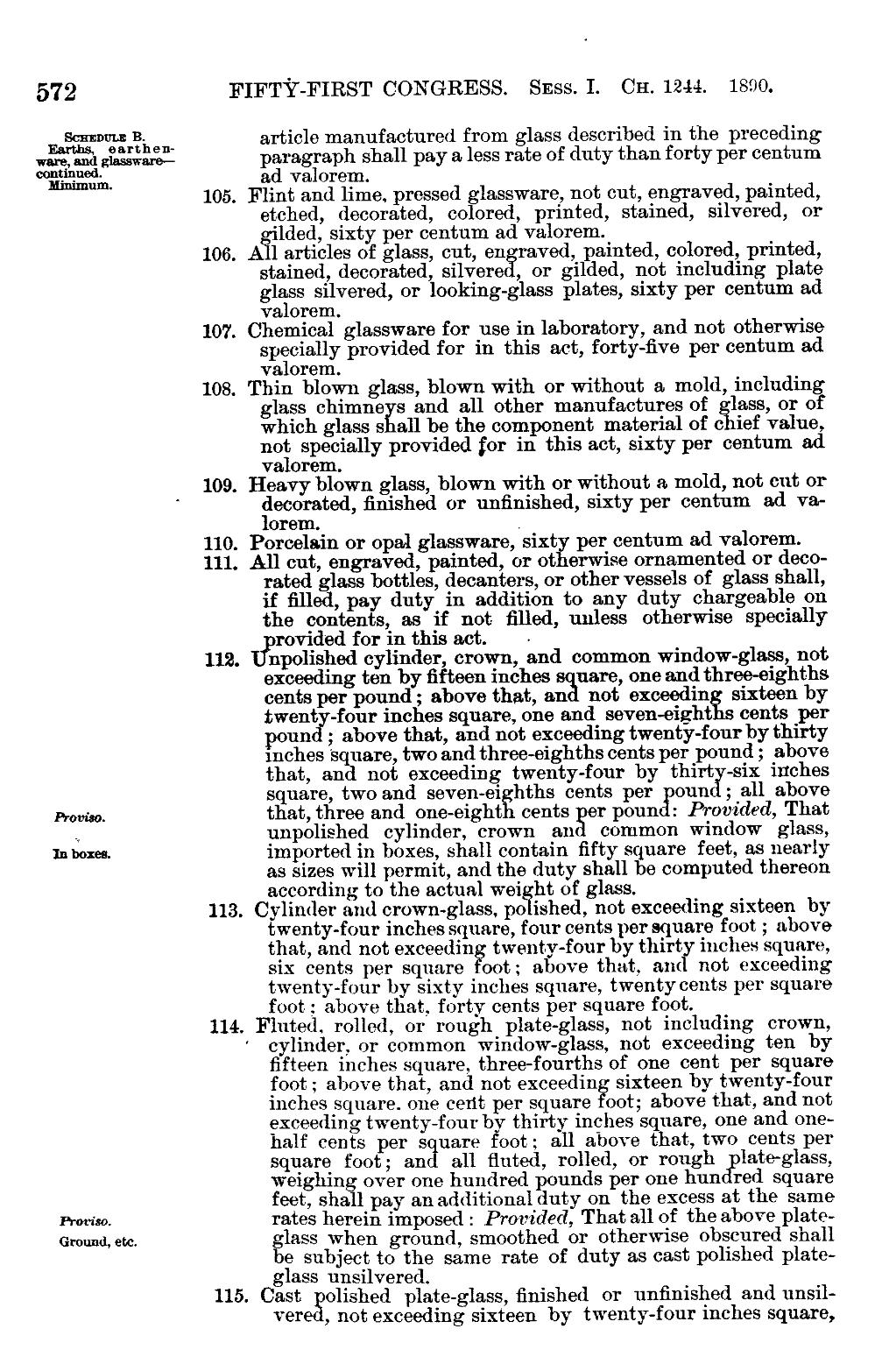

572 FIFTY-FIRST CONGRESS. Sess. I. Ch. 1244. 1800. E S¢¤¤*>¤;·:l_§h€n_ article manufactured from glass described in the preceding wm, and gmsswam- paragraph shall pay a less rate of duty than forty per centum

ad valorem.

105. Flint and lime, pressed glassware, not cut, engraved, painted, etched, decorated, colored, printed, stained, silvered, or gilded, sixty per centum ad valorem. 106. A l articles of glass, cut, en raved, painted, colored, printed, stained, decorated, silvered, or gilded, not including plate glass silvered, or looking-glass plates, sixty per centum ad valorem. 107. Chemical glassware for use in laboratory, and not otherwise specially provided for in this act, forty-nve per centum ad valorem. 108. Thin blown glass, blown with or without a mold, including glass chimneys and all other manufactures of lass, or of which glass s all be the component material of cdiief value, not specially provided for in this act, sixty per centum ad valorem. 109. Heavy blown glass, blown with or without a mold, not cut or ' ilecorated, nnished or unfinished, sixty per centum ad vaorem. . 110. Porcelain or opal glassware, sixt per centum ad valorem. 111. All cut, engraved, painted, or otherwise ornamented or decorated glass bottles, decanters, or other vessels of glass shall, if filled, pay duty in addition to any duty chargeable on the contents, as if not filled, unless otherwise specially Uprovided for in this act. · 112. npolished cylinder, crown, and common window-glass, not exceeding ten by fifteen inches square, one and three-eighths cents per pound; above that, an not exceedin sixteen by twenty-four inches square, one and seven-eightlis cents per pound ; above that, and not exceeding twenty-four by thirty inches square, two and three-eighths cents per pound; above that, and not exceeding twenty-four by thirt -six inches square, two and seven-eighths cents per oundr; all above Promo. that, three and one-eighth cents er poundi Provided, That ., unpolished cylinder, crown and common window glass, mmxu. imported in boxes, shall contain fifty square feet, as nearly as sizes will permit, and the duty shall be computed thereon according to the actual weight of glass. 113. Cylinder and crown-glass, polished, not exceeding sixteen by twenty-four inches square, four cents per square foot ; above that, and not exceedin twenty-four by thirty inches square, six cents per square Poet; above that, and not exceeding twenty-four by sixty inches square, twenty cents per square foot ; above that, forty cents per square foot. 114. Fluted. rolled, or rough plate-glass, not including crown, ‘ cylinder, or common window-glass, not exceeding ten by fifteen inches square, three-fourths of one cent per square foot ; above that, and not exceeding sixteen by twenty-four inches square. one cent per square foot; above that, and not exceeding twenty-four by thirty inches square, one and onehalf cents per s uare foot; all above that, two cents per square foot; and all fiuted, rolled, or rough plate-glass, weighing over one hundred pounds per one hundred square feet, shall pay an additional duty on the excess at the same Prmm. rates herein imposed : Provided, That all of the above platecmunaew. glass when ground, smoothed or otherwise obscured shall be subject to the same rate of duty as cast polished plateglass unsilvered. 115. Cast polished plate-glass, iinished or unnnished and unsilvere , not exceeding sixteen by twenty-four inches square,