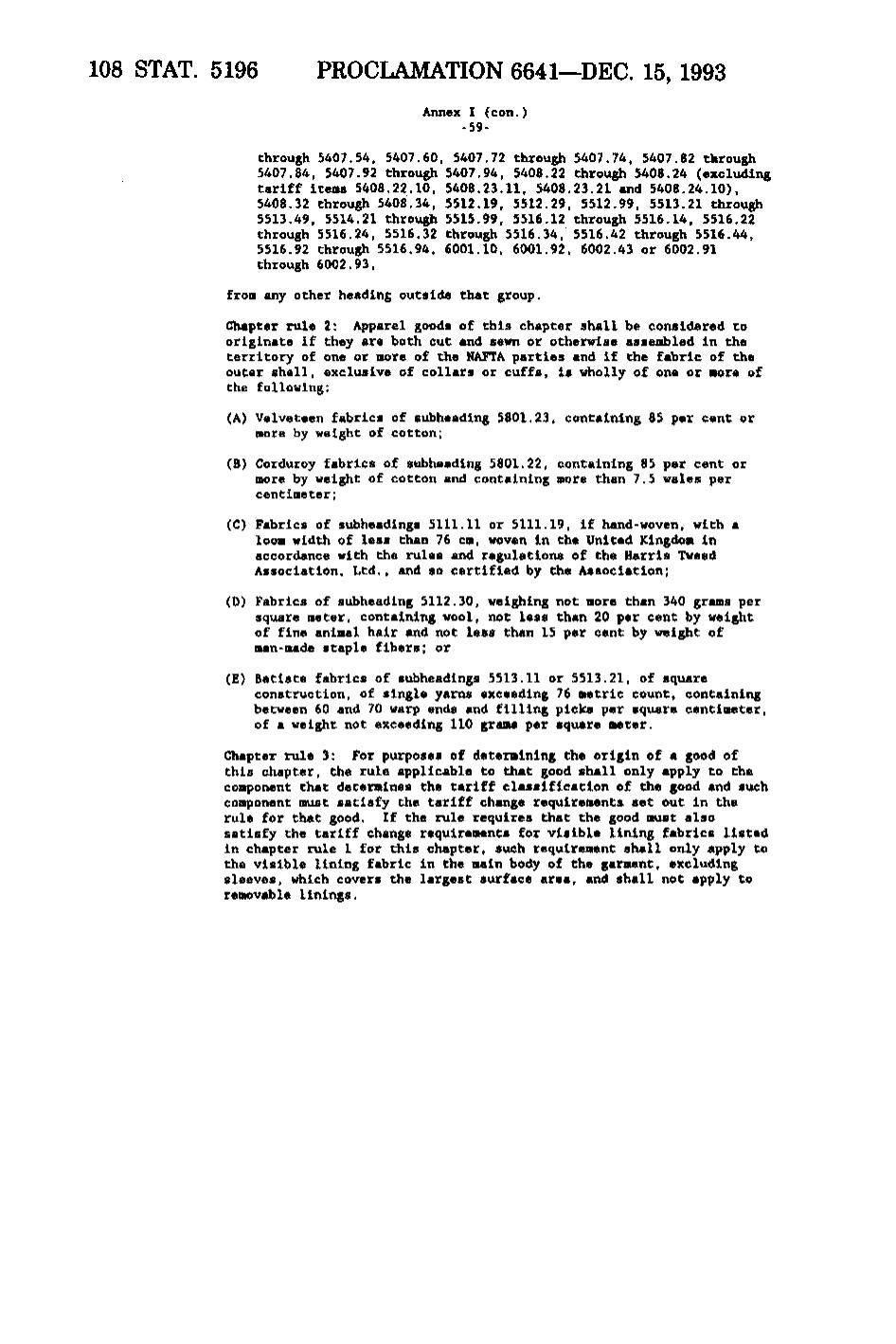

108 STAT. 5196 PROCLAMATION 6641—DEC. 15, 1993 Annex I (con.) -59- through 5407.54, 5407.60, 5407.72 through 5407.74, 5407.82 through 5407.84, 5407.92 through 5407.94, 5408.22 through 5408.24 (excluding tariff items 5408.22.10, 5408.23.11, 5408.23.21 and 5408.24.10), 5408.32 through 5408.34, 5512.19, 5512.29, 5512.99, 5513.21 through 5513.49, 5514.21 through 5515.99, 5516.12 through 5516.14, 5516.22 through 5516.24, 5516.32 through 5516.34, 5516.42 through 5516.44, 5516.92 through 5516.94, 6001.10, 6001.92, 6002.43 or 6002.91 through 6002.93, from any other heading outside that group. Chapter rule 2: Apparel goods of this chapter shall be considered to originate if they are both cut and sevm or otherwise assembled in the territory of one or more of the NAFTA parties and if the fabric of the outer shell, exclusive of collars or cuffs, is wholly of one or more of the following: (A) Velveteen fabrics of subheading 5801.23, containing 85 per cent or more by weight of cotton; (B) Corduroy fabrics of subheading 5801.22, containing 85 per cent or more by weight of cotton and containing more than 7.5 wales per centimeter; (C) Fabrics of subheadings 5111.11 or 5111.19, if hand-woven, with a loom width of less than 76 cm, woven in the United Kingdom in accordance with the rules and regulations of the Harris Tweed Association, Ltd., and so certified by the Association; (D) Fabrics of subheading 5112.30, weighing not more than 340 grams per square meter, containing wool, not less than 20 per cent by weight of fine animal hair and not less than 15 per cent by weight of man-made staple fibers; or (E) Batiste fabrics of subheadings 5513.11 or 5513.21, of square construction, of single yarns exceeding 76 metric count, containing between 60 and 70 warp ends and filling picks per square centimeter, of a weight not exceeding 110 grams per square meter. Chapter rule 3: For purposes of determining the origin of a good of this chapter, the rule applicable to that good shall only apply to the component that determines the tariff classification of the good and such component must satisfy the tariff change requirements, set out in the rule for that good. If the rule requires that the good must also satisfy the tariff change requirements for visible lining fabrics listed in chapter rule 1 for this chapter, such requirement shall only apply to the visible lining fabric in the main body of the garment, excluding sleeves, which covers the largest surface area, and shall not apply to removable linings.

�